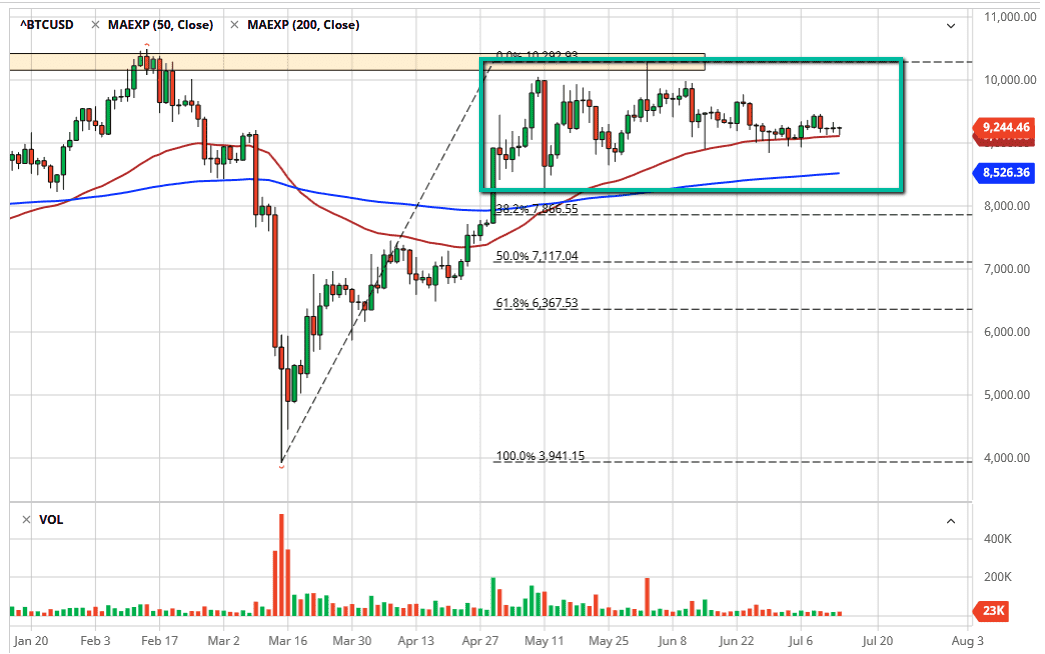

Bitcoin markets have gone back and forth during the last couple of days, reaching down towards the 50 day EMA yet again. This is an area that continues to offer support, especially as not only does the 50 day EMA attract a lot of attention in financial assets, but it tends to be rather interesting for Bitcoin in general. Looking at this chart, the $9000 level underneath is supportive as well, and as a result, I believe that this market will probably find buyers sooner or later. Furthermore, there is that “zone of support” underneath that extends from the 50 day EMA down to the 200 day EMA. That is a major buffer that I think continues to be crucial.

To the upside, I think that the $10,000 level will continue to be the target, but I believe it is a significant resistance barrier that extends all the way to the $10,500 level. If we break above that level, then I think Bitcoin will finally have its move higher. At that point, I would anticipate a move towards the $12,000 level. To the downside, we would need to break down below the 200 day EMA in order for this market to truly start to break down significantly. The $8000 level of course would be supported, and if we can break down below there then things could get rather ugly.

Keep in mind that the US dollar is on its back foot, and the fact that Bitcoin has not been bothered to take advantage of that is something to be concerned about if you are bullish for Bitcoin, and as a result, this market should be watched with attention. The position size should be somewhat cautious, and as a result, I think that the market is likely to go parabolic if we can break out because it will be shaking through a lot of resistance. A breakdown will more than likely find buyers at some level below, but right now I will probably step to the sidelines if we break down below the 200 day EMA as it would be a major shift in attitude. The markets are simply looking for some type of catalyst in order to make the next job higher or dump lower, and we could be in for a slow couple of weeks still.