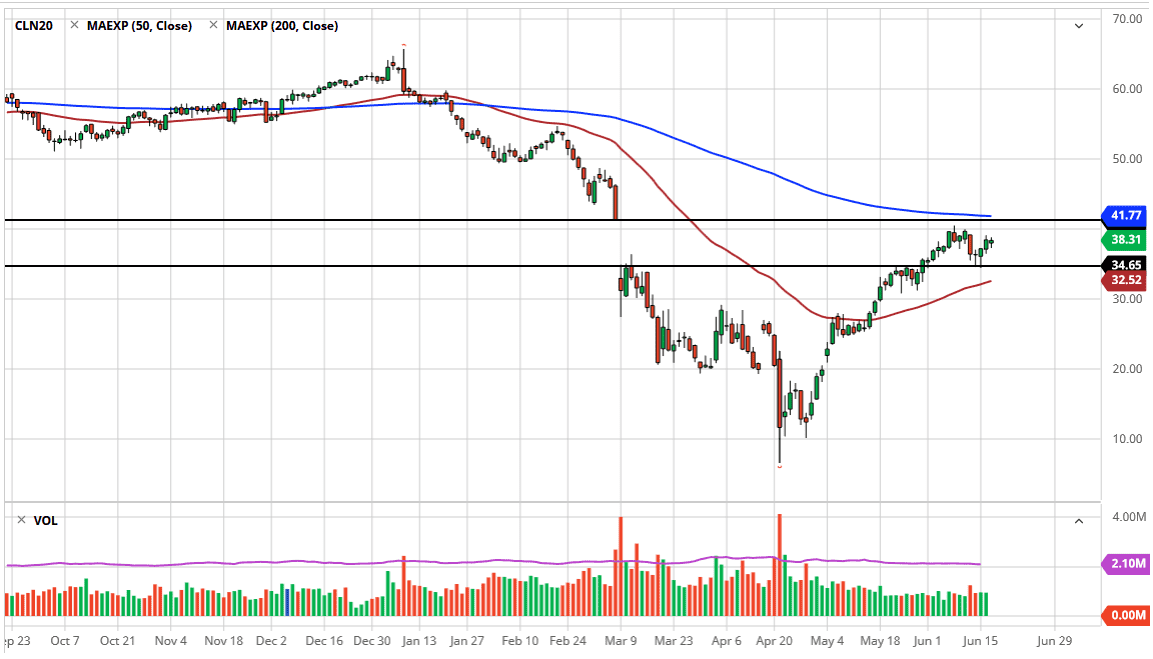

The West Texas Intermediate Crude Oil market gapped lower to kick off the trading session on Wednesday but then pulled back even further. Underneath there though, we have seen buyers and it looks as if we are going to continue to find buyers looking for value. After all, we have a technical signal that extends a move to the $41 level, which is at the top of the gap. If that gets filled, then it makes sense that every time we pull back, we should see buyers.

Looking at this chart, I also see that there is a lot of support near the $34.57 level, extending to the $35 level. The 50 day EMA is underneath at the $32.50 level and I think that there will be buyers in that area as well. Ultimately, I believe that this market is trying to figure out where the next range is, because quite frankly crude oil markets are very technical in nature and tend to find $10 ranges (roughly), and therefore we could be looking at an area between $30 and $40, but we have yet to see that being confirmed yet.

Looking at the overall supply and demand picture, there are possible fresh cuts coming but at the end of the day the real question is whether or not demand will pick up anytime soon? I do not think so, so that is another reason to think that the 200 day EMA would offer resistance, which sits just above that gap. In a sense, the fact that we are between the 200 day EMA and the 50 day EMA suggests that we are squeezing along and that typically means that eventually, we will get some type of move that is worth following. Right now, we do not have that so it is likely that we will need to wait for an impulsive candle to build up a larger position.

If we do get an impulsive candlestick that breaks one of the moving averages, then we could be looking at a new trend. If we break to the upside, meaning clearing the 200 day EMA, then the $50 level would be targeted. If we break down below the 50 day EMA, and perhaps even the $30 level, then that means that crude oil will go looking towards the $25 level, possibly even the $20 level. At this point though, I think short-term we still try to get to the upside and fill that gap.