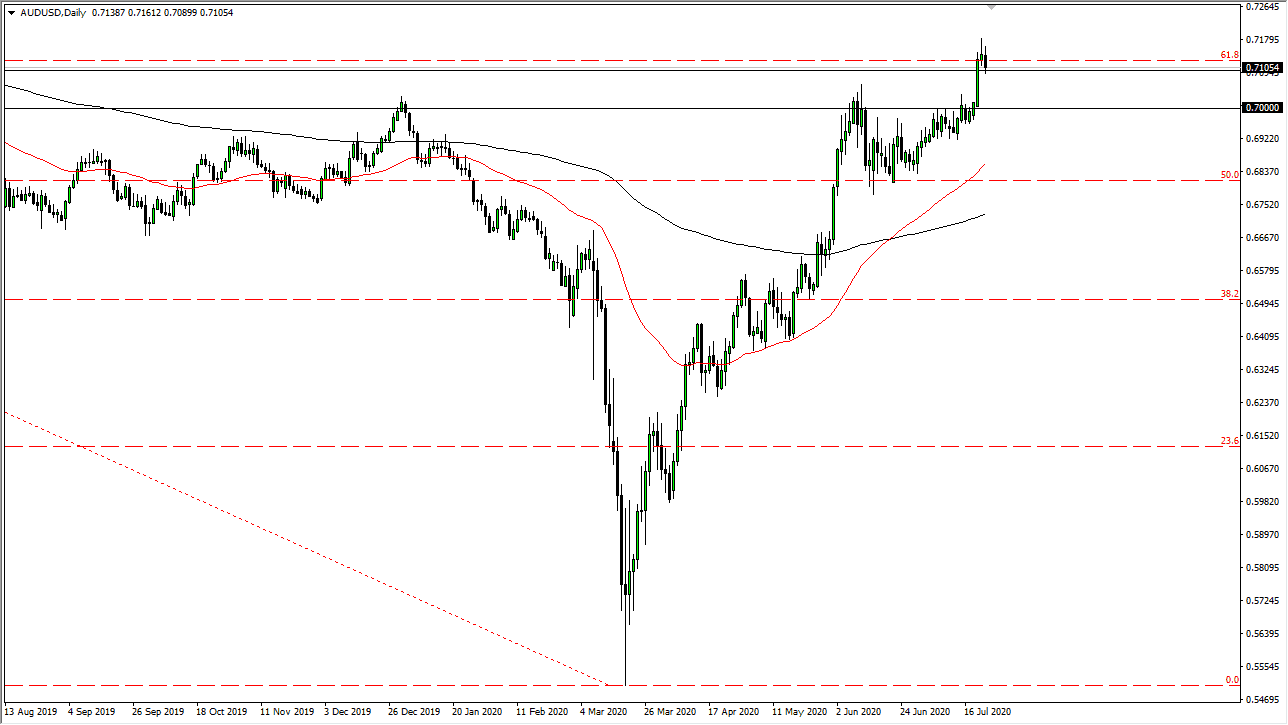

The Australian dollar initially tried to rally during the trading session on Thursday but gave back the gains in order to form a slightly negative candlestick. Ultimately, we had broken above the 0.71 level which was an area that I thought was crucial, and now we will probably pull back in order to find a bit of value. This is typical for the market to pullback after breaking out like it has, so I like the idea of perhaps awaiting for some type of value to enter the proposition. Having said that, we are currently seeing a little bit of support near the 0.71 handle, so we could pop a little bit from here but all things being equal I think it is only a matter of time before buyers get involved regardless.

The 0.70 level is the bottom of support as it was the beginning of resistance, somewhere between here and there I am loving the idea of buying the Australian dollar and the longer-term trend certainly looks very strong although we did end up forming a massive shooting star on Wednesday. I think this is a simple “break out and retest” just waiting to happen, so be a little bit patient and take advantage of “cheap Aussie dollars.”

If we were to break down below the 0.70 level, it is likely that we would then go looking towards the 50 day EMA underneath which is just above the 0.68 handle. At this point, it is likely to see a lot of support and buyers, so I think that is about as low as we would go, although to be honest I would be very surprised if it actually got down there. If it did, I would become a little bit more aggressive with my position size of the belief there is so much in the way of support in that general vicinity. Remember, we are in the midst of a potential long-term trend change, so this is something that does tend to be rather noisy. However, it looks as if the only thing that people care about right now as the Federal Reserve and therefore, I believe that the US dollar continues to lose strength over the longer term. With that being the case, buying the dips is probably the way going forward for the longer-term move up to the 0.80 level which I expect to see hit over the next six months.