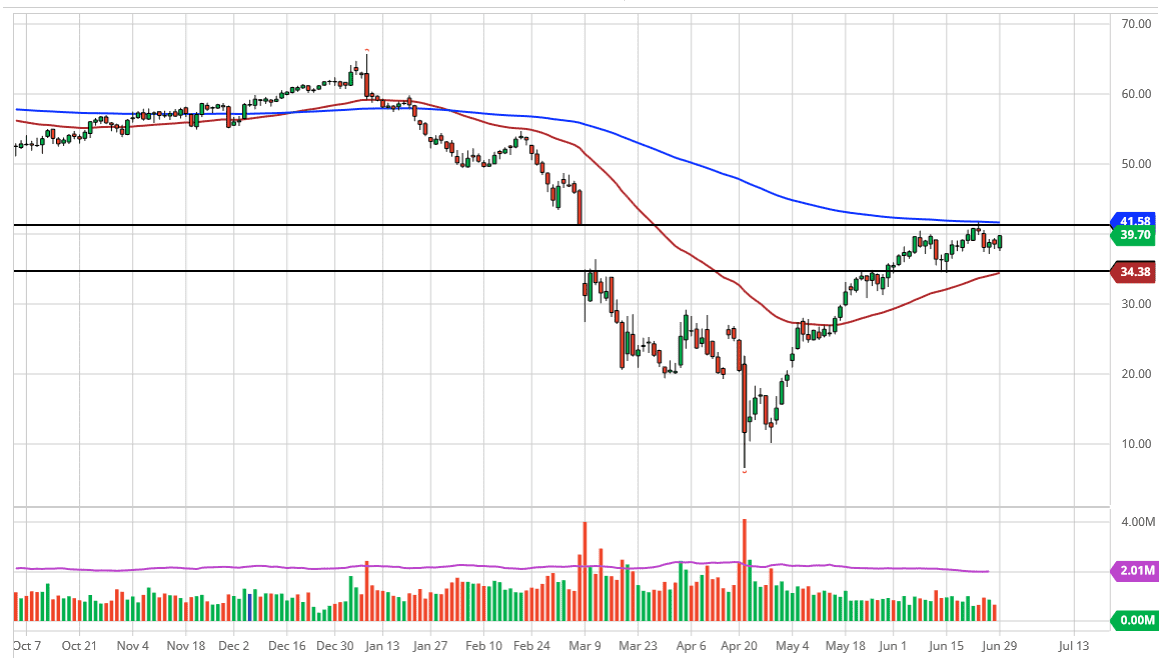

The West Texas Intermediate Crude Oil market has initially gapped lower to kick off the week on Monday, and then turned around to show signs of strength again as we not only fill the gap but went much higher. At this point in time, the market is likely to go higher, reaching towards the 200 day EMA yet again which is where the gap was at the $41.50 area. If we can break above the 200 day EMA, then it is likely that we could go much higher, perhaps reaching towards the $49 level.

All that being said, there is a significant amount of support underneath at the $35 level that should be paid attention to because not only is at the bottom of the previous gap, but it is also where the 50 day EMA is. With that in mind, I do believe that the markets are likely to see noisy trading in this general vicinity, and therefore I think we are in the midst of trying to make a longer-term decision. The longer-term decision will be quite interesting and crucial, so it is worth paying attention to. In the short term though, I think we probably bounce around between the 50 and the 200 day EMA as they both are followed quite intently by technical traders in general.

A breakdown below the 50 day EMA could open up a move down to the $30 level, which is previous resistance so it should now be support based upon “market memory.” After all, the oil markets do tend to move in $10 increments, so it would not be a huge surprise to see that happen. I think we are trying to figure out where we are going from here so it makes sense that we would see a lot of choppiness while the market try to figure itself out. There are massive amounts of production cuts out there, so it is likely that we will see a bit of a floor in this market, but at the same time one has to wonder whether or not there is enough demand out there to drive price higher. This is why I think we are getting close to form some type of range and right now I would anticipate that the most likely of scenarios is somewhere between $41 and roughly $30. However, we have a lot of work to do before we answer that question.