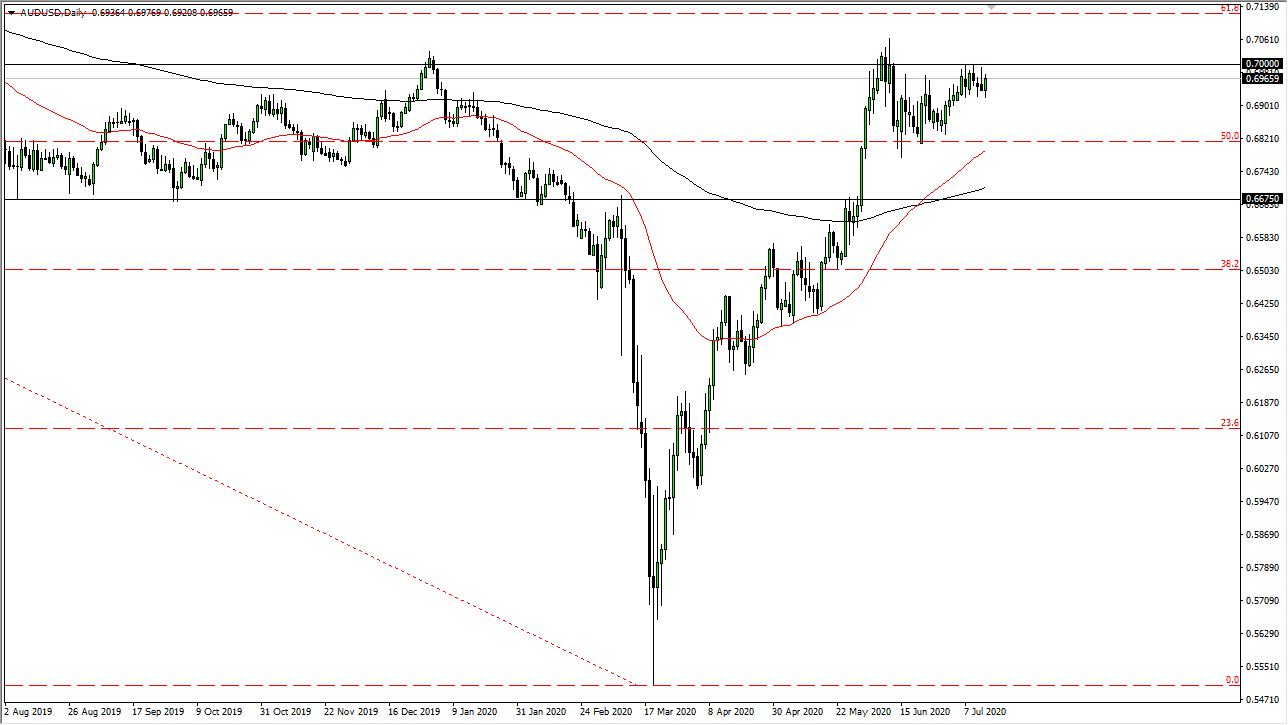

The Australian dollar initially fell during the trading session on Tuesday but then turned around again. Having said that, the market looks likely to continue struggling to break above the 0.70 level, as it has been so stringent as far as resistance is concerned. With that in mind, it is likely that we will see a lot of volatility in this general vicinity and for short-term traders, they will probably find profits in selling signs of exhaustion. Ultimately, the question is whether or not we have the wherewithal to finally break out above not only the 0.70 level, but also the 0.71 level as this is more or less a “zone of resistance.”

Keep in mind that the Australian dollar will be sensitive to risk appetite and risk appetite is obviously all over the place right now as coronavirus figures continue to throw the markets back and forth. The Federal Reserve is probably the one thing working hard for the Australian dollar right now, as they are working so hard against the US dollar. As long as that is the case, there is upward momentum. However, we are at an inflection point where market participants seem to be more than willing to step in and press back. In the short term, you can make an argument for a 200 PIP range between the 0.70 level on the top and the 0.68 level on the bottom.

Furthermore, the 50 day EMA is starting to reach towards the 0.68 handle, so that is an area of contention and interest as well. I think that it is only a matter of time before buyers will return on that breakdown unless there was some major shift in the overall fundamental outlook for the global economy beyond COVID-19. Remember, if China starts to fall into rough times, the Australian dollar is the first thing that gets sold. Having said all of that, if we do manage to break above the 0.71 level then it becomes a bit of a “buy-and-hold” trend change. I would anticipate that we would be looking at a move towards the 0.80 level over the longer term. I do not think that happens in the short term, but it is something that I am paying attention to. I think we will continue to see a lot of volatility through the summer and not only this pair but many others.