The West Texas Intermediate Crude Oil markets have broken down significantly during the trading session on Wednesday as traders are starting to worry about whether or not the coronavirus numbers are going to pick up, and slow things in the economy down. As far as the market is concerned, it is likely that we will continue to see a lot of angst when it comes to the supply/demand equation, due to the fact that the inventory numbers were bigger than anticipated, and the fact that the coronavirus situation continues to get worse. If it does, then it is highly likely we will see significant demand destruction for crude oil as people will not be driving anywhere.

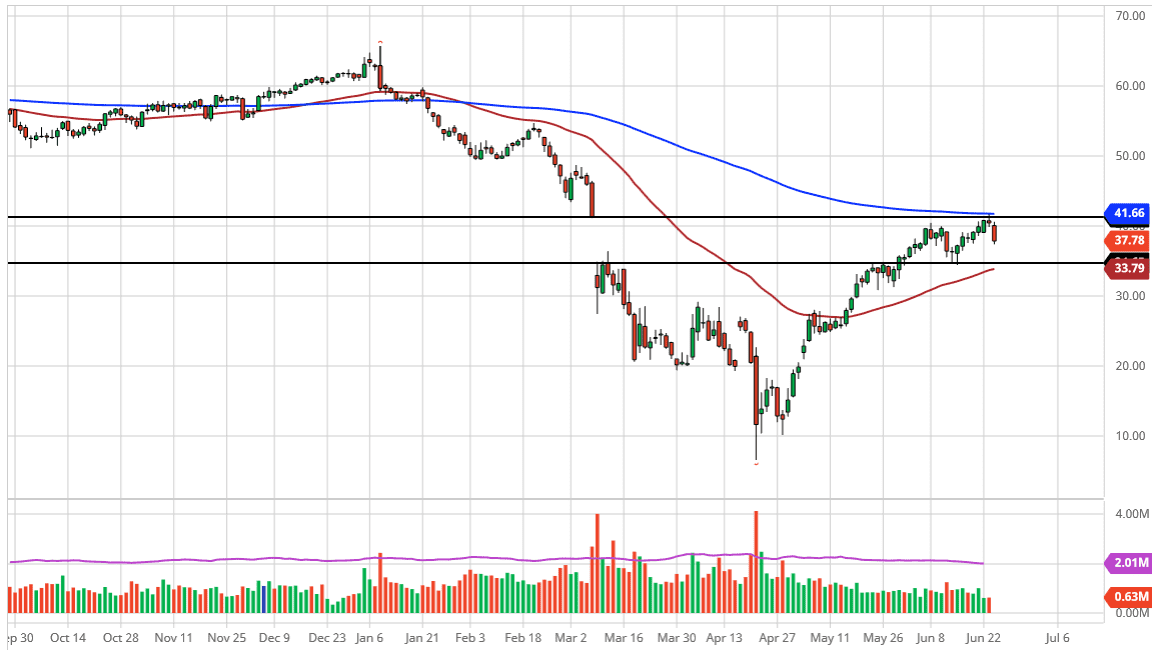

Looking at this chart, it is obvious that we had filled a major gap during the session on Tuesday, so pulling back from here makes quite a bit of sense but the sell-off was a bit stronger than I would have anticipated. The 50 day EMA underneath probably offers support so I think the market is going to try to drip down towards that area. That is an area where I think a lot of people would jump into the market, but I think you would have to do so slowly. As far as selling is concerned, you may have a day or two to do so, but I would anticipate that somewhere around the $35 level you would see traders come back in and try to pick it up.

I think that because we are between the 50 day EMA and the 200 day EMA, we are more than likely going to see a bit of a squeeze, and that of course comes into play as volatility in this market. Choppy back-and-forth trading with a slightly downward tilt is probably what we see in the next day or two, but I would fully anticipate that there should be buyers underneath. If we were to break down below the 50 day EMA, it is likely that we then go looking towards the $30 level underneath which could be the bottom of an overall channel that the market may try to trade in, as this market seems to like $10 intervals. That being said, I think we are trying to figure out what we are doing going forward, and the next couple of days could settle that situation.