Yesterday’s initial jobless claims out of the US pointed towards a significantly weaker recovery trend than the May NFP report suggested. The data merely registered a minor decrease, demoting the cheered May job additions to an anomaly. With over 40% of Covid-19 related job losses forecast to remain permanent, the US labor market faces a long and painful road to recovery. Following April’s record plunge in job losses and retail sales, a massive reversal in May, as states embarked on an aggressive and premature reopening process, was expected. The USD/ZAR spiked above its resistance zone, in an unconfirmed moved, which is now vulnerable for a swift reversal.

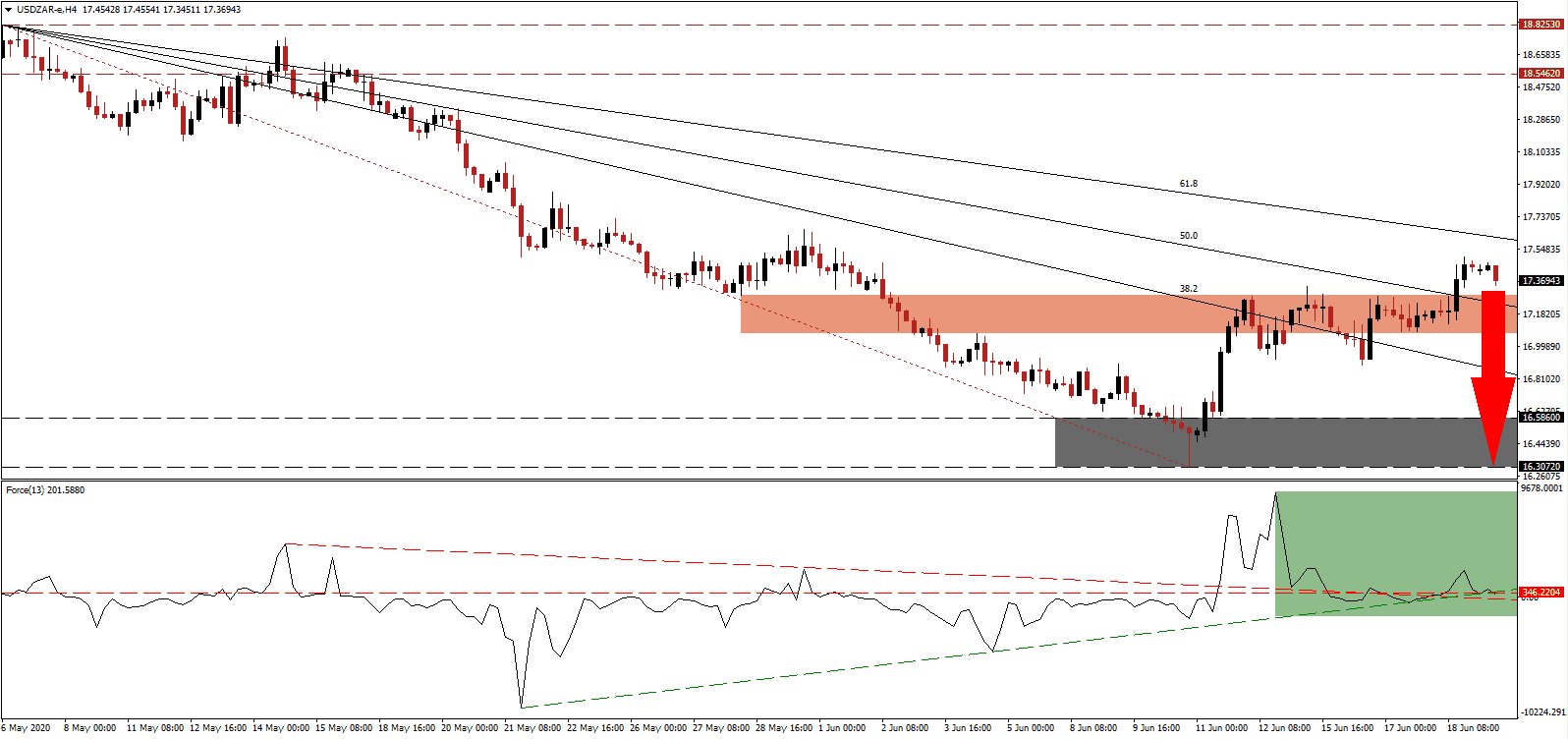

The Force Index, a next-generation technical indicator, registered a negative divergence. It is an early bearish trading signal created when price action forms a higher high while the underlying indicator reaches a lower high. Intensifying bearish pressures is the breakdown below its ascending support level and the conversion of its horizontal support level into resistance, as marked by the green rectangle. The Force Index is expected to collapse below its descending resistance level. Bears will resume complete control of the USD/ZAR once this technical indicator crosses below the 0 center-line.

Intensifying worries over the health of the labor market are evident in South Africa. A recent survey concluded that just 21% work as before the crisis. Before the Covid-19 pandemic forced a nationwide lockdown, the unemployment rate stood at 29%. The study revealed that 86% are concerned about employment, and 66% cited Covid-19 as an extreme concern. One positive development is the willingness of the government to address labor market reforms. Despite the breakout in the USD/ZAR above its short-term resistance zone located between 17.0717 and 17.2890, as identified by the red rectangle, the dominant bearish chart pattern remains intact.

Permanent changes to supply chains and consumer behavior will shape the post-Covid-19 economy on a global scale. With 46% of South African’s fearing a worsening labor market, 79% believe working from home will become the new norm. It will accompany new demand for delivery services, with 27% confirming it over gathering in public places. Pending changes are likely to contribute positively to South Africa in the long-term. The descending 61.8 Fibonacci Retracement Fan Resistance Level is favored to enforce the corrective phase, pressuring the USD/ZAR into its support zone located between 16.3072 and 16.5860, as marked by the grey rectangle.

USD/ZAR Technical Trading Set-Up - Breakdown Scenario

Short Entry @ 17.3600

Take Profit @ 16.3000

Stop Loss @ 17.6600

Downside Potential: 10,600 pips

Upside Risk: 2,000 pips

Risk/Reward Ratio: 5.30

A bounce in the Force Index off of its descending resistance level, serving as temporary support, could initiate a breakout attempt in the USD/ZAR above its 61.8 Fibonacci Retracement Fan Resistance Level. Forex traders are advised to consider this a temporary advance, which will generate a secondary short-selling opportunity, based on misplaced economic optimism out of the US. The next resistance zone awaits this currency pair between 18.5462 and 18.8253.

USD/ZAR Technical Trading Set-Up - Limited Breakout Scenario

Long Entry @ 17.9600

Take Profit @ 18.5600

Stop Loss @ 17.6600

Upside Potential: 6,000 pips

Downside Risk: 3,000 pips

Risk/Reward Ratio: 2.00