Bitcoin markets have been quiet over the last several sessions, and if you have been following my analysis here at the Daily Forex, the recent attitude of this market had me thinking that we were trying to form some type of an ascending triangle, but we have not done that move, and now have drifted through what would have been the bottom of an uptrend line. With this, now it looks like we are simply going to trade in a bit of a range, perhaps trading some type of rectangle.

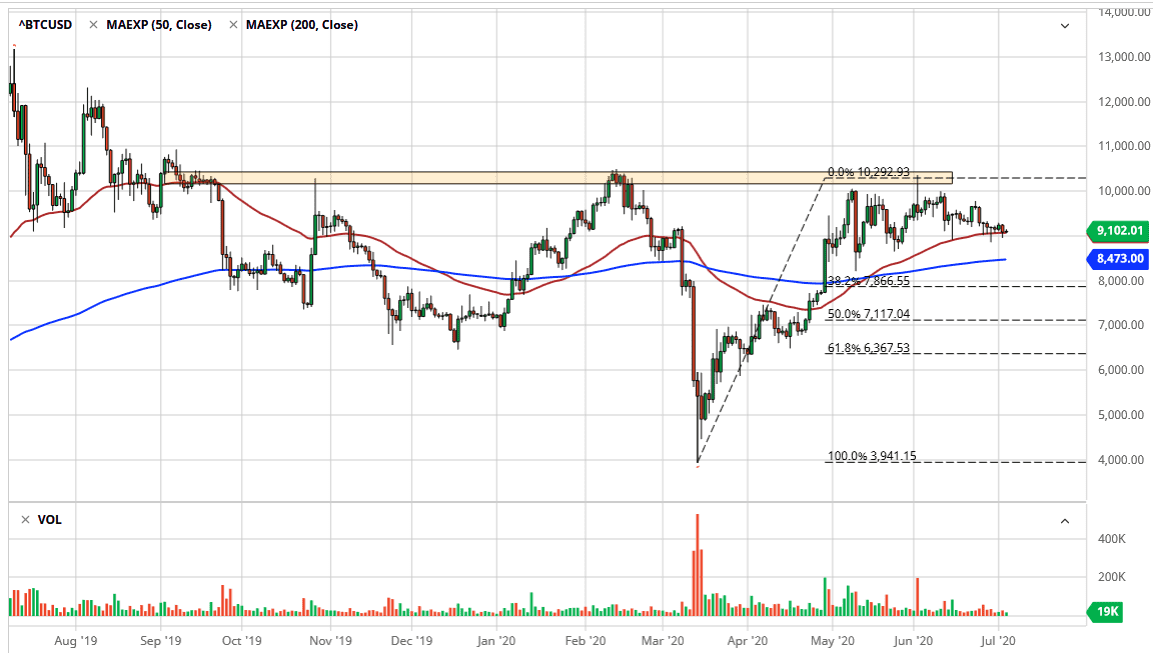

Even though we drifted through the bottom of the ascending triangle, we have not necessarily broken apart either and therefore I think we are simply saving up inertia in order to build a larger move. I think at this point we might be looking at more of a rectangle, with the $9000 level offering a significant support level. Just above, we still have the $10,000 level causing significant resistance, extending to the $10,500 level, meaning that it is going to take a lot of momentum to finally break out above there.

To the downside, not only do we have the $9000 level but we also have the 200 day EMA underneath so the entire range between the 50 day EMA and the 200 day EMA could be thought of as a potential support range, and therefore I think that dips into this area will continue to attract a certain amount of attention. What is interesting is that Bitcoin has not taken off after the Federal Reserve has announced more liquidity measures, and that is one thing that does have me a bit concerned.

We have seen of the last couple of years the Bitcoin is not completely disconnected from the financial system, so that might be part of what we have had going on in this market, meaning that as we have not seen a major run away from the US dollar, Bitcoin has not been able to take advantage of that. Gold is an ironic counterpart to Bitcoin as gold traders and Bitcoin traders seem to argue a lot, but at the end of the day it looks as if the gold markets are stronger than Bitcoin. This is the scenario that worries we the most about this market, so as long as we can stay above the 200 day EMA I remain somewhat bullish. A breakdown below the 200 day EMA would be extremely negative.