Guy Parmelin, the Vice President of Switzerland and the minister responsible for the Federal Department of Economic Affairs, Education and Research, announced an extension of short-term unemployment benefits by six months to eighteen months. He also confirmed support for the public transport sector, severely impacted by the Covid-19 pandemic, and facing financial losses. Since April, more than 190,000 companies have applied for federal assistance, covering almost two million employees or 36% of the Swiss labor force. Safe-haven demand for the Swiss Franc continues to drive the corrective phase in the EUR/CHF, with a pending breakdown below its support zone predicted to extend it.

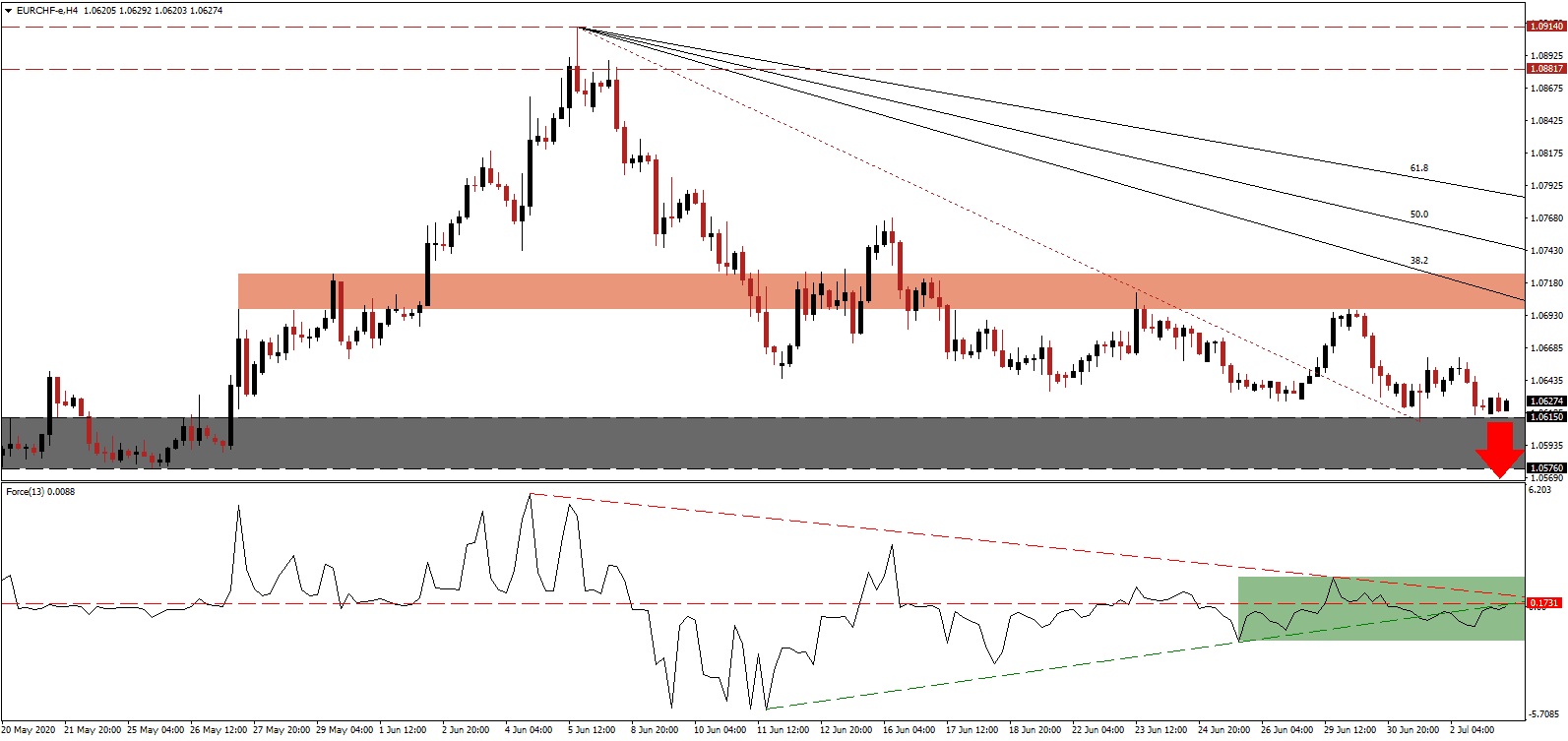

The Force Index, a next-generation technical indicator, remains below its horizontal resistance level, likely to reject the most recent drift higher. Following the breakdown below its ascending support level, as marked by the green rectangle, bearish pressures expanded. Increasing downside momentum is the descending resistance level, forecast to push this technical indicator below the 0 center-line, placing bears in charge of the EUR/CHF.

While the forward-looking KOF Economic Barometer increased by 9.8 points in June to 59.4, it remains well below its long-time average of 100. Any reading below 100 indicates the economy is underperforming. It also missed expectations for an increase to 77.0, while May was revised to 49.6 from 53.2. The manufacturing PMI disappointed, suggesting prolonged economic issues. The trend is mirrored across the global economy, while Covid-19 infections record new daily records. After the rejection in the EUR/CHF by its short-term resistance zone located between 1.0698 and 1.0725, as marked by the red rectangle, the dominant bearish chart pattern was confirmed.

Finance Minister Ueli Maurer excluded tax increases to pay for the expected budget deficit of CHF1 billion in 2021. Estimates for total coronavirus debt range between CHF20 billion to CHF35 billion. The new budget will not be published until September, with a debt repayment plan due by year-end. Given Switzerland’s market attractiveness, serving as a bullish catalyst for the Swiss Franc, a breakdown extension in the EUR/CHF below its support zone, located between 1.0576 and 1.0615, as identified by the grey rectangle, is favored. The descending Fibonacci Retracement Fan sequence is positioned to enforce the downtrend, with the next support zone located between 1.0497 and 1.0508.

EUR/CHF Technical Trading Set-Up - Breakdown Extension Scenario

Short Entry @ 1.0630

Take Profit @ 1.0500

Stop Loss @ 1.0660

Downside Potential: 130 pips

Upside Risk: 30 pips

Risk/Reward Ratio: 4.33

In case the Force Index reclaims its ascending support level, providing temporary resistance, the EUR/CHF may reverse. Due to the rise in Covid-19 infections across the Eurozone, and the associated economic harm, resulting in more market manipulation by the European Central Bank, the outlook is increasingly bearish. The Swiss National Bank remains active, but the correction is poised to gather steam. Forex traders are advised to sell any rallies, with the upside potential limited to its 50.0 Fibonacci Retracement Fan Resistance Level.

EUR/CHF Technical Trading Set-Up - Reduced Upside Scenario

Long Entry @ 1.0690

Take Profit @ 1.0740

Stop Loss @ 1.0660

Upside Potential: 50 pips

Downside Risk: 30 pips

Risk/Reward Ratio: 1.67