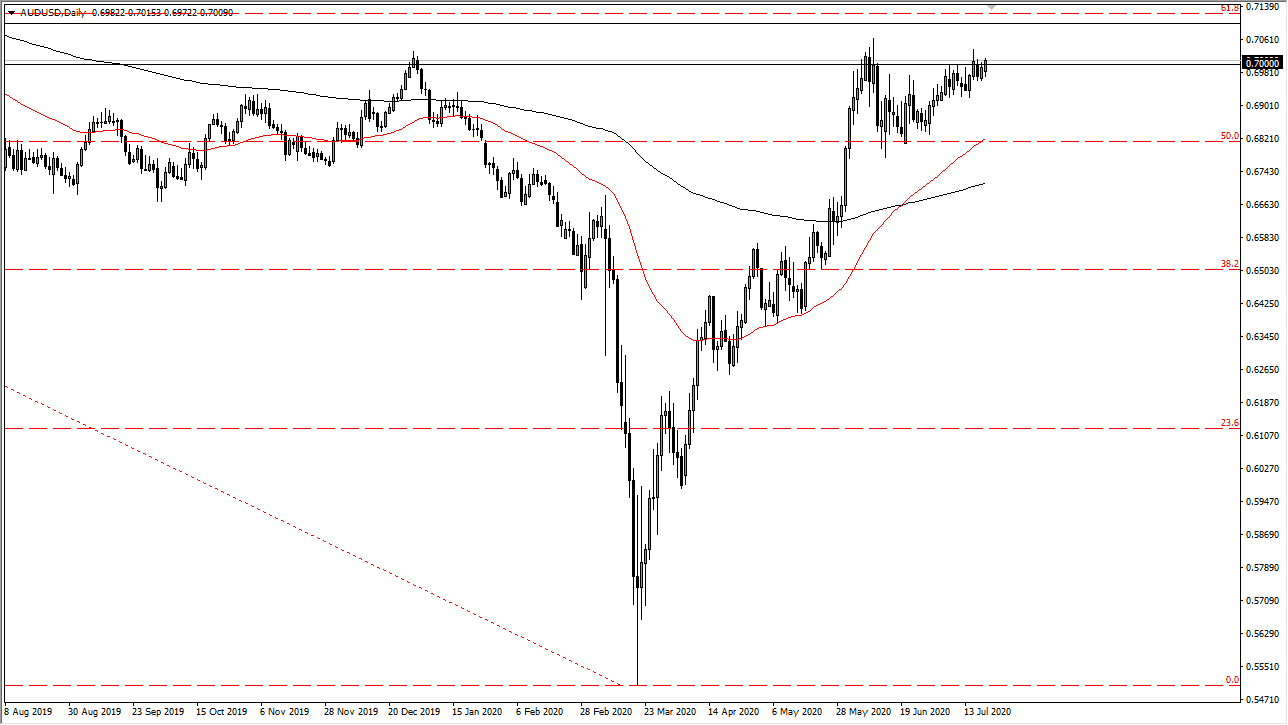

The Australian dollar has rallied again on Monday, crossing the 0.70 level. If this sounds like Groundhog Day that makes quite a bit of sense considering that the market has been very closely glued to the area as a potential ceiling, which extends all the way to the 0.71 handle. If we can break above that level, it is likely that we could go into a longer-term move to the upside, perhaps as high as the 0.80 level. From what I see in the precious metals markets, it is likely this will eventually happen. This is not to say that it is going to happen overnight, but I think that is where the endgame plays out.

I have found that short-term pullbacks have the potential to offer buying opportunities, as we have seen so much resiliency in this pair. I think there is massive support all the way down to the 0.68 handle underneath, which is the bottom of the trading range that we have been in. However, you can see clearly that we have been grinding higher and just going to the upside regardless. I think at this point you are looking for short-term pullbacks as a buying opportunity more than anything else. You can make an argument for an ascending triangle, but there is so much in the way of resistance above that continues to cause issues, so it is not until we get that daily close above the 0.71 level that I feel the Australian dollar has the ability to truly start to take off to the upside. If it does, then it is likely that we will start to see a significant amount of momentum.

The 50 day EMA underneath is massive support near the 0.68 handle, and I think that the support runs not only from there, perhaps even down to the 200 day EMA as well, forming a bit of a “zone of support.” I like the idea of taking advantage of “cheap Australian dollars” every time they appear. Remember, the Federal Reserve continues to loosen monetary policy so that has been working against the value of the greenback overall. I think that is going to continue to play itself out in this market, so I like the idea of getting away from the US dollar if and when I get an opportunity to. Simply buying here would be rather difficult though.