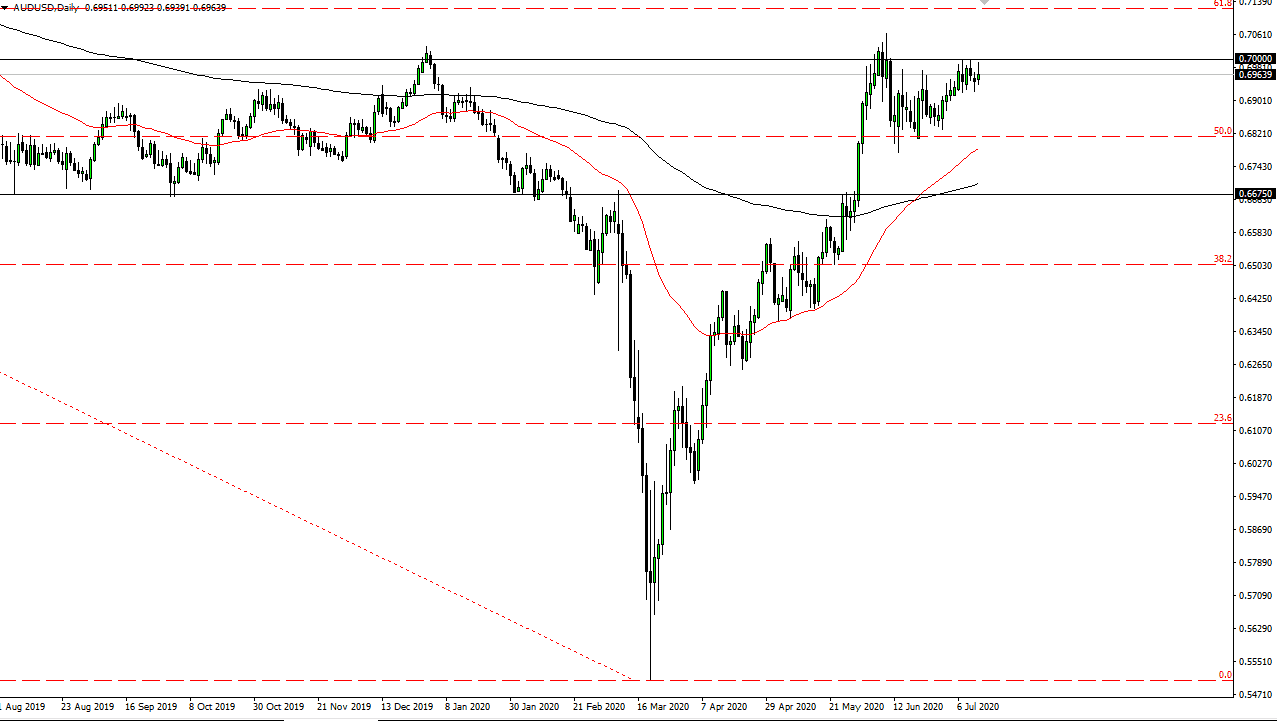

The Australian dollar initially tried to rally during the trading session on Monday to kick off the week, but you can see that we are falling again from the 0.70 level. This is an area that should attract a lot of attention yet again, as we have seen a lot of bearish pressure in this general vicinity. The 0.70 level is the beginning of the resistance that extends all the way to the 0.71 level. This is a major inflection point on the longer-term charts, so it is obviously going to take a lot to get things to turn around and simply slice through that area. However, if it does it would be a very bullish sign and could send this market looking towards the 0.80 level over the longer term. In that scenario, it becomes more of a “buy-and-hold” type of currency, and therefore we would have to play this as a longer-term value hunt.

To the downside, I believe there is plenty of support near the 0.68 level, and furthermore the 50 day EMA coming into that level will confirm that from what I can see. This is a market that is very noisy in general but also has a lot of leverage to the Chinese situation and global growth in general. If both of those falter, that could be enough to send this pair much lower. I think given enough time we at the very least are probably going to consolidate in this area, so it is not a huge surprise to see this market pullback. Whether or not we can break down below the 0.68 level is a completely different question, but certainly, one that I think would resolve in quite a negative fashion if we do. In the sense, this is a market that is simply trying to figure out where it wants to go next, and we are killing time at what is an extraordinarily resistive area. On the one hand, you have a lot of fears about the global growth situation, which directly ties into the Australian economy. On the other hand, you have the Federal Reserve doing everything he can to bail everybody out, weakening the US dollar in the process. It is a bit of a “push-pull” still, but I think we should get some type of resolution rather soon. In the meantime, I think we bounce around in this 200 point range.