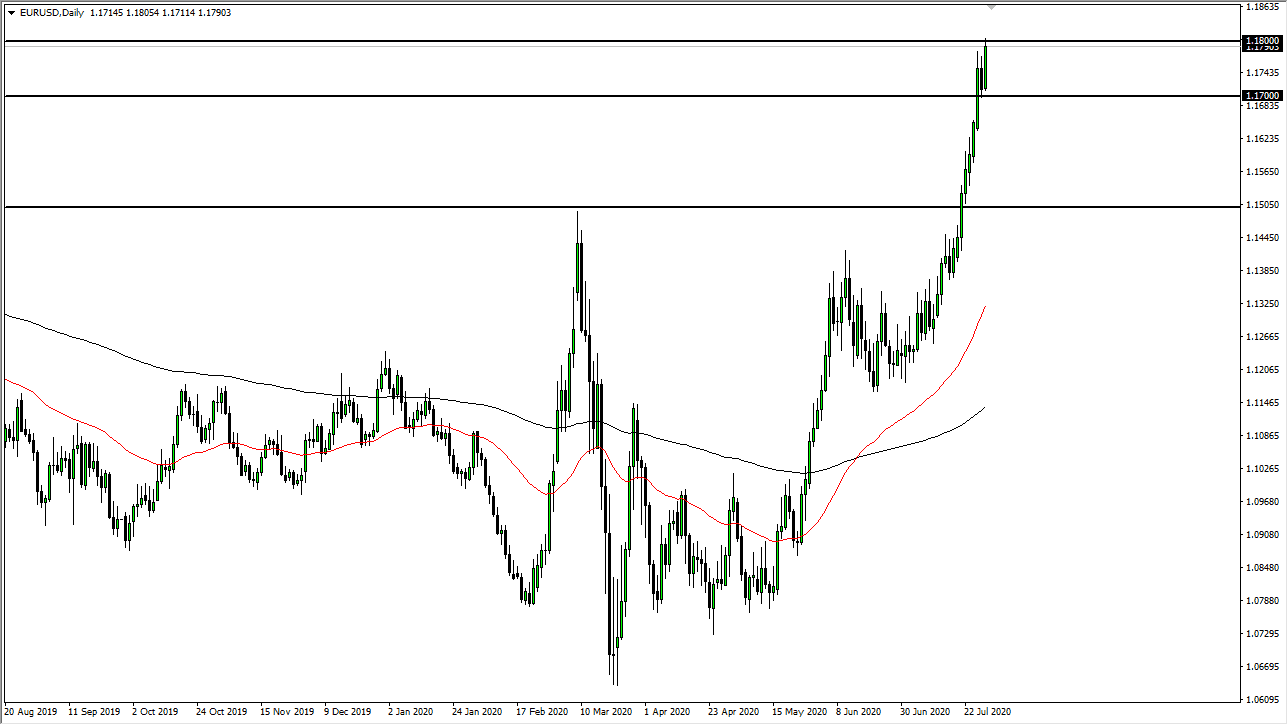

The Euro has rallied quite significantly during the trading session on Wednesday, reaching towards the 1.18 level. However, it is getting a bit stretched even though we are now past the FOMC meeting and press conference. This suggests that we are perhaps going to continue to go to the upside but may need to find a bit of value in the process in order to go longer. The $1.17 level is an area that is worth paying attention to, as it should be supportive. If we break down below there, then I will simply look to buy the Euro at lower levels and would be especially interested in the $1.15 level.

All of that being said, I recognize that it will take quite a bit to drive the market down to that handle, so it is very likely that we will have to settle for some type of bullish flag like we just had form over the last month or so. At this point, I think looking for value is the only way to go because quite frankly if we break above the $1.18 level, although we are probably going to go to the $1.20 level, it also invites a massive selloff as we will have gotten far too stretched to continue this type of momentum.

I think at this point everybody is cognizant to the fact that we may have a bit of a trend change going on, but that does not necessarily mean that you need to jump in right away. With that being the case, look for value and be very patient because if you are not already long of the Euro, you simply have no business in trying to buy it all the way up here. I think eventually we will not only hit the $1.20 level, but possibly even the $1.25 level. The Euro has recently broken out enough to change the longer-term trend, so at this point we may have a long way to go, and it is probably something that will take months, if not years to play out. The US dollar has been in an uptrend for years now, so it takes quite a bit of time to unwind the US dollar longs that we have been placing. Remember, is to trade with the trend, and that is clearly up at this point.