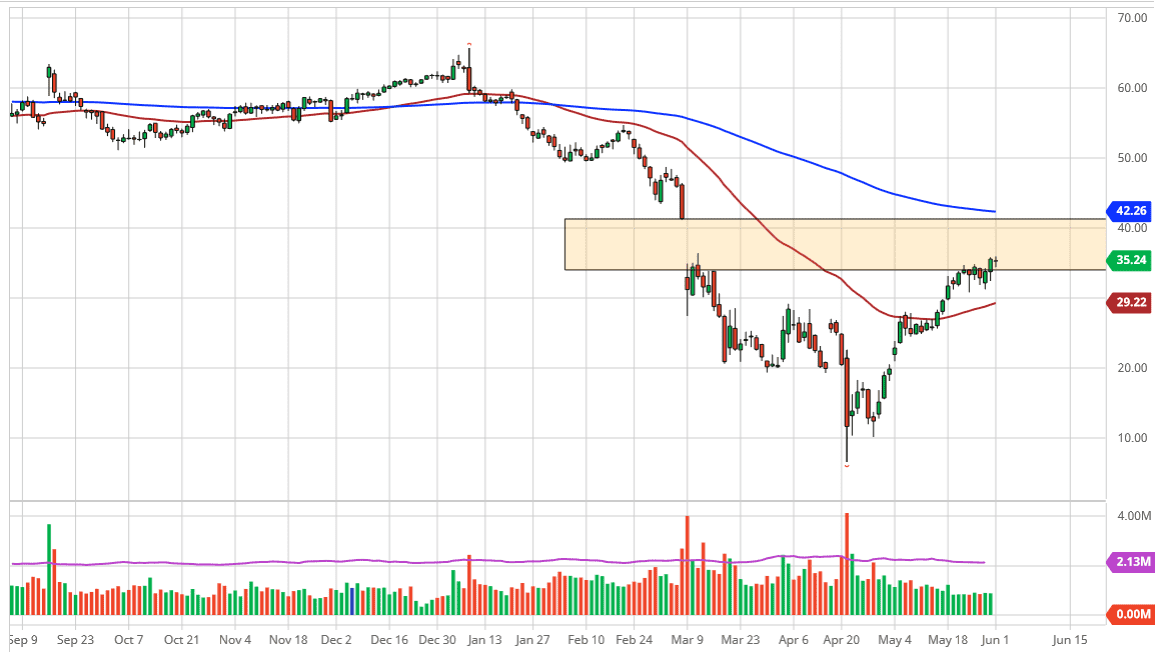

The West Texas Intermediate Crude Oil market has done nothing during the day on Monday, as we are simply sitting around and waiting to see whether or not we can break out to the upside. The $36 level above in my estimation is where we finally make the breakout to go filling the gap, which could open up the door to the $41 level. That of course is the top of the gap, and where we have seen a massive breakdown. Beyond that, we also have the 200 day EMA that sits just above the $41 level and will obviously attract quite a bit of attention in and of itself. Because of this, I think that the upside is somewhat limited, but it does make sense as “gap gets filled.”

At this point, if we do pull back and think there is plenty of support underneath and it is worth noting that Russia and OPEC are starting to discuss the possibility of cutting back production of crude oil, and that of course can continue to put upward pressure on this market. Furthermore, the closing of multitudes of rigs in the United States of course offers quite a bit of bullish pressure for price as well. Remember, the WTI Crude Oil market is much more of a localized market for North America, so of course that has a major influence.

Having said that, the market will still have to deal with the fact that there is going to be a lot less demand than there once was. Because of this, I anticipate that we are going to go looking towards the top of the gap before rolling over. The 200 day EMA of course makes quite a bit of sense as resistance, because it is an area that I think will continue to be a major issue. If we do break above the 200 day EMA though, that could be a very bullish sign. At this point, I find it exceedingly difficult to think that we will break above there, but it is a possibility that you have to be paying attention to. If it does in fact happen, then we are looking at a potential move towards the $50 level above which of course has a major psychological significant figure that will have a lot of headlines. At this point, the path of least resistance will be higher, before rolling back over.