The Australian dollar has rallied again during the trading session on Wednesday and now that we have gotten the FOMC statement and press conference on the way, is very likely that the Aussie can continue the trend that we have been in. The US dollar is still on its back foot and the Federal Reserve did nothing to dissuade traders from shorting it as they continue the overall bet on plenty of monetary stimulus coming out of the Federal Reserve.

That being said, it is not as if we will simply see this market go straight up in the air, I think we are likely to see a lot of buyers on dips as it offers a bit of value, something that market participants will continue to be attracted to. Over the longer term, I believe that the Australian dollar is probably going to go looking towards the 0.80 level above, which is a large, round, psychologically significant figure. Furthermore, I think that we could blow through there as well. This is a market that is most certainly reacting to the US dollar and the Federal Reserve more than anything else, so I am not particularly concerned about what is going on and Australia.

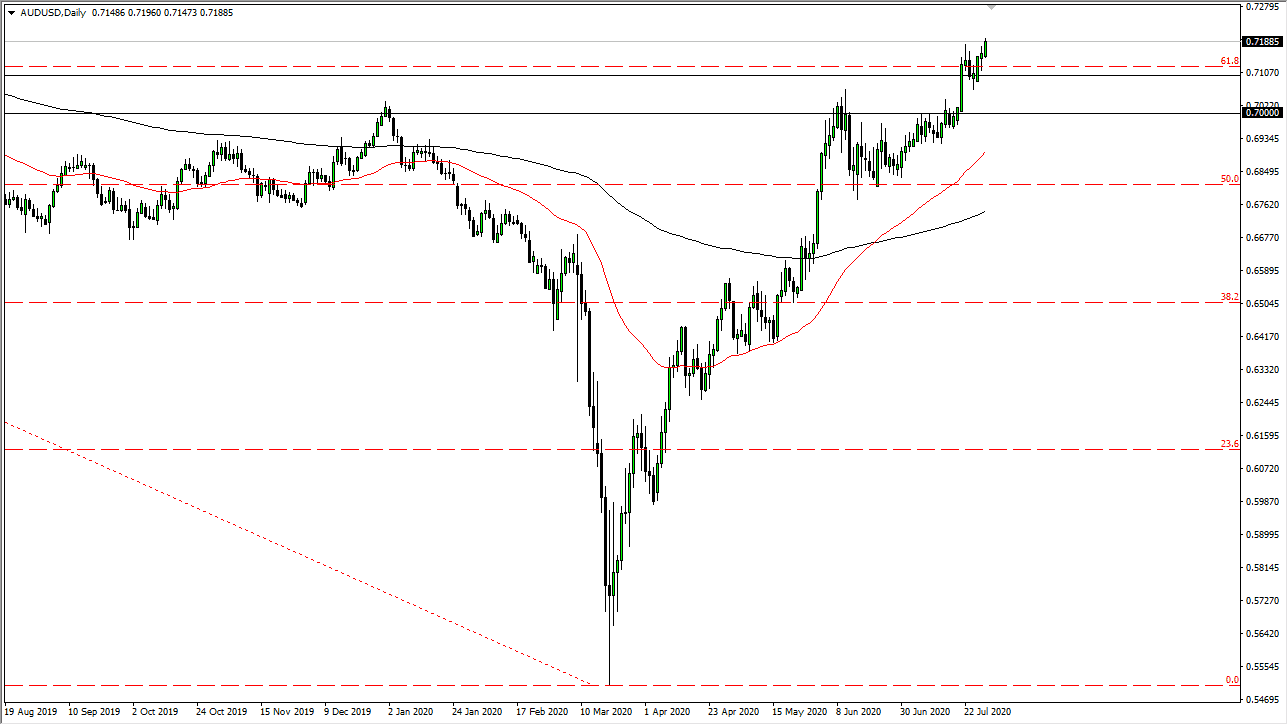

Sometimes, the market is all about growth in China and the like, but right now the markets are so distorted by the Federal Reserve flooding everything with liquidity that it makes quite a bit of sense that we simply see the US dollar fall and that is about it. The Australian dollar is a major benefactor because it is not only not the US dollar, but it is also sometimes driven by gold, which of course has rallied rather significantly as of late. I anticipate that this market will probably continue to find plenty of buyers on dips and I think that the 0.70 level will continue to be massive support. Below there, the market could find support at the 0.68 level as well, but I think we are in an uptrend for a bigger move. Being patient and waiting for value will continue to pay dividends as the Australian dollar has been so strong over the longer term. Based upon the ascending triangle that we just broke out of; I fully anticipate that the Aussie dollar is going to go looking towards the 0.73 level relatively soon. Either way, I do not have any scenario in which I am a seller anytime soon.