An article published in the Swiss Journal of Economics and Statistics suggested the use of a daily fever curve (f-curve) to gauge the health of the Swiss economy. Macroeconomic data is published with a significant delay, and the f-curve can be computed on a next-day basis. The author outlines the usage of publicly available financial markets and news data to provide an initial warning if the economic condition is worsening. While Switzerland appears to have the Covid-19 pandemic under control, the export-oriented Alpine nation requires a strong global economy to operate at full potential. The EUR/CHF entered a counter-trend advance, but the bullish momentum loss at its short-term resistance zone hints at a profit-taking sell-off.

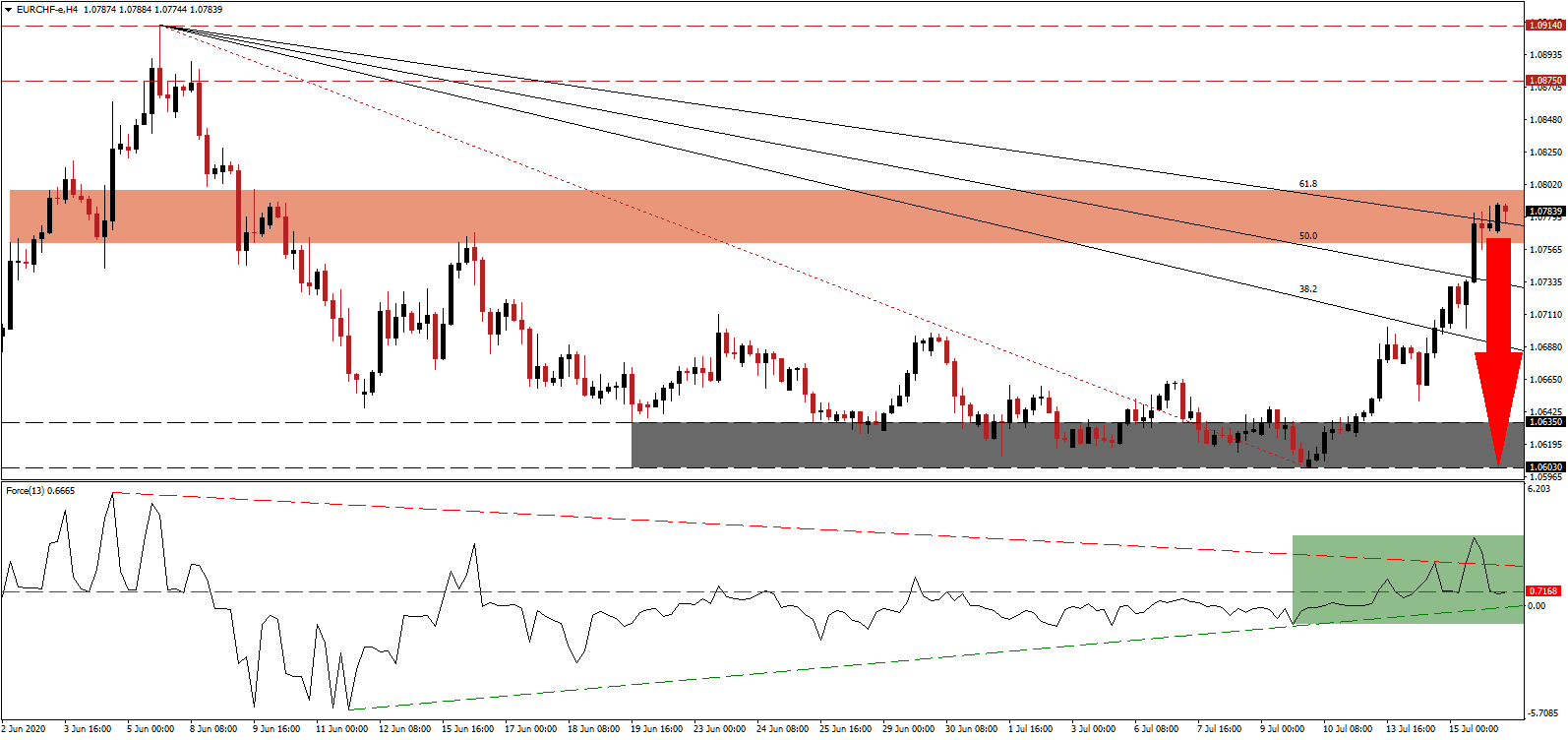

The Force Index, a next-generation technical indicator, initially spiked to a new multi-week high together with the advance in this currency pair. It swiftly collapsed below its descending resistance level, as marked by the green rectangle, and the converted its horizontal support level into resistance. This technical indicator is now on course to move below its ascending support level and into negative territory, placing bears in full control of the EUR/CHF.

Swiss National Bank Chairman Thomas Jordan confirmed that the central bank would continue its monetary policy of negative interest rates and foreign exchange purchases. He acknowledged it as a costly but necessary approach for Switzerland due to the safe-haven status of its currency in a global low-interest-rate environment. The EUR/CHF was able to pierce above its descending 61.8 Fibonacci Retracement Fan Resistance Level, crossing through the short-term resistance zone located between 1.0761 and 1.0798, as marked by the red rectangle.

One rare and unexpected bright spot for Swiss exports in the first half of 2020 was arms exports, which increased by CHF230 billion to CHF501 billion. Artillery, tanks, and other military vehicles represent the bulk of sales, with 55 countries placing orders this year. Switzerland is well-positioned to grow out of the Covid-19 pandemic as a more dominant economy, adding to bullish pressures on the Swiss Franc while creating expensive problems for the central bank. The EUR/CHF is likely to complete a breakdown and accelerate into its support zone located between 1.0603 and 1.0635, as identified by the grey rectangle.

EUR/CHF Technical Trading Set-Up - Breakdown Scenario

Short Entry @ 1.0785

Take Profit @ 1.0600

Stop Loss @ 1.0830

Downside Potential: 185 pips

Upside Risk: 45 pips

Risk/Reward Ratio: 4.11

Should the Force Index push through its descending resistance level, the EUR/CHF could be inspired to seek more upside. While the Eurozone economy recovered from the lows set in April, structural issues remain, and the European Central Bank embarked on a destructive path for the Euro. Forex traders are advised to consider any breakout as a selling opportunity. The upside potential is limited to its resistance zone between 1.0875 and 1.0914.

EUR/CHF Technical Trading Set-Up - Limited Breakout Scenario

Long Entry @ 1.0860

Take Profit @ 1.0910

Stop Loss @ 1.0830

Upside Potential: 50 pips

Downside Risk: 30 pips

Risk/Reward Ratio: 1.67