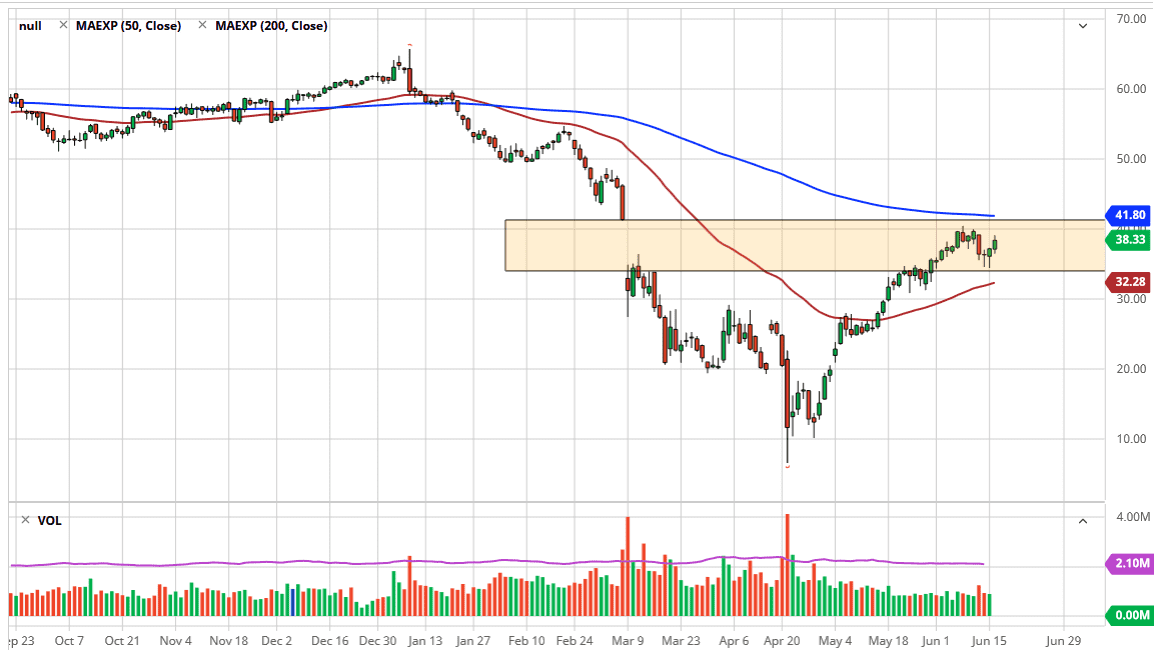

The West Texas Intermediate Crude Oil market has rallied a bit during the trading session on Tuesday, breaking above the top of the hammer from the previous session on Monday. The fact that we broke above the top of that hammer is a very bullish sign, and it is a technical signal to start buying. If the market does break above the hammer, then it suggests that we could move towards the next resistance barrier.

At this point, I see the $40 level as resistance that extends all the way to the top of the gap at which is closer to the $41 handle. In other words, I think that a short-term buying opportunity is here, but you are going to have to be very quick to take advantage of it.

Keep in mind that the $35 level formed a hammer on Monday which of course is a very bullish sign, and suggests that the large, round, psychologically significant figure is in fact support. Underneath that candlestick, then we could go looking towards the 50 day EMA next. On the upside, in order to fill the gap, we will need to reach towards the $41 level, but I think that a trade to the $40 level makes a lot of sense so I would be more than willing to take my profit in that range.

The candlestick for the trading session on Tuesday was rather healthy, although we did give back some of the very upper parts of the range. Because of this, I think that short-term pullbacks will offer buying opportunities for people who are willing to take advantage of it, and more or less a grind to the upside than anything else. If we were to break above the 200 day EMA, which is essentially just above the top of the gap at the $41 level, then it would be a complete change in attitude. Although, that seems to be very unlikely to happen.

One thing that you can probably count on is that the crude oil market is going to make a lot of noise, and that is because there are conflicting reports as to how the economy is doing from a demand perspective. Beyond that, we have also seen a bit of US dollar strength during the day, and that caused some of the selling that we had seen at the upper part of the range.