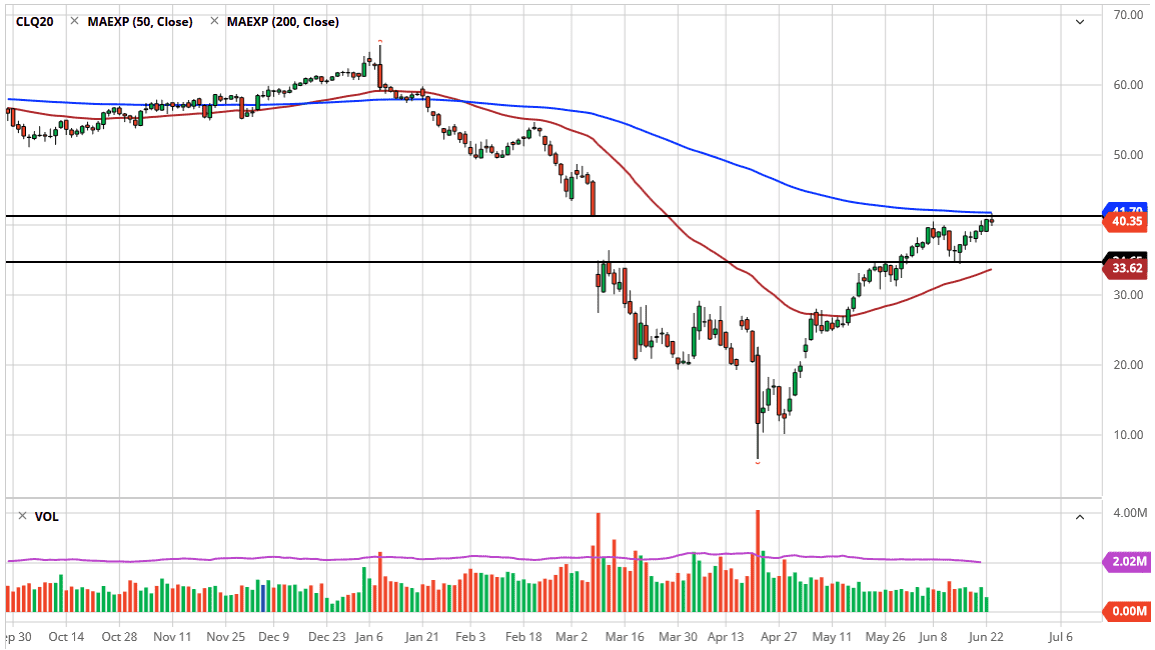

The West Texas Intermediate Crude Oil market has reached towards the $41 level before pulling back slightly. The 200 day EMA is obviously a technical indicator that a lot of people that people will be paying attention to. Now that we are at the top of the gap and facing the 200 day EMA, it is highly likely that we could pull back from here. Ultimately, this is a market that likes to find a range to work with, typically a $10 range.

Furthermore, we have the candlestick for the day being slightly red, so at this point it is likely that we may be getting a bit exhausted. The US dollar is also starting to show signs of strengthening a bit, and therefore that could work against the value of the WTI Crude Oil market. Underneath, the $35 level could be a bit of support just along with the 50 day EMA right below it. However, like I said the crude oil market does like the $10 ranges, so this is something worth paying attention to.

The market continues to look for stability, and I think we are starting to see it as you can tell that the overextended actions of the market have stopped and it is likely that we are going to continue to see a lot of back and forth. Ultimately, you should also keep in mind that we are below the 200 day EMA and the 50 day EMA. Because of this, I think you will see a lot of pressure in both directions so therefore we will probably see range bound trading work out the best for traders going forward but I think that the position size should be kept relatively small, due to the fact that we have caused so much in the way of damage to the sellers, but clearly they are going to jump into this market. I think that you need to trade at short-term charts, looking at the potential $41 level as resistance. However, if we break above the 200 day EMA on a daily close, then I think we could go looking towards the $49 level. The market more than likely will look at the $50 level is a massive barrier, so even if we do break out to the upside, I think it is somewhat limited. OPEC is looking to cut production, so that is the one thing that works for oil, but at the end of the day there is not much in the way of demand. Record inventories continue to work against the value.