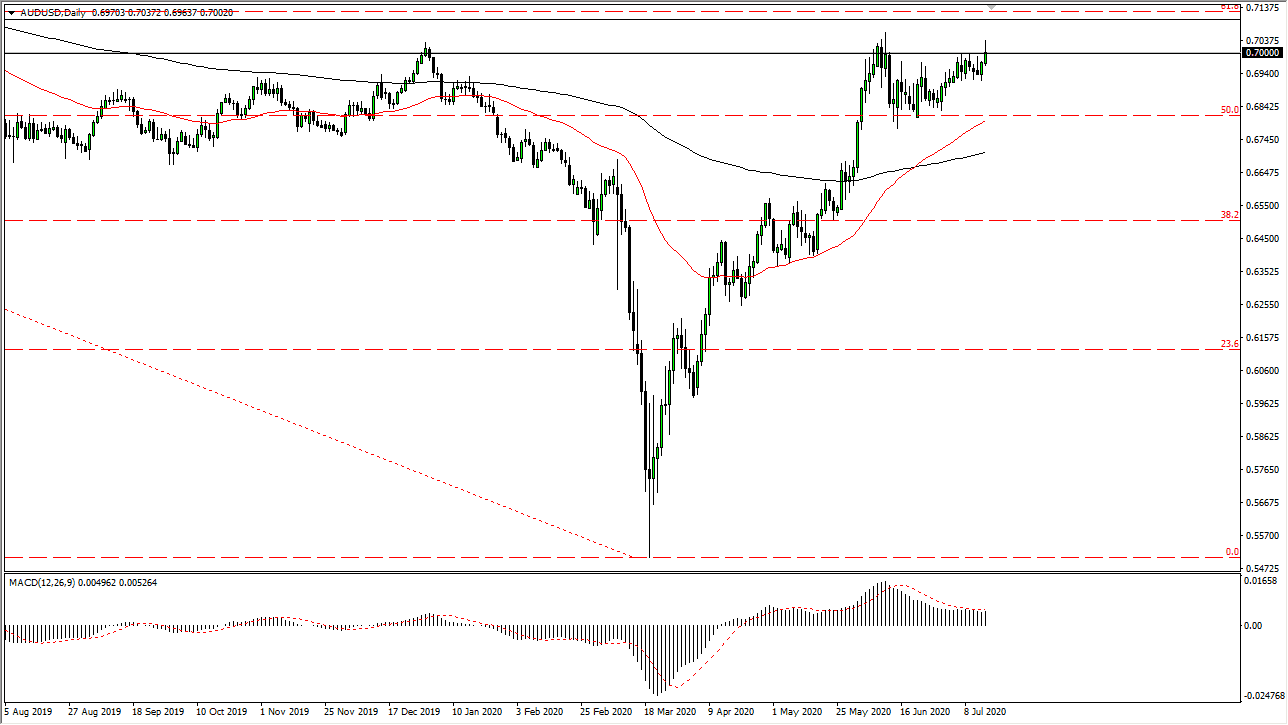

The Australian dollar initially tried to rally during the trading session on Wednesday but gave up the gains above the 0.70 level. At first, it looked like we were going to see a significant break out, but the fact that we closed right around the 0.70 level has traders asking a lot of questions. The US dollar has been sold off quite drastically and one has to wonder whether or not we have not gotten a bit overdone. However, the buying pressure has been rather relentless, so it is a bit difficult to get overly bearish of any currency against the greenback at the moment. The Federal Reserve is doing everything it possibly can to kill the value of the US dollar, so I think it is only a matter of time before value hunters come back.

Looking at the chart, there has been a clear area of resistance between the 0.70 level and the 0.71 level. We did do a significant amount of technical damage to it during the trading session on Wednesday, so the question now is whether or not there will be more sellers coming back in? I kind of doubt it due to the fact that we have been so negative on the US dollar, so I think it is only a matter of time before we break to the upside. I believe that the fact that the Federal Reserve is liquefying the market is one of the main drivers of this currency pair. It is worth noting that the area between the 0.71 level and the 0.70 level underneath is a massive level on the longer-term charts. If we break above the 0.71 handle, I feel at that point it is likely that the Australian dollar will enter a longer-term “buy-and-hold” type of mentality.

To the downside, if we were to break down below the daily candlestick for the trading session on Wednesday, then the 0.68 level would have to come into focus, as it had been previous support. I do not think that the US dollar is going to fare very well over the next several months as we continue to see quantitative easing in America and swap lines being repaid by central banks. The inflow seems to be slowing down, so with that, it makes sense that the demand for US dollars is starting to ease up just a bit.