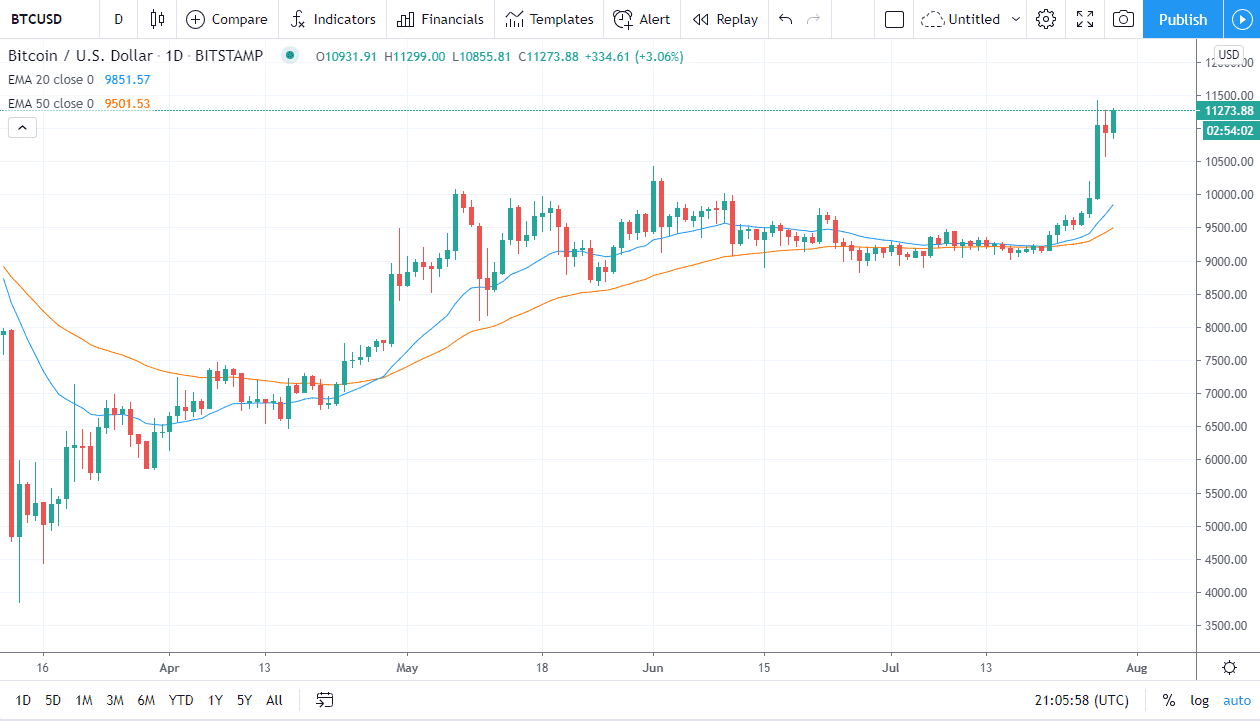

The Bitcoin markets have rallied again during the trading session on Wednesday, as we continue to see buyers jump into this marketplace. If you remember looking back, I had suggested that there was a significant resistance barrier between the $10,000 level and the $10,500 level, and now that we are above there it is likely that we are free to go to much higher levels, with my original target being $12,500. Looking at this chart, that does not take much imagination anymore as we have seen so much strength.

The US dollar continues to get pummeled and Bitcoin finally picked up on that as well. I had been questioning as to whether or not Bitcoin was ever going to move considering that the US dollar has sold off so drastically, and now it finally has. That was the biggest concern I had going forward, and now it looks like we are back into a “buy on the dips” type of mode. The $10,500 level should continue to offer plenty of support, and I believe at this point the $10,000 level probably is the “floor”, at least in the short term. I think at this point the US dollar continues to suffer at the hands of the Federal Reserve which is looking to flood the market with the greenback, and that of course means that it will take more of them to buy “things”, of which Bitcoin is. Bitcoin is actually a commodity, or at least trades like it over the longer term, despite the fact of the cult of people that trade it are willing to say. At the end of the day, price is price, and price is the only thing that matters. When I look at this chart, it is rising so really that is the only thing that matters at this point in time.

Having said that, the market was to break down below the $9000 level, that could represent a potential wipeout, something that Bitcoin is prone to occasionally. If that happens, get out of the way and look for some type of support underneath, perhaps closer to the $7000 level. We are near there quite yet, so I think we will continue to see a move to the upside, as the impulsive candlestick from the Monday session suggested by breaking as high as it did. Wednesday with simply a continuation candlestick.