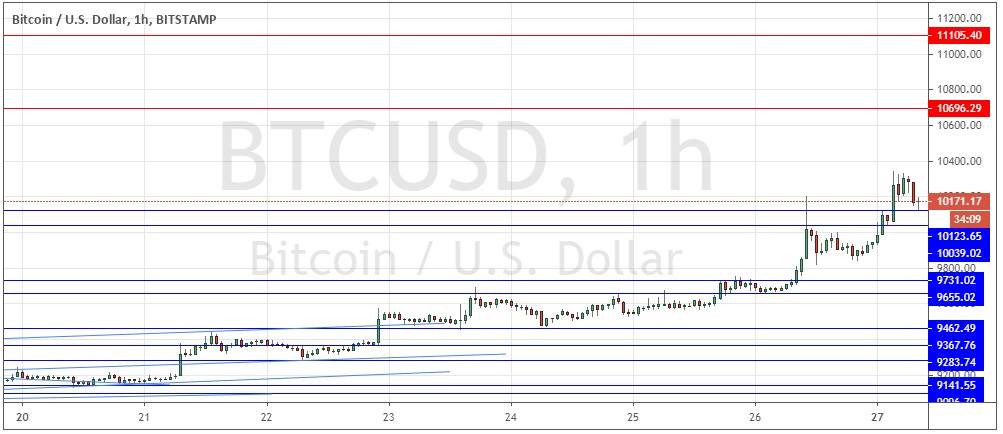

BTC/USD: Bulls finally overcoming key resistance

Last Thursday’s signals produced a very profitable long trade from the bullish bounce at the key support level identified at $9,462.

Today’s BTC/USD Signals

Risk 0.50% per trade.

Trades must be taken before 5 pm Tokyo time Tuesday.

Long Trade Ideas

- Go long after a bullish price action reversal on the H1 time frame following the next touch of $10,123 or $10,039.

- Put the stop loss $50 below the local swing low.

- Adjust the stop loss to break even once the trade is $50 in profit by price.

- Take off 50% of the position as profit when the trade is $50 in profit by price and leave the remainder of the position to ride.

Short Trade Ideas

- Go short after a bearish price action reversal on the H1 time frame following the next touch of $10,696 or $11,105.

- Put the stop loss $50 above the local swing high.

- Adjust the stop loss to break even once the trade is $50 in profit by price.

- Take off 50% of the position as profit when the trade is $50 in profit by price and leave the remainder of the position to ride.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

BTC/USD Analysis

I wrote last Thursday that the technical picture had become significantly more bullish. I thought that if the price could get established above $9,546 that would be a bullish sign, so I took a bullish bias as we did get two consecutive hourly closes above that level later in the day.

This was a good call as the price has finally risen strongly enough to break above the extremely important psychological round number at $10,000.

This creates a much more bullish technical picture and should strongly encourage Bitcoin bulls, especially long-term investors. However, we might ask how much of this is to do with the strong weakness we have seen over recent days in the U.S. Dollar. Nevertheless, Bitcoin does not usually advance against the USD just because the USD is weak.

Due to the significantly more bullish technical situation, I do not want to take any short trades in Bitcoin today.

I will be very happy to take a long trade from a bullish bounce at either of the support levels I have identified above $10,000 especially if the bounce rejects the round number at $10,000 itself. I think that scenario would produce a high-probability long trade. I would be more careful to take a long at a bounce significantly below $10,000.

There is nothing of high importance scheduled today regarding the USD.