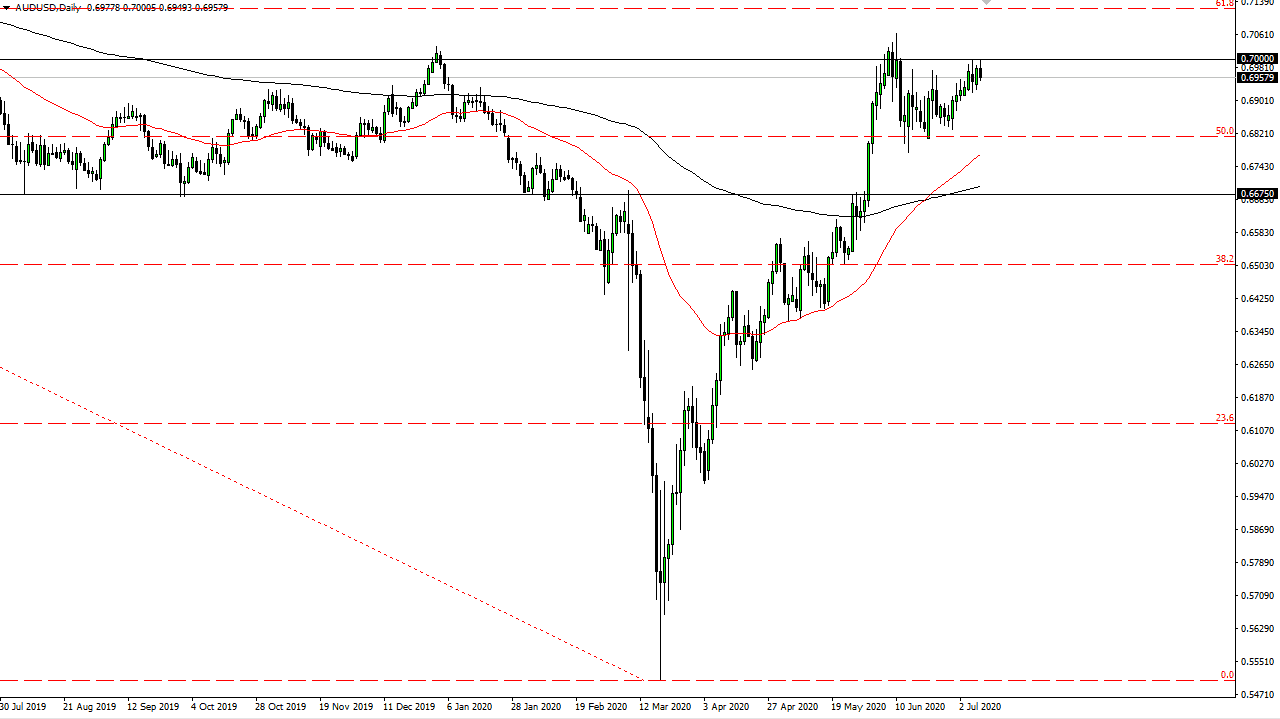

The Australian dollar initially tried to rally during the trading session on Thursday but as you can see the 0.70 level has caused a bit of trouble yet again as we pulled back towards the 0.6950 level. At this point, the market is likely to struggle to break above there based upon what we have seen of the last couple of days. With that being the case, I like the idea of fading short-term rallies, but I also recognize that we have seen an extraordinarily bullish move over the last several months, so at this point it is likely that we will continue to see this volatility.

After all, the Australian dollar is sensitive to global risk appetite and of course the Chinese economy. The Chinese economy is the engine of global growth, not only through construction but it more importantly the manufacturing of the goods that so much of the world buys. That being said, Australia is going to be vulnerable to negative news coming out of that region.

We are starting to be more concerned when it comes to the coronavirus figures, so keep in mind that the markets are going to continue to see reactions to headlines, especially as we are starting to see places like Hong Kong show more infection. If that is going to be the case, and we are seeing parts of China being locked down as well, that could put bearish pressure on the Australian dollar. One of the biggest reasons we have been going higher is that the Federal Reserve has been pumping the markets with cheap money, and that does tend to devalue that currency eventually. However, at the moment we also have a lot of concern and the US Treasury markets continue to attract a lot of attention. As long as that is the case, there is going to be a demand for US dollars, as those markets are funded in those dollars. Beyond that, with so much debt in the world, it suggests that there is going to be a lot of demand for dollars as most debt is denominated in that currency. That being said I like the idea of selling as we get close to the 0.70 level. It is not until we break above the 0.71 level that I more comfortable to hang onto a longer-term position. I think right now we are simply going back between the 0.70 level and the 0.68 level underneath.