Important support levels near 17.0000 have been broken and the level is now being used as a resistance juncture by many technical traders.

The USD/ZAR has mirrored other major forex currencies pairs and shown the US Dollar losing value the past month. The price of gold works as major psychological sentiment for the African Rand and the value for the precious metal has lost some ground the past week, but importantly gold remains near its highs when taking a long term approach.

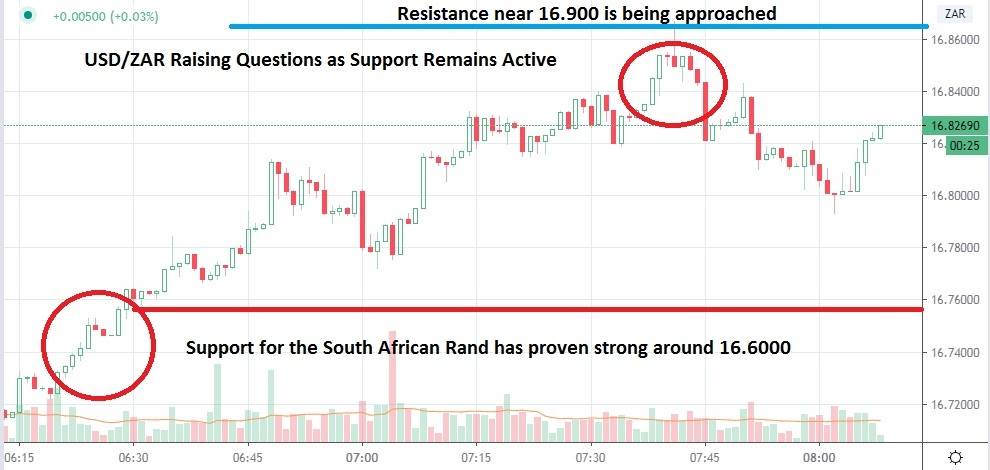

The South African Rand has shown a tendency to give some of its value back the past week of trading, but an important short term range may be emerging. If the 17.0000 value can hold as resistance the USD/ZAR may have an opportunity to try and approach the 16.6000 to 16.7000 support level. And it is the 16.5000 level which is the focal point for many speculators.

Until the 16.5000 support level is broken traders may not believe the South African Rand has the ability to gain much further against the US Dollar short term. The last time the 16.5000 level was seen was in mid-March just as the Coronavirus pandemic began to be felt regarding its economic impact.

Support near 16.6000 will be watched intently and may be used short term as an opportunity to buy the US Dollar against the South African Rand by speculative traders. The past week of trading has seen support consistently set off a flurry of long positions as traders have taken the opportunity to buy perceived support levels and hoped for a retest of what may be considered weak resistance values.

The USD/ZAR is a speculative trade, one in which traders must be able to use their risk management ability wisely. The price range of the US Dollar and South African Rand will likely remain a market in which traders looking to scalp value in the short term rule the playing field for the currency pair. Selling positions by traders of USD/ZAR must consider carefully stop losses around the 17.0000 to protect themselves should US Dollar strength emerge short term against the South African Rand.

South African Rand Short Term Outlook:

Current Resistance: 17.0000

Current Support: 16.5000

High Target: 17.2000

Low Target: 16.3000