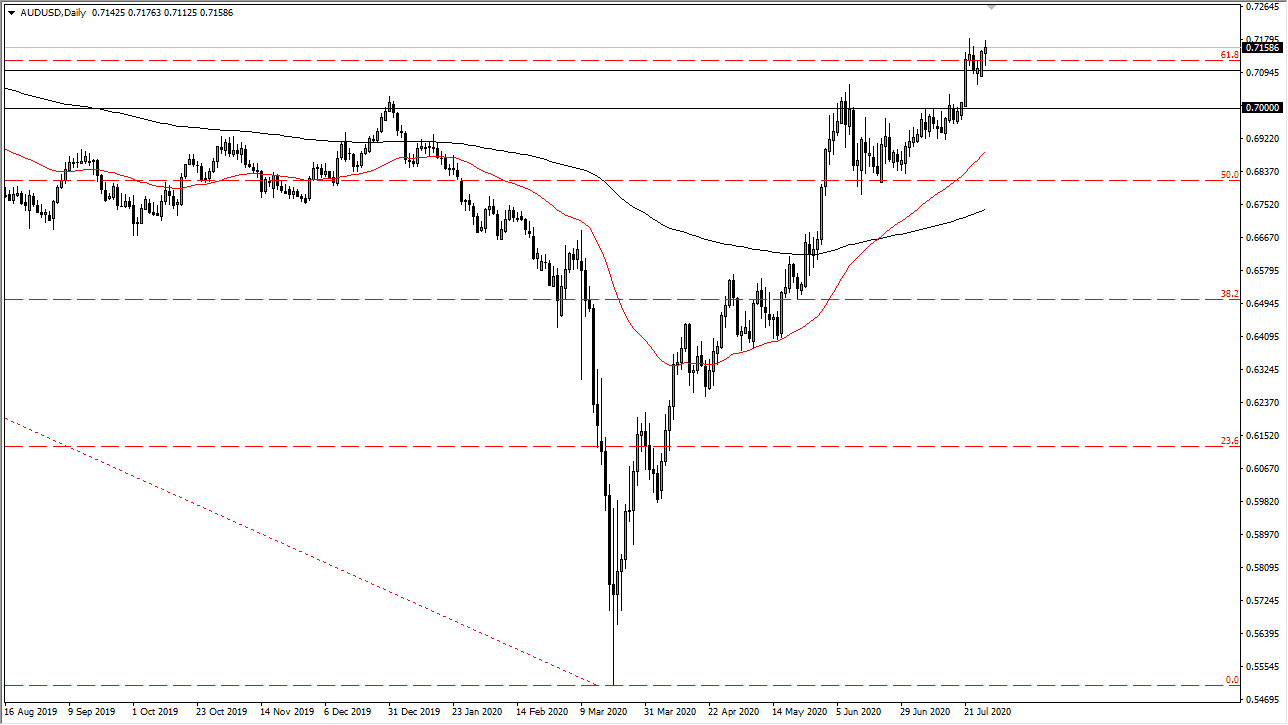

The Australian dollar had a choppy session on Tuesday, initially trying to rally before breaking down towards the 0.71 handle. We turned around from there again and ended up forming a bit of a hammer. The hammer of course is a bullish sign and as a result it is likely that we will continue to find buyers on dips. At this point in time, the market has plenty of support extending down to the 0.70 level, so I think that there is a zone of buying pressure underneath. With this, we may have some time ahead of us before we take off but clearly it is likely to go higher rather than lower, mainly due to the fact that the US dollar is getting hammered against almost everything.

Looking at this candlestick, it does suggest that there is still plenty of fight in the Aussie to the upside, even after the explosive move that has been had over the last several months. In fact, I do not have any interest in shorting this market anytime soon, because the momentum has clearly shown itself to be in favor of the Aussie.

The market could be looked at as offering a small bullish flag, and we have in theory broken out above it during the trading session on Tuesday. If that is true, then the next move will probably be to the 0.73 handle. Longer-term, I still believe that the Aussie is going to go looking towards the 0.80 level after that. This does not mean that we are going to get there overnight but I do think that we get there eventually. By looking at short-term pullbacks it is likely that we will find value that we can continue to take advantage of. That is essentially what this market is going to be all about, taking advantage of “cheap Aussie dollars.” In fact, I do not have any interest in trying to short this market, I simply look for buying opportunities. In fact, it is not until we break down below the 0.68 level that I would be even in the slightest bit interested in trying to short this market. This market continues to be very noisy, but it will move based upon a multitude of things, perhaps not the least of which will be the FOMC announcement on Wednesday. This market continues to be noisy, yet very positive over the longer term.