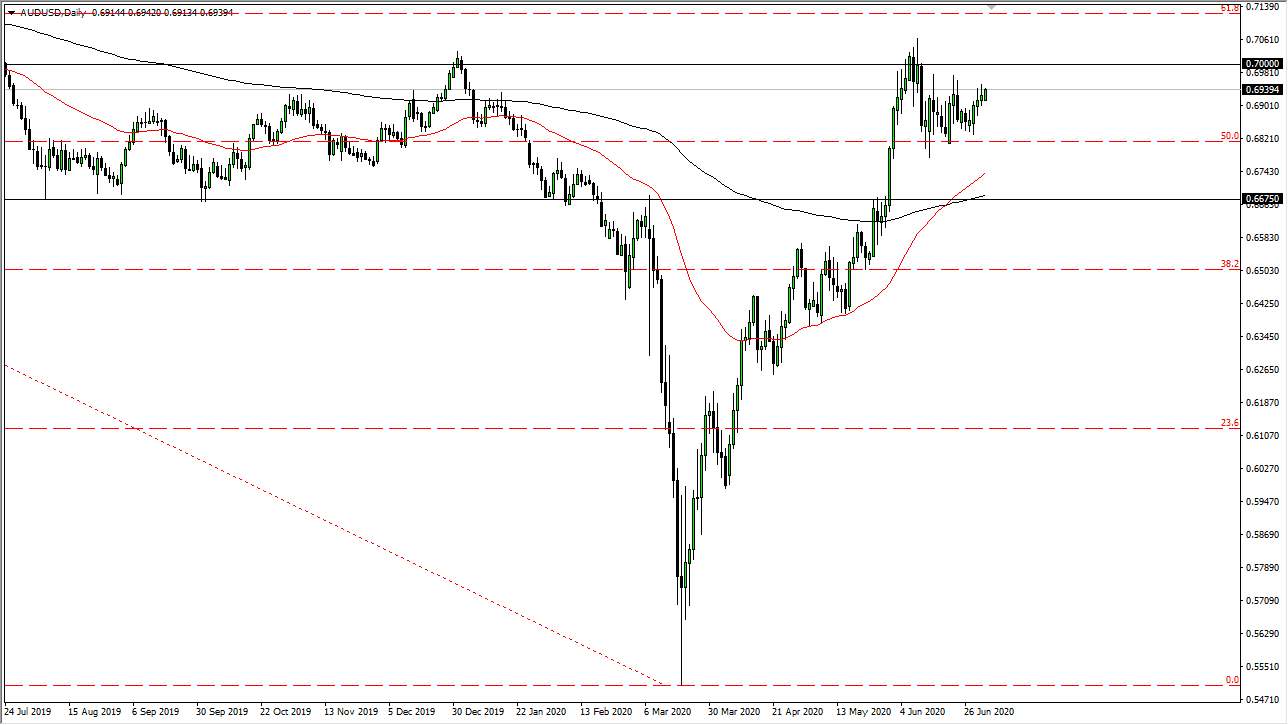

The Australian dollar rallied a bit during the trading session on Friday and what could have been quiet trading due to the Americans observing Independence Day. With that being the case, we had a very tight range. However, when you look at the range from Friday, it was not terribly different than Wednesday’s or Thursday’s candlestick. Looking at this chart, there is a lot of resistance above at the 0.70 level, so I think that it’s only a matter of time before sellers come back to push this pair lower. I would also point out the fact that it has been extraordinarily resilient, and on the weekly chart this weekly candlestick is closing with most of the gains being retained.

When I think about this market, I recognize that the Australian dollar is sensitive to the Chinese situation and global growth, which is under serious stress, but at the end of the day it is perhaps the Federal Reserve that is driving this pair more than anything else. After all, the Federal Reserve is printing as many US dollars as it can, so having said that it is only a matter of time before the Aussie takes out to the upside if this keeps up.

The alternate scenario of course is that we break down below the 0.68 level and go looking towards the 0.6675 handle, perhaps in some type of major “risk-off” type of scenario. This market has a massive amount of resistance just above, starting at the 0.70 level. That resistance extends all the way to the 0.71 handle, so it does mean that it is going to take a significant amount of momentum to finally break out above there. We have failed at the first serious attempt, so I would not expect much in the way of change once we get back up there. Furthermore, I think a lot of the world is essentially holding its breath as to what to do about risk appetite because although stock markets and the like around the world continue to rally, the reality is that the global economy is very weak. At least this is better than the worst case scenario where a lot of people were looking after the pandemic hit China, the United States, and the European Union.