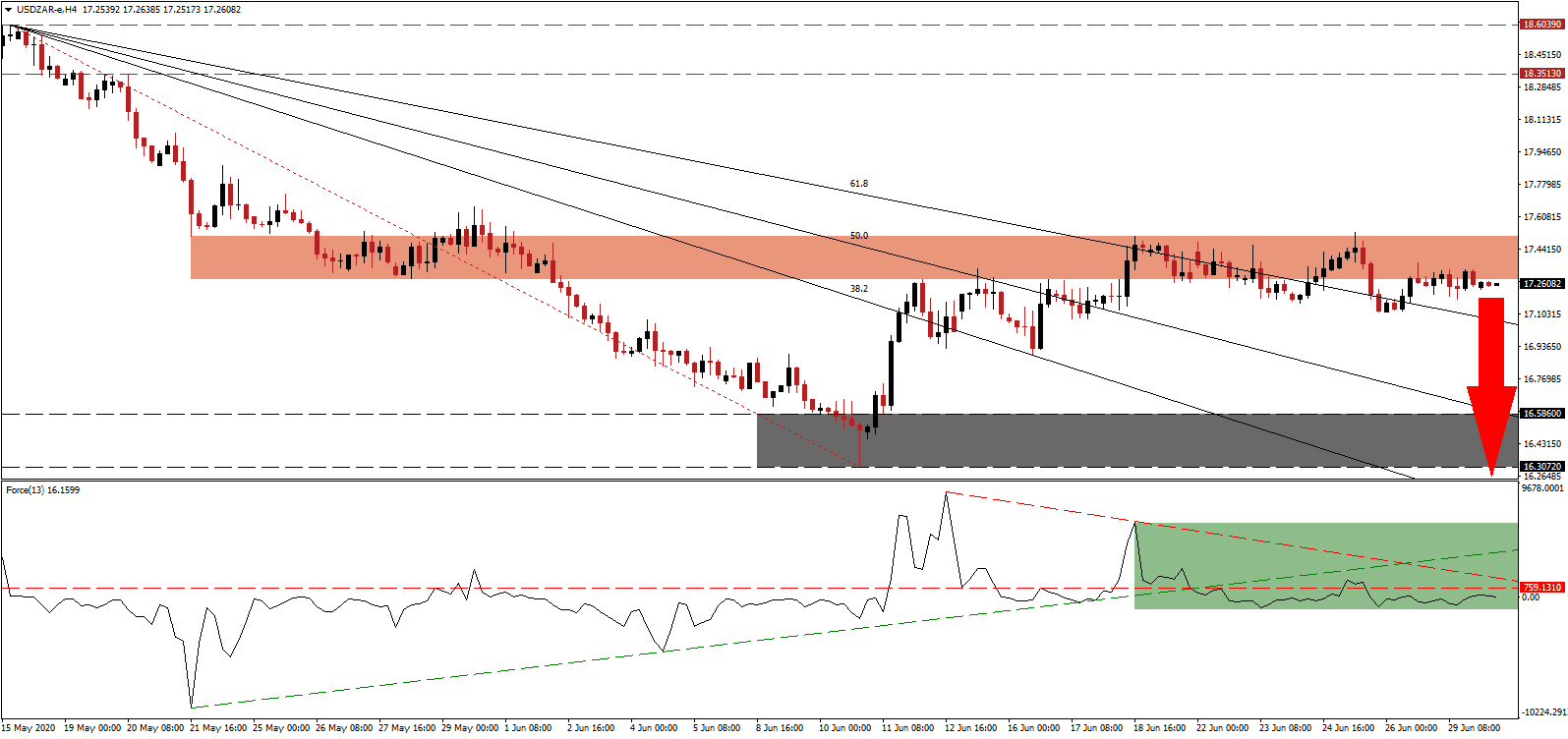

South African Finance Minister Tito Mboweni confirmed the government has no plans to raise income, corporate or value-added tax. Before the Covid-19 pandemic forced a nationwide lockdown, draining public finances, discussions to lower the corporate tax rate to lure companies and spur job creation were debated. The possibility of an inheritance tax and solidarity tax exists, the latter as a short-term measure, while President Ramaphosa and his African National Congress (ANC) favor a wealth tax. The USD/ZAR faces growing breakdown pressures near the bottom range of its short-term resistance zone.

The Force Index, a next-generation technical indicator, points towards bearish momentum below its horizontal resistance level. With the ascending support level detaching further, the descending resistance level is increasing downside pressures, as marked by the green rectangle. Bears wait for this technical indicator to move below the 0 center-line to gain complete control over the USD/ZAR.

With the overall tax rate in South Africa excessive, any further increase will magnify the negative economic impact already in place. The tax-to-GDP ratio is 26%, per data from the World Bank, against a global average of 15%. The income tax rate is 45% in the top tier, the corporate tax is 28%, and the value-added tax 15%. Public finances remain insufficient in Africa’s most industrialized nation, but the Covid-19 pandemic is forcing the government to address issues, adding a cautious bullish catalyst to the USD/ZAR. The short-term resistance zone located between 17.2813 and 17.5081, as identified by the red rectangle, is increasing breakdown pressures on price action.

Infrastructure projects are part of the plan to get boost the South African economy from depressed levels. Finance Minister Mboweni supports the use of pension funds and retirement savings to finance them, but an amendment to Regulation 28 of the Pension Funds Act is required. Another positive development is the potential settling of municipal debt owed to troubled state utility Eskom, whose blackouts were partially blamed for a reduction in economic activity. The descending Fibonacci Retracement Fan sequence is expected to guide the USD/ZAR into its support zone located between 16.3072 and 16.5860, as marked by the grey rectangle, with more downside probable.

USD/ZAR Technical Trading Set-Up - Breakdown Extension Scenario

Short Entry @ 17.2600

Take Profit @ 16.2600

Stop Loss @ 17.5600

Downside Potential: 10,000 pips

Upside Risk: 3,000 pips

Risk/Reward Ratio: 3.33

Should the Force Index accelerate above its descending resistance level, the USD/ZAR could be pressured temporarily higher. Given the ongoing surge in new Covid-19 cases in the US, in conjunction with more debt-funded stimuli in a depressed economy, any advance will offer Forex traders another selling opportunity to consider. The upside potential is limited to its continuously downward revised resistance zone between 18.3513 and 18.6039.

USD/ZAR Technical Trading Set-Up - Temporary Breakout Scenario

Long Entry @ 17.9100

Take Profit @ 18.4100

Stop Loss @ 18.5600

Upside Potential: 5,000 pips

Downside Risk: 3,500 pips

Risk/Reward Ratio: 1.43