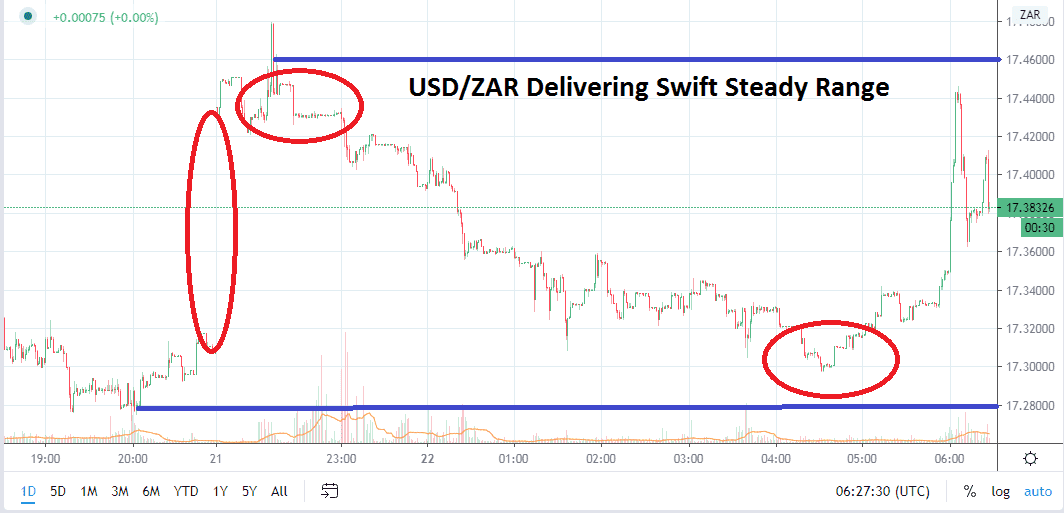

The value range of the USD/ZAR continues to deliver a known trading range which speculators may find opportunistic and worthy of taking positions. After South African Rand sentiment on Friday experienced a sudden loss of faith and the USD/ZAR produced a strong buying spree, the currency pair tamed its emotion and continued to trade within its known boundaries.

A resistance level of 17.5000 is displaying a reliable area to attempt reversals for short term traders. And while a resistance level up above at 17.6000 would be considered a very close technical reference point by many, speculators may find value in placing stop losses within this vicinity if they believe the USD/ZAR is going to experience greater selling. Risk reward for the currency pair remains difficult to say because neither side of its trading window offers enough evidence to have a strong opinion about direction, so risk management remains vital for South African Rand speculators.

While news about Coronavirus and its effect on economic conditions in South Africa is worrisome, the nation’s workforce has realistic concerns, and the sentiment is also being affected by the value of Gold which is mustering new high values. The value of the precious metal has produced solid gains and its rather strong consolidated price serves as a backbone for the South African Rand under the present market conditions.

Support levels near the 17.2500 level do look vulnerable and traders may target these price levels as legitimate short term goals. The past five days of trading have produced a substantial amount of trading between the 17.1000 and 17.4000 price junctures and speculators cannot be faulted for considering this a natural value guide technically as long as the potentially correlated price of Gold sustains its new highs.

Global trading sentiment remains fragile and the South African Rand is a good barometer of investor behavior. The USD/ZAR pair remains attractive as a trade for speculators who have an understanding of the currency’s main forces and have the ability to not let short term gyrations scare them. Shorting the USD/ZAR with adequate risk management appears to remain a trading opportunity to examine and may prove worthwhile over the next couple of days.

South African Rand Short Term Outlook:

Current Resistance: 17.5000

Current Support: 17.2500

High Target: 17.6000

Low Target: 17.0000