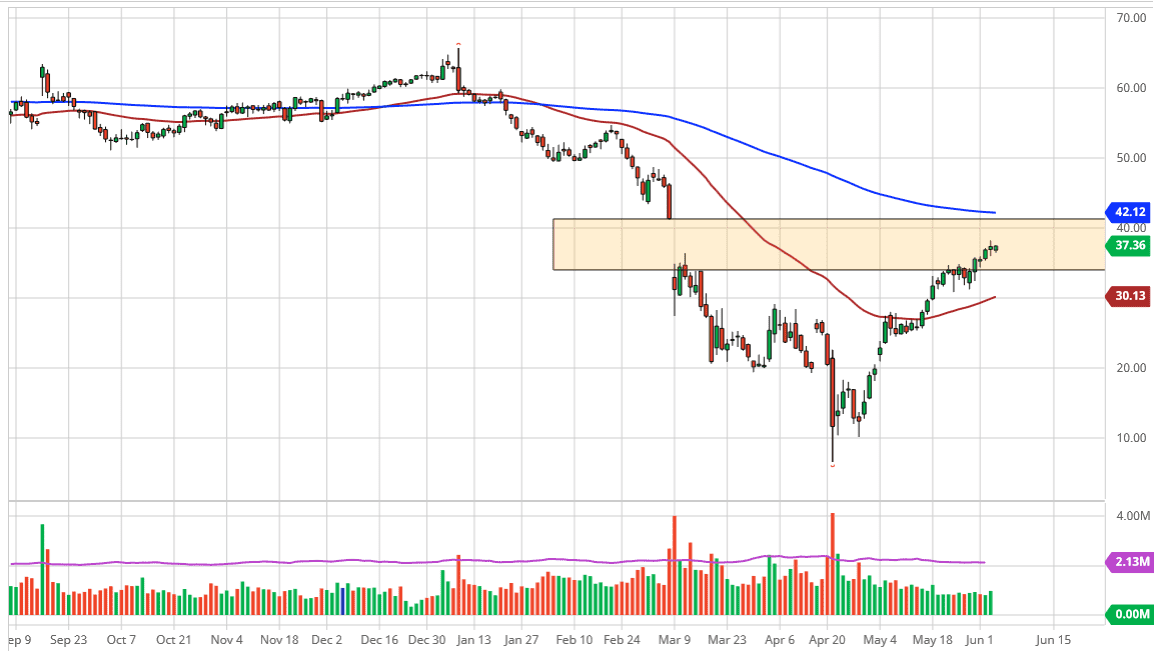

The West Texas Intermediate Crude Oil market has rallied a bit during the trading session on Thursday as we continue to see a major “risk on rally” in everything. Crude oil markets of course continue to have a lot of pressure to the upside, as there is a gap above that should get filled. Ultimately, I believe that the market will fill the gap just due to the fact that a lot of technical traders would like to see that happen. The 200 day EMA attracts a lot of attention, so having said that it is likely that the sellers will come into the marketplace to make the 200 day EMA even more important due to the fact that it is attached to that gap.

At this point, any signs of exhaustion in that area probably is that being a selling opportunity. However, if we were to break above there it shows a bit of a runaway market and oil will continue to rally quite significantly, reaching towards the $50 level. That does not seem to be highly likely though, so it is highly likely that we will continue to see sellers commit eventually.

Signs of exhaustion between here and the 200 day EMA will be jumped on, and quite frankly I think it could lead to short-term pullbacks to give us an opportunity to pick up oil “on the cheap.” From what I see, the market looks as if it is trying to form a new range, something that oil was quite well-known to do. The market has not quite settled on it yet, but for me it looks like the market will pull back and then go looking for support underneath. The question at this point in time is where will that range be? I suspect that there are going to be a lot of selling near the $41 level, but the support level is probably going to be closer to the $25 level. Ultimately, I think we are going to see a range that is somewhat noisy and erratic, but eventually we need some type of tradable market. Right now, it is simply a matter buying on dips until we get to the top of that gap as it is something that technical traders will be pushing hard for, and of course OPEC’s decision based upon cutting back production could be reason enough to rally in the short term.