Before the global Covid-19 pandemic, South Africa’s economy was suffering from the Eskom capacity issue, which led to ongoing blackouts, limiting output across Africa’s most developed economy. GDP growth over the past three years averaged an anemic 0.8% annualized, below the disappointing 10-year average of 1.4%. The National Treasury Before the global Covid-19 pandemic, South Africa’s economy was suffering from the Eskom capacity issue, which led to ongoing blackouts, limiting output across Africa’s most developed economy. GDP growth over the past three years averaged an anemic 0.8% annualized, below the disappointing 10-year average of 1.4%. The National Trea forecasts an increase to just 1.6% by 2020, but the outlook is now impacted by the nationwide lockdown in response to the pandemic. President Ramaphosa’s government has lowered the alert level to three, but social distancing and widespread fear continue to hemorrhage the economy. The USD/ZAR remains resilient, and while a short reversal above its support zone is likely, the long-term downtrend is intact and unlikely to be violated.

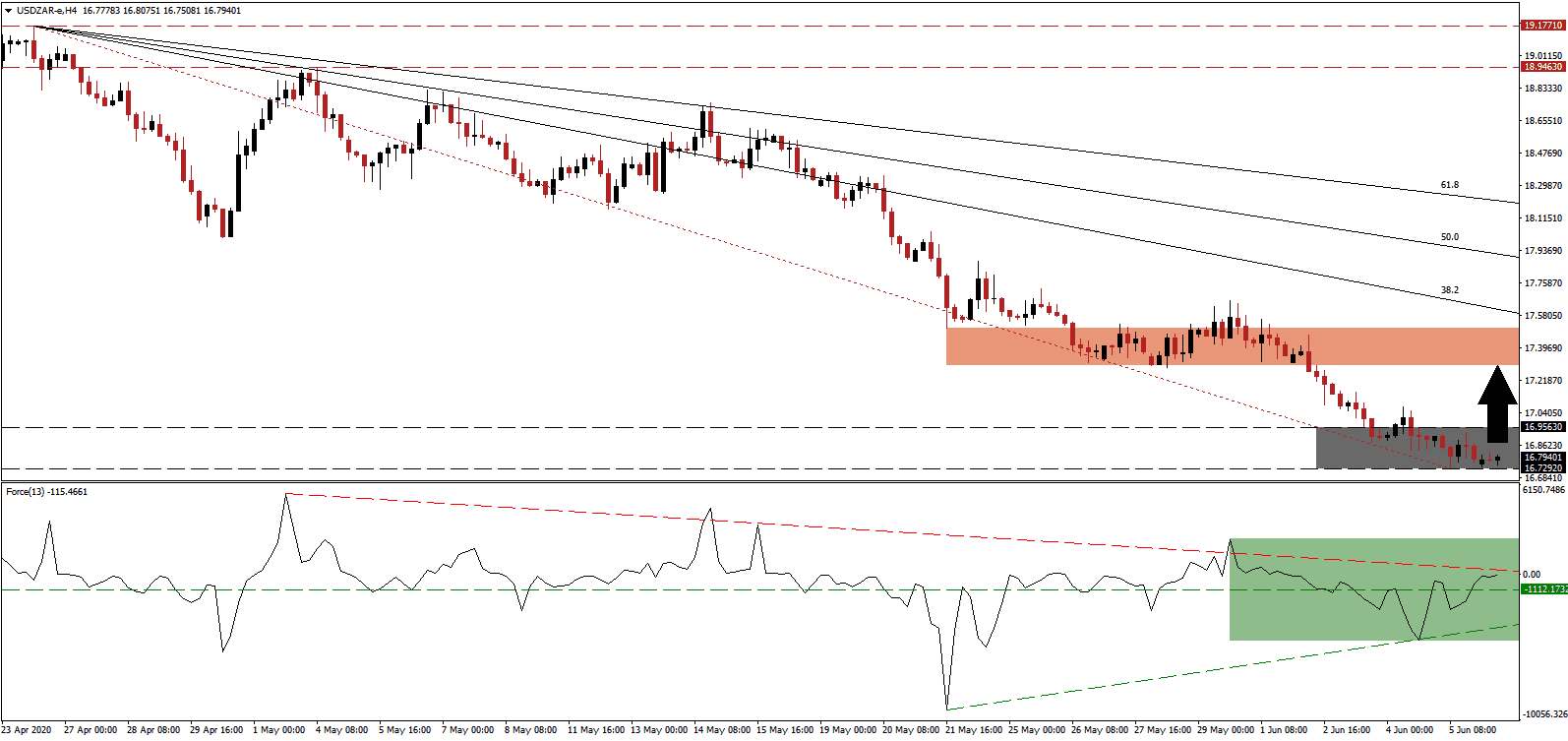

The Force Index, a next-generation technical indicator, confirms the increase in bullish momentum after reversing off of its ascending support level. It led to a conversion of the horizontal resistance level into support, as marked by the green rectangle. Bears remain in complete control of the USD/ZAR with this technical indicator in negative territory. The descending resistance level is exercising downside pressure. A brief spike above it cannot be excluded, but a resumption of the dominant downtrend is preferred.

South Africa was forced by the virus to address complex challenges, which add a long-term bullish catalyst to the South African Rand. The renewable energy sector has been identified as essential for the economy to rebuild. As the Eskom crisis confirmed a pressing need to increase electricity output and stability, the government is now exploring sustainable alternatives. It adds to the downside potential in the USD/ZAR after a short-term reversal ensures the health and longevity of the bearish chart pattern. A breakout in this currency pair above its support zone located between 16.7292 and 16.9563, as marked by the grey rectangle, is expected to lead to an accelerated sell-off.

While South Africa is willing to reform, the US continues its approach of unsustainable debt to create demand artificially. More stimulus spending is being discussed after Covid-19 infections surpassed two million, and riots across the country increase the potential for a spike in new cases. Enforcing the dominant bearish chart pattern is the descending Fibonacci Retracement sequence. The 38.2 Fibonacci Retracement Fan Resistance Level is approaching the top range of the downward revised short-term resistance zone, currently located between 17.3013 and 17.5081, as identified by the red rectangle. More revisions are expected to reflect the rise in bearish progress in the USD/ZAR.

USD/ZAR Technical Trading Set-Up - Temporary Breakout Scenario

Long Entry @ 16.7700

Take Profit @ 17.3000

Stop Loss @ 16.5600

Upside Potential: 5,300 pips

Downside Risk: 2,100 pips

Risk/Reward Ratio: 2.52

Rejection in the Force Index by its descending resistance level could lead to an accelerated push to the downside without a temporary breakout. Given the ongoing stress on the US economy, in conjunction with the likelihood of more job losses ahead following the surprise NFP report published last Friday, Forex traders are advised to sell any recovery attempt. Price action will challenge its next support zone between 15.7482 and 16.0010.

USD/ZAR Technical Trading Set-Up - Breakdown Extension Scenario

Short Entry @ 16.3700

Take Profit @ 15.7500

Stop Loss @ 16.5600

Downside Potential: 6,200 pips

Upside Risk: 1,900 pips

Risk/Reward Ratio: 3.26