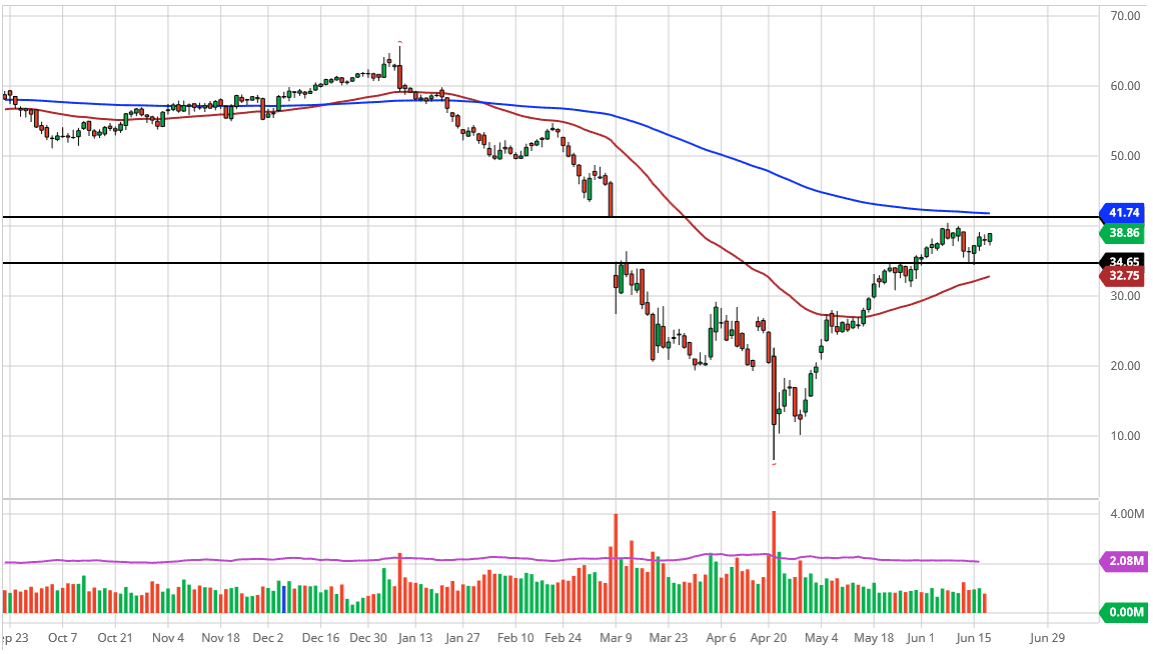

The West Texas Intermediate Crude Oil market has continued to show a lot of resiliency, as we see buyers jump in and try to fill the gap at the $41 level. Quite frankly, the analysis has not changed much for some time, but there were further headlines out there that suggested that the production cuts may be extended. After all, the Russian Oil Minister suggested during the day on Thursday that an emergency meeting ahead of the December meeting could very well happen if necessary. That is a clear sign that Russia is taking a look at the market and seeing whether or not it remains somewhat supportive.

Regardless, the reality is that a lot of traders believe that the gap gets filled, so in a sense, it becomes a bit of a self-fulfilling prophecy. If that is going to be the case, then the $41 level will be tagged. The 200 day EMA is sitting just above so that is an obvious resistance barrier anyway, so at this point in time it is very unlikely that we do not make it, but it is just as likely that we do not break out either. I think short-term buying still makes quite a bit of sense, as we try to figure out what the overall range will be next. The downside has not really been figured out yet, but I think it is only a matter of time before the market tries to find out where that is. Currently, my best guess is that it would be between the $40 level on the top and the $30 level on the bottom. We do not really know that yet, but the smart money is betting on the $40 level reaching towards the $41 level as a barrier.

If we were to break above that barrier, and clear the 200 day EMA, then it is likely that we are going to go to the $49 level. The $50 level is an area that will attract a lot of attention as well, but ultimately this is a market that will more than likely struggle to do that. I think right now we are simply in the middle of building the next range that we can trade back and forth from. It might be a bit nauseating at times, but overall, it looks like the short-term money is pushing higher.