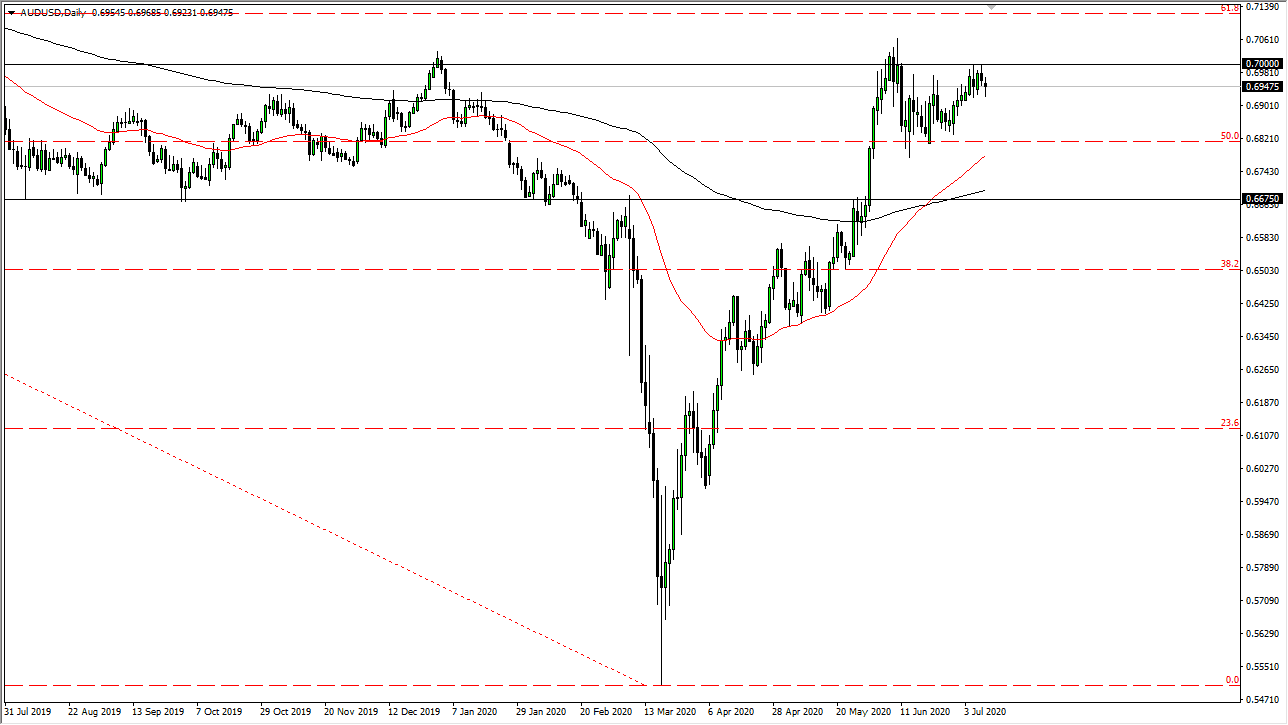

The Australian dollar has gone back and forth during the trading session on Friday, forming a bit of a neutral candlestick. The Aussie continues to face a lot of the same problems, as there has been a significant amount of resistance at the 0.70 level, which extends all the way to the 0.71 level. This is an area that I think continues to see a lot of noise, and therefore I think it is going to take something rather special to finally break out above there. It is worth noting that traders were not willing to carry the Aussie dollar into the weekend, which is something that is a bit telling as far as risk appetite is concerned.

The main thing that is driving this pair higher is probably the Federal Reserve pumping greenbacks into the markets. Ultimately, the Australian dollar is highly levered to the Chinese economy and global growth in general. As we have a lot of concerns about the coronavirus situation and the escalating tension between the United States and China, it would make sense to see the Aussie fall a bit overall. With this, I believe that the market could very well end up falling down towards the 0.68 level underneath, which has been supported. To the upside, we would need to break all the way above the 0.71 level for me to feel comfortable buying because at that point in time it becomes more of a “buy-and-hold” type of scenario.

As there are so many moving pieces out there when it comes to the global economy, I think that it is going to be difficult for the Aussie dollar to rally longer term. That does not mean it cannot happen, just that we need to see a lot of good news suddenly pop into the market. If we were to break down from here and sliced through the 0.68 handle, then we have the ability to go down to the 0.6675 level. In that area, I see a 200 day EMA indicator that could offer a significant amount of support. A breakdown below that level would be negative for the Aussie dollar, perhaps sending it way farther to the downside. All things being equal though, we are probably looking at more range bound choppiness in the short term, just keep that in mind.