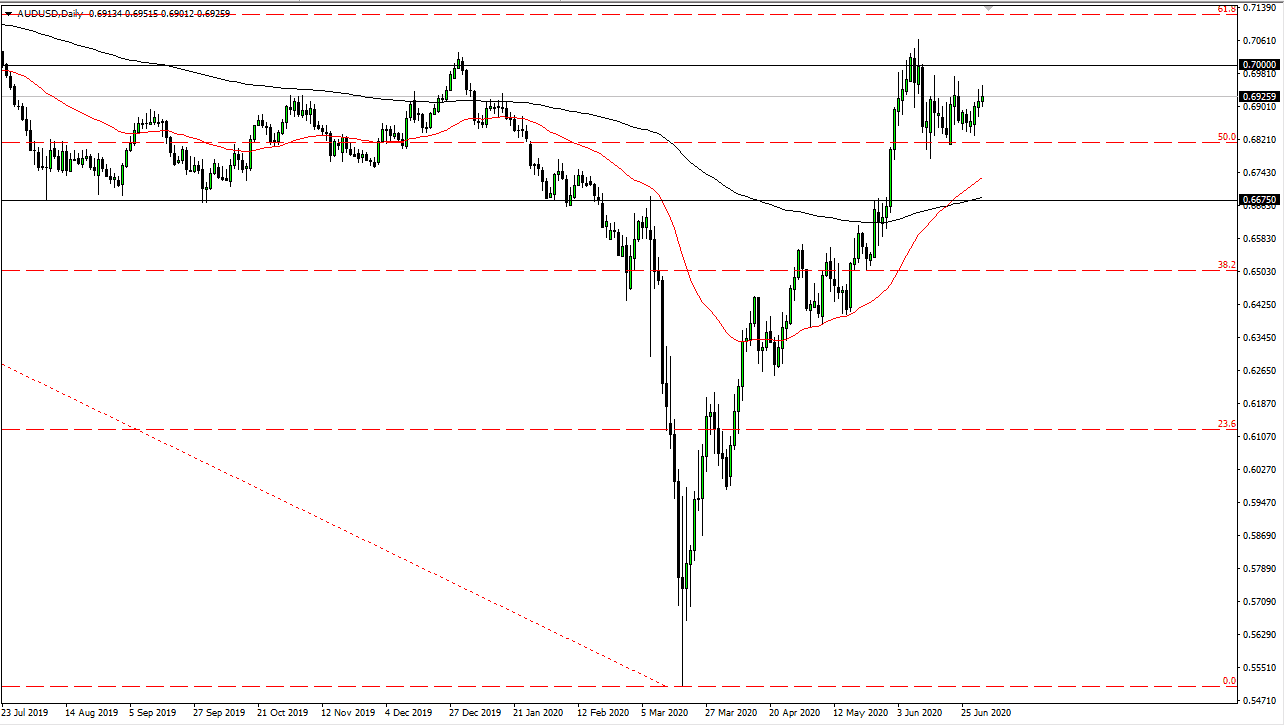

The Australian dollar has rallied a bit during the trading session on Thursday, but as you can see, we have failed to continue to go much higher. At this point, the 0.70 level above continues to be a massive barrier that traders will pay attention to, which extends all the way to the 0.71 handle. With that being the case, I believe that the Australian dollar is going to continue to be very fragile.

The US dollar started to see a little bit of strength during the day, and the fact that the jobs number in the United States came out much better than anticipated could give traders the thought of buying the US dollar as the US economy should in theory continue to do better than other ones. Remember, the Australian economy is highly levered to the Chinese situation, which of course is still a bit of a mess. We have to worry about the US/China trade situation and then of course the global growth situation which of course could be a bit all over the map right now. Ultimately, I think that if we break down below here, we could test the 0.68 level. If we break down below there, then the market should go down to the 0.6675 handle. The 200 day EMA is in the same neighborhood, so that of course could offer a bit of support by itself.

To the upside, the 0.70 level is significant resistance because it is a large, round, psychologically significant figure. That being the case, there has been a lot of selling in that area. The market is likely to find resistance all the way to the 0.71 handle. In other words, I think that this is a market that is going to continue to struggle to break to the upside. I think we are trying to figure out what to do with this “V-shaped” that we have formed. If we break down below the 200 day EMA, then we could go down to the 0.65 handle. Looking at the recent trading, it is essentially forming some type of triangle right now and looks a bit confused. We have to ask the question whether or not we are forming distribution, or are we consolidating to continue the overall uptrend. With this being the case, I think the one thing you can count on is a lot of choppy trading.