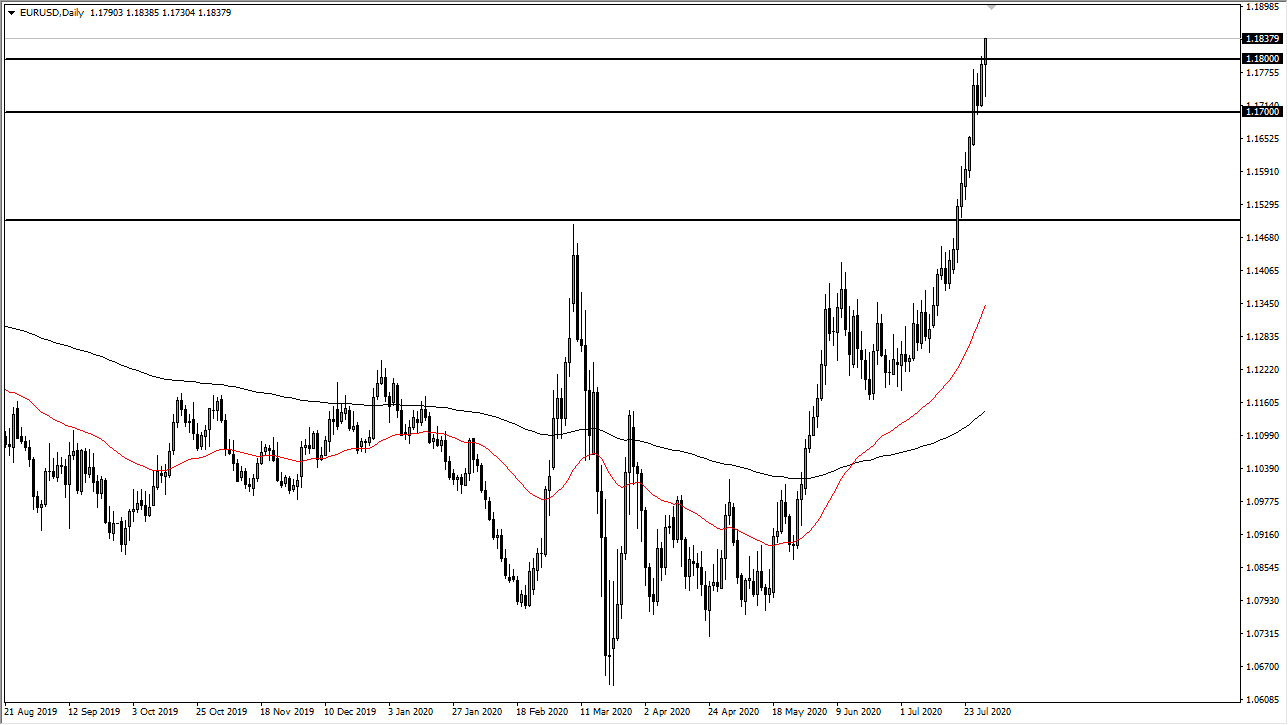

The Euro initially fell during the trading session on Thursday to reach down towards the 1.17 level. However, we have turned around to blast through the 1.18 level during the New York session, and we are most certainly overdone at this point. Simply looking at this chart at a glance you can see that we are parabolic. These moves tend to cause serious issues given enough time, but at this point it is almost impossible to start shorting this market. After all, this is a market that has been explosive to the upside and the Euro is the quickest way people choose to express a “shore dollar” bias.

Looking at the candlestick, it is obvious that the market is getting a bit parabolic and perhaps even overdone but at this point I think that the Euro is obviously changing the overall trend. In that scenario, you cannot short this market, but you can look for value. I have to admit that I am a little bit surprised at just how much this is taken off to the upside, especially considering that most of the time this market will put you to sleep. The one-way trade that we have seen for a while will certainly end in tears for those buying at extreme highs, but the question then becomes “where are the extreme highs?” It is far too dangerous to buy the market here, but if we were to drop to at least 1.17, if not even the 1.16 level, then I would be more comfortable in going long.

Eventually we will go looking towards the 1.20 level, and possibly beyond. Longer-term I suspect that we are probably looking at a move towards the 1.25 handle, but it is going to take quite some time to get there. These last couple of impulsive moves that we have seen our bit extraordinary for this pair, and in fact I have not seen the Euro act like this in about a decade. I think the likelihood is that the Federal Reserve will get what it wants, meaning an absolutely destroyed US dollar and relative terms. That being said though, it must be noted that the US dollar is extremely strong compared to the historical average, so it has quite a bit of distance it can travel over the longer term.