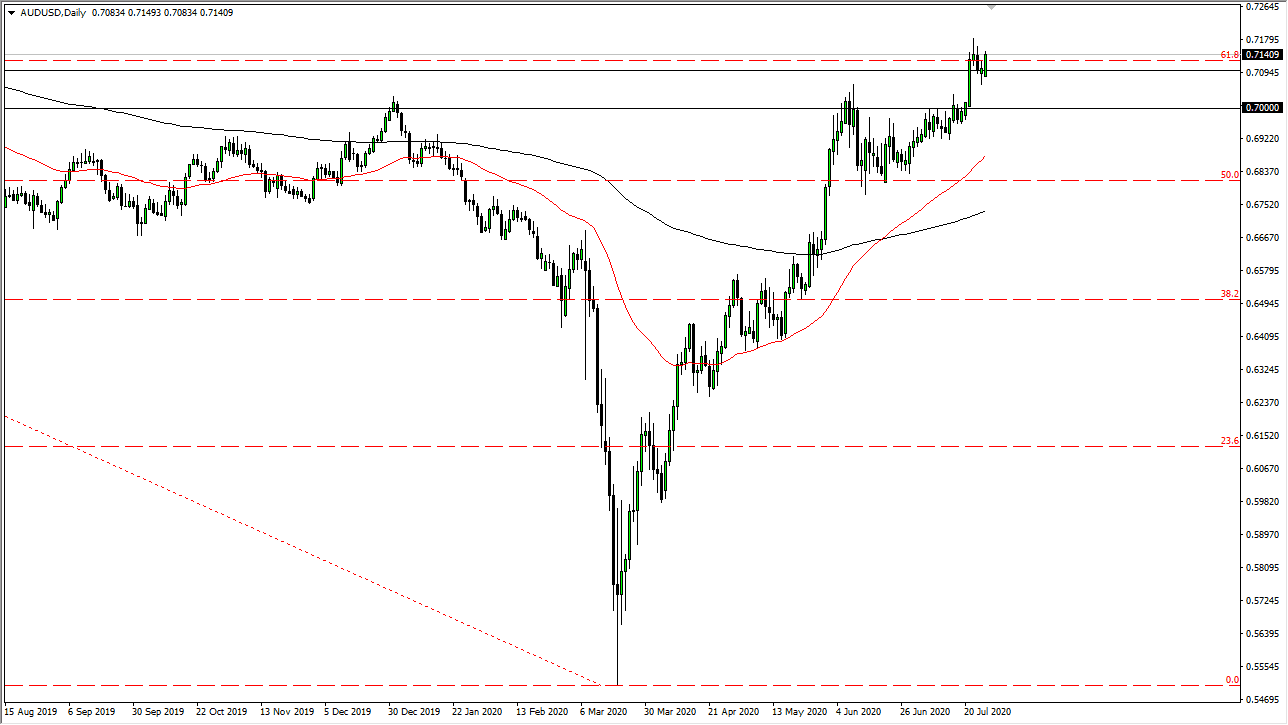

The Australian dollar has rallied significantly during the trading session on Monday, breaking above the 0.71 handle, and reaching towards the highs again. At this point in time, the market is likely to continue seeing a lot of buyers on dips, and I think that the Australian dollar will continue to strengthen due to the fact that the US dollar is so soft. The market is closing towards the top of the range for the day, and that is a very bullish sign.

To the downside, I think that the 0.70 level is the absolute “floor” in the market and the uptrend, and I think that the buyers will continue to jump into this market on these dips. The 0.70 level is an area that is going to be very crucial, and therefore I think it determines whether or not we are still in the uptrend. The 50 day EMA is underneath and reaching towards the highs again and has now broken well above the 0.68 level. The market has clearly been very bullish for some time and I do not think that is going to change anytime soon. In fact, I fully anticipate that the Australian dollar will have yet another bullish run during the week. I look at short-term dips as buying opportunities and have no interest in shorting the Aussie, mainly because of the US dollar falling in general.

Overall, I think that the market will eventually go looking towards the 0.80 level, but that is obviously a longer-term call. Every time we rally and then pulled back, I think that more people will jump in and pick up bits and pieces of value. We have clearly changed the overall trend of the markets, and as a result, we need to trade as such. I like the idea of finding value going forward. The market is likely to continue seeing a lot of volatility, but in the end, it is obvious that the US dollar is on its back foot due to the Federal Reserve doing everything it can to liquefy the economy, and thereby drive down the value of the US dollar over the longer term. Quantitative easing continues to be a major issue, and therefore I think the longer-term trend has most decidedly broken in favor of anything but the US dollar right now.