South Africa asked assistance from the International Monetary Fund’s coronavirus relief facility. President Ramaphosa is negotiating a $4.2 billion loan, after substantial resistance to embark on what his allies refer to as a slippery slope to submission. It comes with little strings attached, but the fear is that it will result in demand for a more significant capital injection. Comparisons are drawn to Zambia in the 1980s, which faced severe poverty and unrest after it requested assistance from the US-based IMF. The USD/ZAR is positioned for a short-covering rally on the back of rising bullish momentum, suggesting a brief advance is likely to precede more selling.

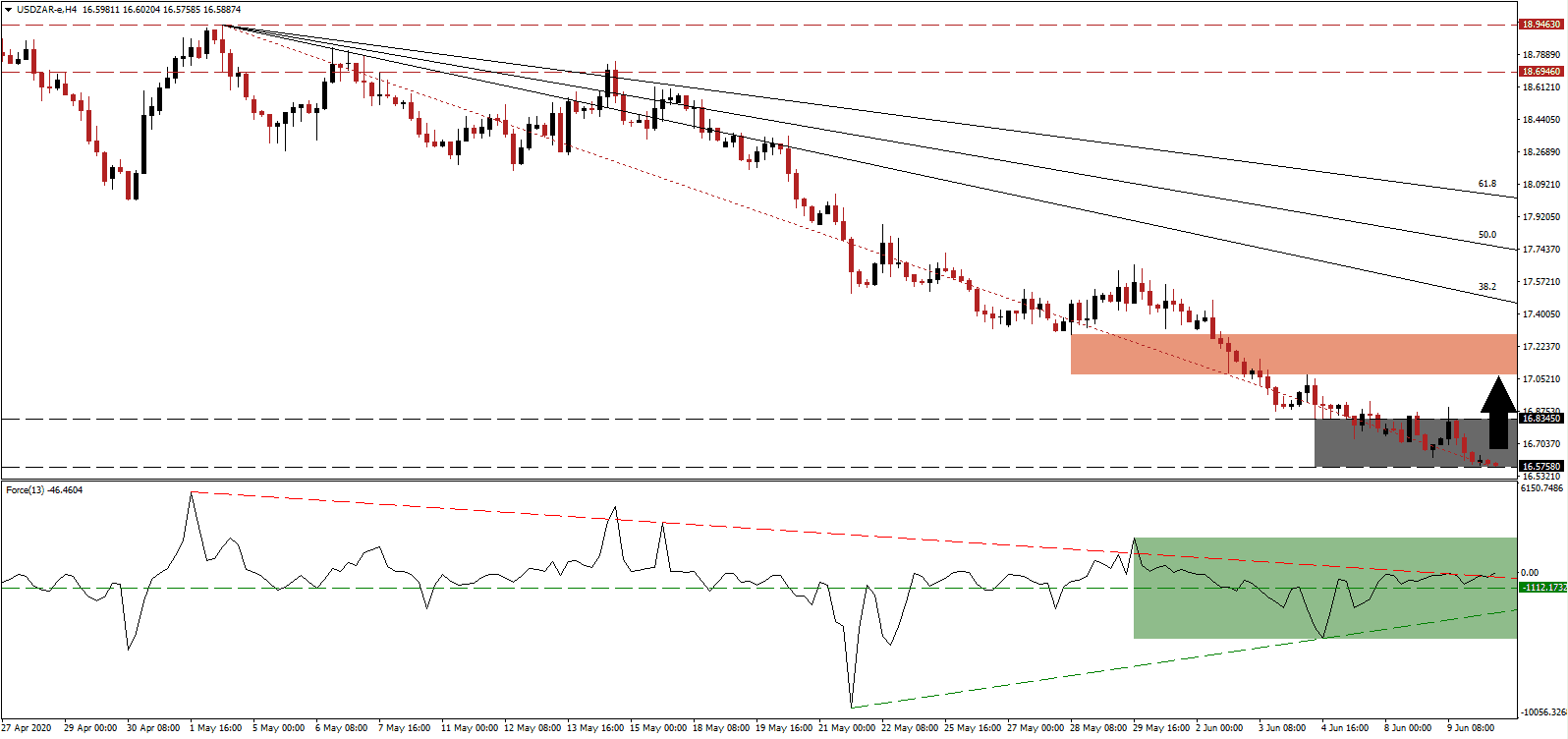

The Force Index, a next-generation technical indicator, points towards a positive divergence after gradually advancing while price action trend to the downside. It is indicative of a pending trend reversal. After the Force Index used its ascending support level to push higher, it converted its horizontal resistance level into support. Adding to bullish developments is the breakout above its descending resistance level, as marked by the green rectangle. This technical indicator is favored to temporarily push into positive territory, granting bulls control of the USD/ZAR.

Failure to reform over the past two decades has forced South Africa into the hands of the IMF. The government is additionally seeking monetary assistance from the World Bank, the African Development Bank, and the New Development Bank, for the first time in its history. An expected tax revenue loss of 285 billion Rand due to implemented lockdown measures added to the bailout request. Per one source, negotiations are taking longer than usual, increasing short-term breakout pressures in the USD/ZAR above its support zone located between 16.5758 and 16.8345, as marked by the grey rectangle.

Before the requested bailout, discussions between the African National Congress and labor unions favored deploying domestic capital from pension funds to revive the economy. What led to President Ramaphosa’s decision is unclear, but more details are likely to emerge. Forex traders are advised to remain cautious, and while a limited breakout in the USD/ZAR is possible, the long-term trend remains bearish. Confining the upside potential is the downward revised short-term resistance zone located between 17.0717 and 17.2890, as identified by the red rectangle. The descending 38.2 Fibonacci Retracement Fan Resistance Level enforced the downtrend, and any advance should be considered a selling opportunity.

USD/ZAR Technical Trading Set-Up - Minor Short-Covering Scenario

Long Entry @ 16.5900

Take Profit @ 17.0700

Stop Loss @ 16.3900

Upside Potential: 4,800 pips

Downside Risk: 2,000 pips

Risk/Reward Ratio: 2.40

In case the Force Index collapsed below its ascending support level, the USD/ZAR is favored to bypass its pending counter-trend advance. Today’s US Federal Reserve meeting may provide a breakdown catalyst, depending on the economic assessment. While South Africa is faced with a tremendous challenge, US monetary and foreign policy is pressuring the US Dollar to the downside. Forex traders are recommended to sell any breakout attempt amid a bearish long-term outlook. The next support zone is located between 15.7482 and 16.0010.

USD/ZAR Technical Trading Set-Up - Breakdown Extension Scenario

Short Entry @ 16.2400

Take Profit @ 15.7500

Stop Loss @ 16.3900

Downside Potential: 4,900 pips

Upside Risk: 1,500 pips

Risk/Reward Ratio: 3.27