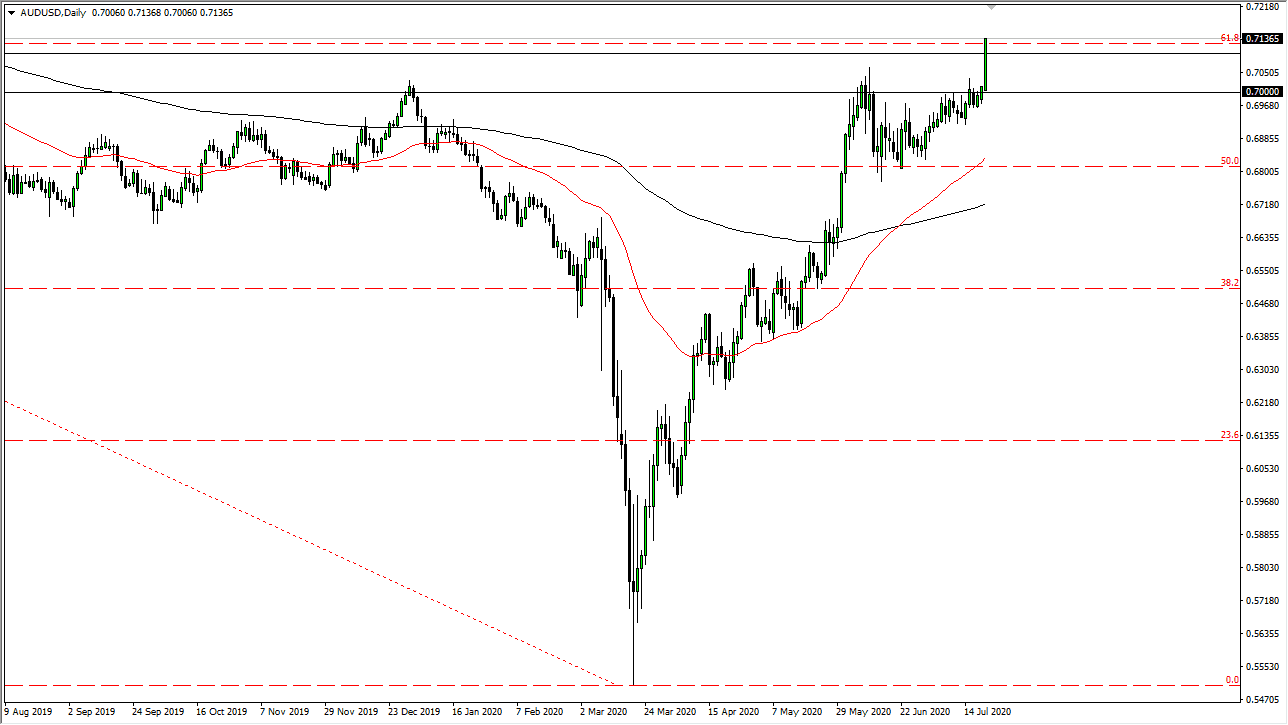

The Australian dollar has broken through the 0.71 level, which I have been looking at as a major barrier extending all the way from the 0.70 level. Now that we have broken above this, I believe that the Australian dollar has much further to go, although it will not necessarily be a straight shot up in the air. After all, Philip Lowe suggested earlier in the session that the Reserve Bank of Australia could drop interest rates down to 10 bps, which is not exactly bullish for the currency. However, the one thing that the Australian dollar has for it going right now is that it is not the US dollar. The US dollar has been pummeled on just about every front, and there is no difference here. Ultimately this is about liquidity being injected into the system by the Federal Reserve.

Furthermore, there is an argument about the coronavirus situation. It should be noted that Australia is starting to see another spike in cases, so although it is a bit counterintuitive, it looks like money is flowing to the Aussie dollar. Global growth certainly will not be the main driver, because it is going to struggle in these times. With global growth slowing down the way it has, demand for Australian commodities will probably continue to suffer, although the Chinese are pretending like everything is normal again.

All things being equal, we are now in a situation where it is a “buy on the dips” type of market as we have finally cleared what I thought was going to be a major barrier. In fact, it is very crucial noting this considering just how much resistance we have seen in this general vicinity. At this point, I believe that the Australian dollar is more than likely going to find itself closer to the 0.80 level eventually, but that is obviously a longer-term call. With that in mind, I believe that the market is probably going to continue to grind higher from time to time but that we will see plenty of buyers every time we pull back. I have no scenario in which I’m willing to short this market right now unless of course something drastic happens to global risk appetite or something involving China which of course always can happen. Regardless though, it looks like the Federal Reserve is the only thing people care about.