New Zealand appears to have the Covid-19 pandemic contained, with isolated cases over the past few weeks. Only 22 active cases are presently reported in the island nation, sparking hopes for an economic recovery to materialize. Given the dependence on international educational travel and tourism, the most recent optimism by rating agency S&P Global over outperformance by New Zealand could prove to be a premature analysis. After the short-term resistance zone rejected the EUR/NZD, it is on course to extend to the downside, driven by Euro weakness rather than New Zealand Dollar strength.

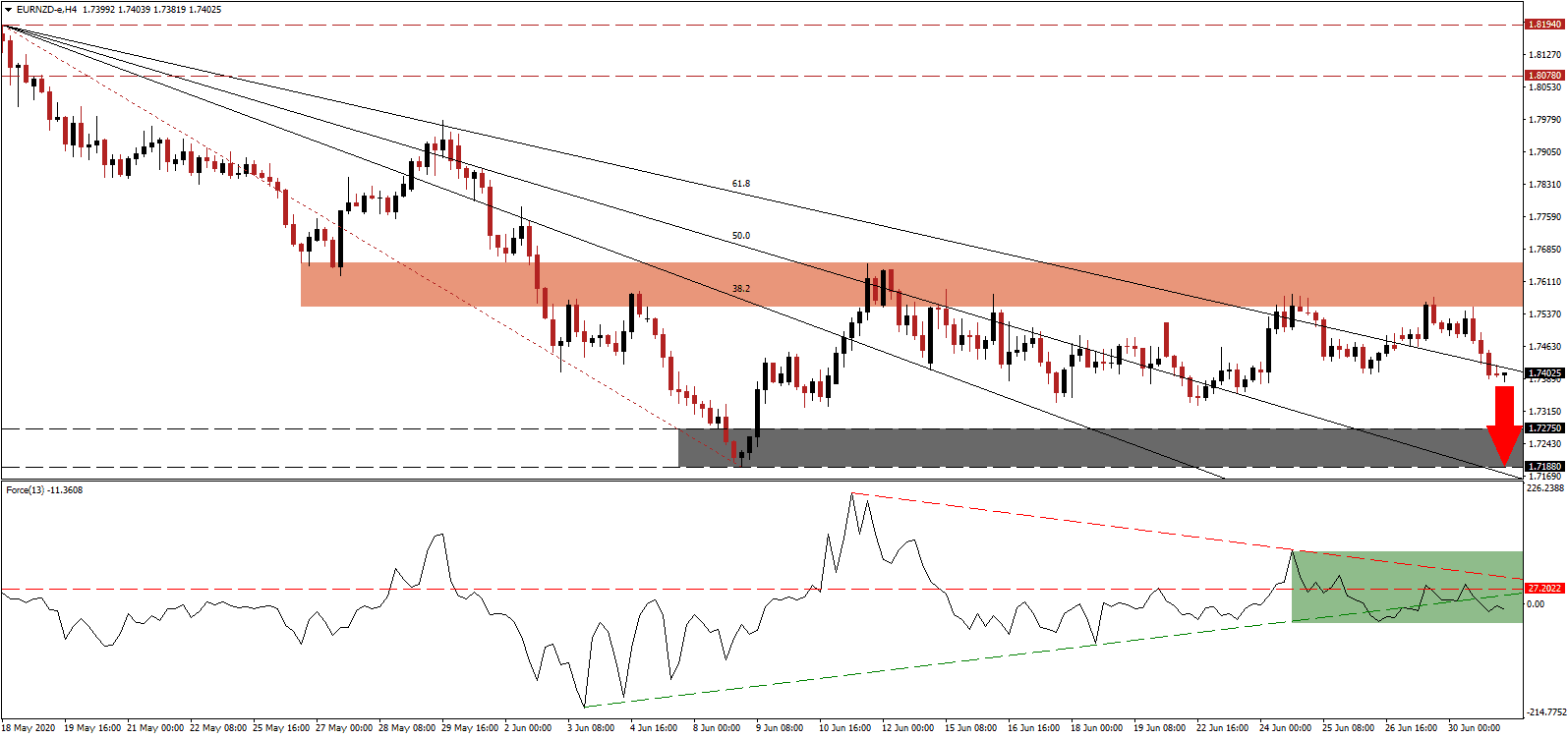

The Force Index, a next-generation technical indicator, points towards dominant bearish momentum. A brief advance above its horizontal resistance level was swiftly reversed into a breakdown below its ascending support level, as marked by the green rectangle. The descending resistance level is adding to downside pressure. Bears are in complete control over the EUR/NZD, with this technical indicator sliding deeper into negative territory.

Adding one significant problem for the New Zealand economy is its lack of productivity, ranking last in the OECD’s 37 economies. Prime Minister Ardern places her government’s hopes on domestic tourism, food exports, and creative arts. It confirms the lack of a sustainable economic catalyst, and the global Covid-19 pandemic will keep trade at depressed levels for longer than planned. Weakness in the export-oriented Eurozone added to the rejection in the EUR/NZD by its short-term resistance zone located between 1.7552 and 1.7654, as identified by the red rectangle, with breakdown pressures on the rise.

Following upbeat preliminary PMI reports across the Eurozone, additional data missed expectations. The ongoing surge of infections has resulted in localized lockdowns, resulting in a decreased economic recovery pace. While those shocks are smaller as compared to a full nationwide lockdown, they add to ongoing areas of concern. The descending 61.8 Fibonacci Retracement Fan Resistance Level is anticipated to pressure the EUR/NZD into its support zone located between 1.7188 and 1.7275, as marked by the grey rectangle. A breakdown remains probable but temporarily, given the state of the New Zealand economy and cautiously bearish outlook.

EUR/NZD Technical Trading Set-Up - Breakdown Extension Scenario

Short Entry @ 1.7400

Take Profit @ 1.7190

Stop Loss @ 1.7460

Downside Potential: 210 pips

Upside Risk: 60 pips

Risk/Reward Ratio: 3.50

In the event the Force Index pushes above its descending resistance level, the EUR/NZD may attempt a reversal. The upside potential remains confined to the top range of its short-term resistance zone, amid increasing economic uncertainty out of New Zealand. It is falling behind Australia and is reliant on outside factors for stability. Forex traders are advised to consider any breakout as a selling opportunity.

EUR/NZD Technical Trading Set-Up - Confined Breakout Scenario

Long Entry @ 1.7510

Take Profit @ 1.7620

Stop Loss @ 1.7460

Upside Potential: 110 pips

Downside Risk: 50 pips

Risk/Reward Ratio: 2.20