South Africa’s economy is predicted to contract by 7.2% in 2020, as outlined during a budget adjustment delivered by Finance Minister Tito Mboweni. It will be the worst collapse in 89 years. He added the budget deficit is likely to climb to 15.7% this year, and the debt-to-GDP ratio is forecast to reach its peak in four years at 87.4%. Pledges to reign in debt and bring finances under control after the Covid-19 pandemic will result in a spike, kept the USD/ZAR inside of its short-term resistance zone. Economists pointed out for years that national debt is unsustainable.

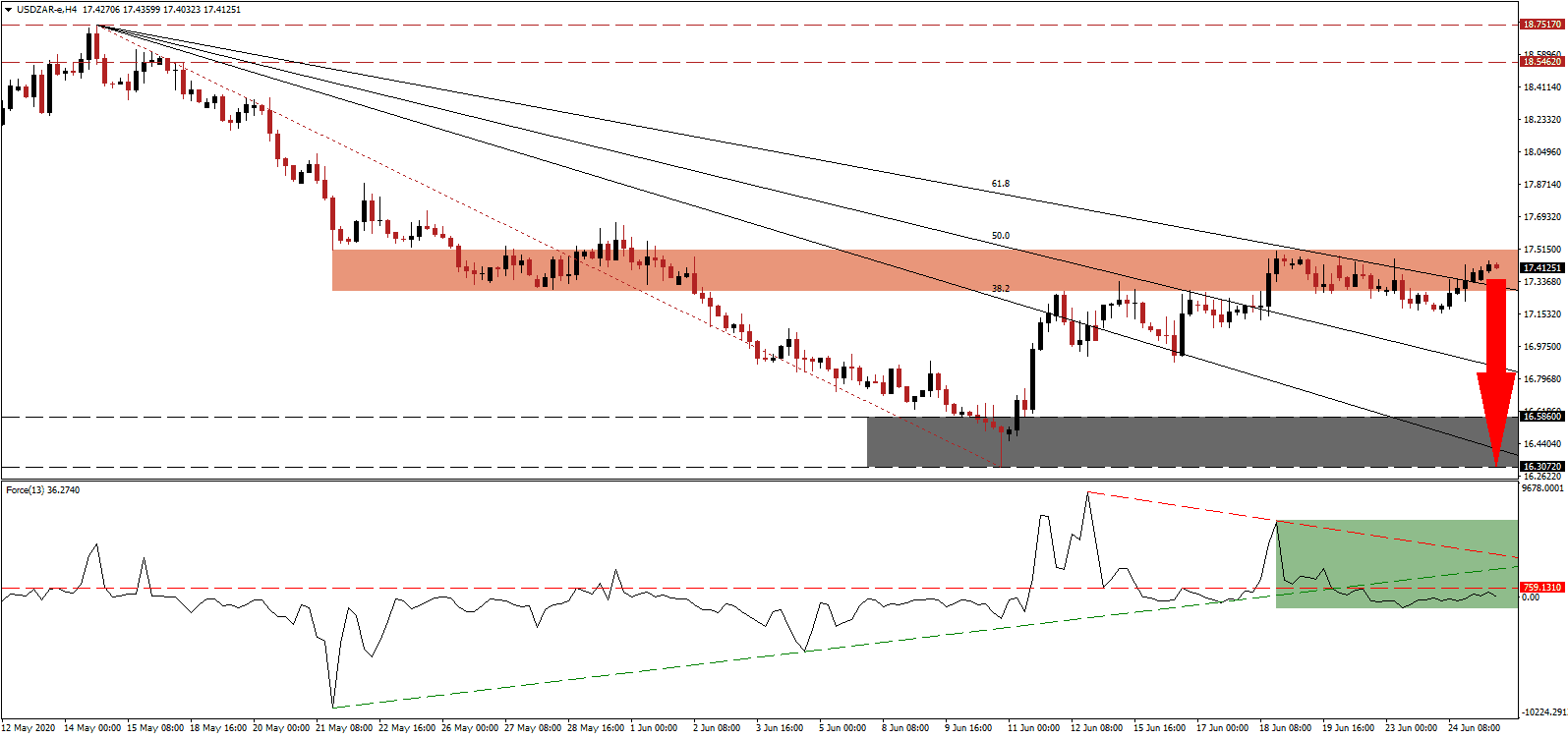

The Force Index, a next-generation technical indicator, points towards ongoing accumulation in bearish pressures beneath the horizontal resistance level. A negative divergence offered the initial warning of a pending price action reversal. After the Force Index collapsed below its ascending support level, as marked by the green rectangle, downside momentum expanded. The descending resistance level is adding to breakdown pressures, favored to push this technical indicator below the 0 center-line, granting bears full control over the USD/ZAR.

Adding to a range of issues for South Africa to address is the unemployment rate, which surged to an all-time high of 30.1%. More job losses are likely to follow, and the government revised down its revenue projection from February’s R1.43 trillion to R1.12 trillion. The revised budget included plans to increase revenues by R40 billion over the next four years, while spending will be cut by R230 billion. More details will be released during the 2021 budget speech. The USD/ZAR was able to eclipse its descending 61.8 Fibonacci Retracement Fan Resistance Level. It is now testing the strength of its short-term resistance zone located between 17.2813 and 17.5081, as identified by the red rectangle.

President Ramaphosa’s government secured a $1 billion loan from the New Development Bank. It remains in negotiations with the International Monetary Fund for a $4.2 billion bailout, criticized by opponents as undermining the country’s sovereignty. The World Bank is likely to contribute $1.8 billion if the IMF approves a loan. Despite the $7 billion debt surge, the USD/ZAR is well-positioned for a breakdown from current levels, amid intensifying progress in the US economy. A profit-taking sell-off is favored to take price action into its support zone located between 16.3072 and 16.5860, as marked by the grey rectangle. A breakdown continuation cannot be excluded.

USD/ZAR Technical Trading Set-Up - Profit-Taking Scenario

Short Entry @ 17.4100

Take Profit @ 16.3100

Stop Loss @ 17.6600

Downside Potential: 11,000 pips

Upside Risk: 2,500 pips

Risk/Reward Ratio: 4.40

A breakout in the Force Index above its ascending support level, serving as resistance and is likely to push the USD/ZAR farther to the upside. The US is considering adding to its massive debt load, with annual interest payments above $1 trillion, which is adding to ongoing downside pressure on the US Dollar. The next resistance zone is located between 18.5462 and 18.7517, and Forex traders are advised to view it as an excellent selling opportunity.

USD/ZAR Technical Trading Set-Up - Limited Breakout Scenario

Long Entry @ 17.9100

Take Profit @ 18.5600

Stop Loss @ 17.6600

Upside Potential: 6,500 pips

Downside Risk: 2,500 pips

Risk/Reward Ratio: 2.60