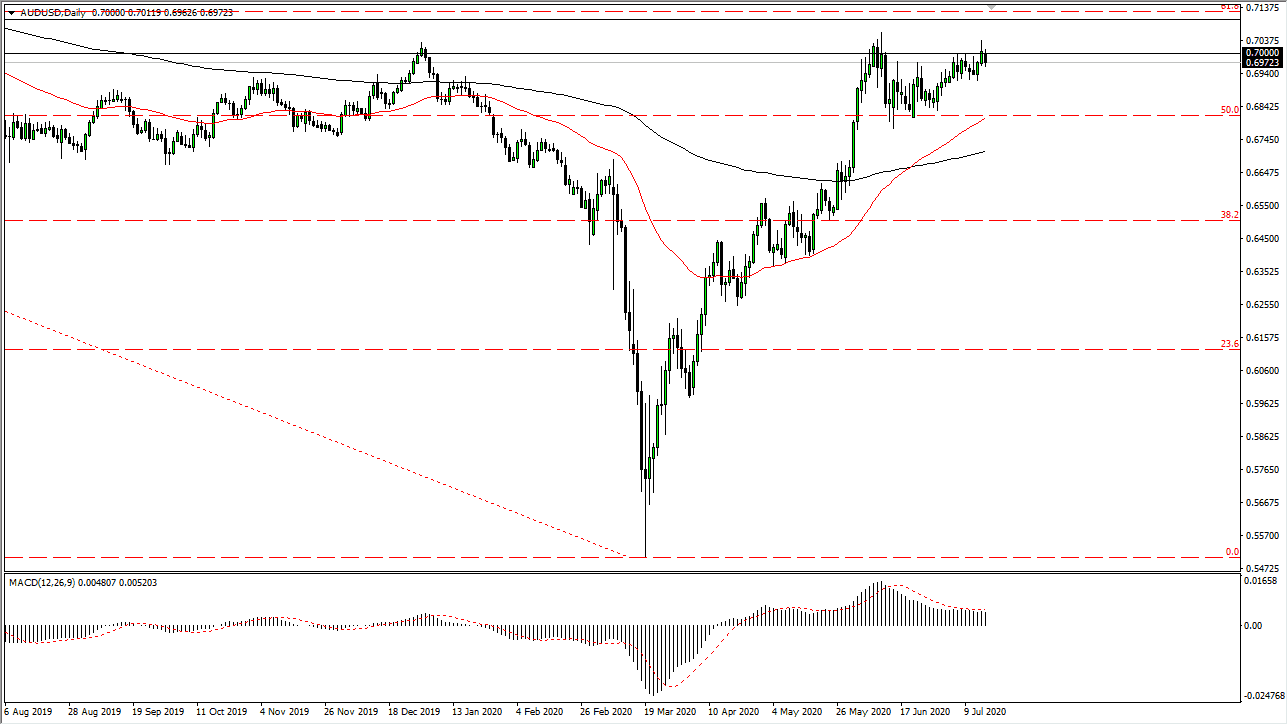

The Australian dollar initially tried to rally during the trading session on Thursday but failed again at the 0.70 level. Having said that, we need to keep things in perspective here, the Australian dollar only fell 30 pips or so. However, what I do see is that there is a lot of resistance extending from the 0.70 level to the 0.71 level, and therefore is going to take something rather special to break out. With that in mind, I also have to admit that this market has been rather relentless, so it is worth paying attention to the fact that the sellers have not been able to knock this pair back down.

If they do not get back down, it is likely that we will see a lot of support near the 50 day EMA which also happens to be near the most recent support level in the form of the 0.68 handle. With that being the case, unless we get some type of major shift in risk appetite, I believe that we will find buyers in that area to take advantage of the Australian dollar being a little bit “cheap” in relation to its recent valuations.

When I look at the longer-term weekly chart, I can make a strong argument for some type of break down from here, as this is an area that has been important support and resistance over the years. Having said that, it does not mean that it is going to be easy to take that trade, and we need some type of catalyst to have money flowing back to the US dollar. I just do not see it right now, unless it is fear driven because the Federal Reserve is doing everything it can to work against the value of the greenback.

We may get a little bit of a slump on Friday, but I would not read too much into it. If we turn around a break above the highs from Thursday that would be very bullish, but the real key is to overcome the 0.71 handle, as it would lead into a longer-term trend change. We most certainly have press the issue as of late, but we still have not crossed the Rubicon of downtrend to uptrend quite yet. We are most certainly working on that though and at this point it looks as if it is only a matter of time.