Fitch Ratings downgraded South Africa’s credit rating farther into junk territory. It predicts a 5.5% decrease in GDP for 2020, a 14.4% rise in the fiscal-deficit-to-GDP-ratio, and an 80.9% debt-to-GDP ratio. The outlook remains negative, as the rating’s agency sees no clear path to government debt stabilization. President Ramaphosa is negotiating a $4.2 billion loan from the International Monetary Fund’s coronavirus relief facility. Fears of more bailouts and comparisons to 1980s Zambia, which faced severe poverty and unrest after it requested assistance from the US-based IMF, added to a healthy counter-trend advance in the USD/ZAR. The collapse in bullish momentum suggests a profit-taking sell-off is imminent.

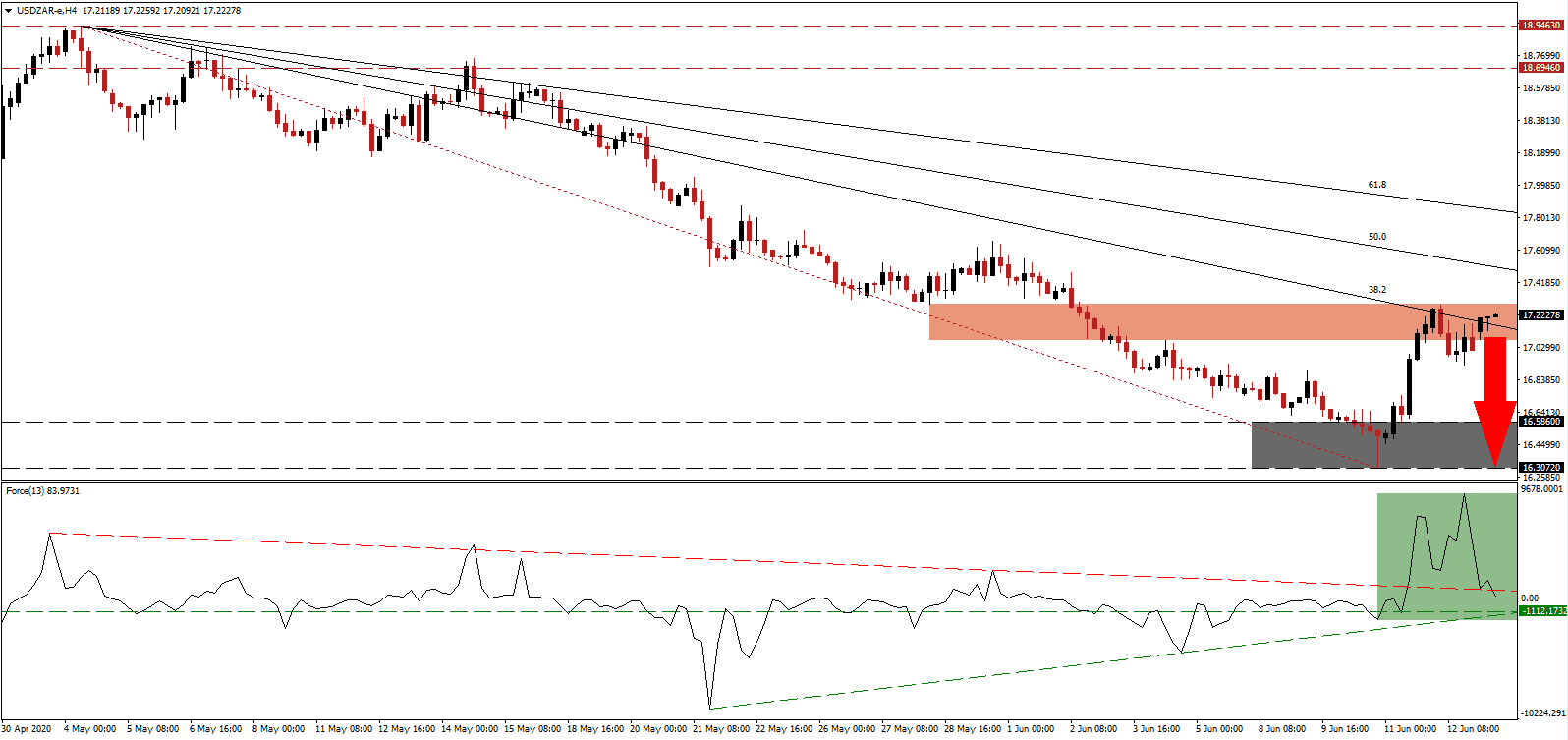

The Force Index, a next-generation technical indicator, confirmed the advance and surged to a new multi-week low. It was swiftly reversed and extended below its descending resistance level, acting as short-term support, as marked by the green rectangle. A conversion of the horizontal support level into resistance is expected, from where a breakdown extension below its ascending support level is likely. Bears will resume complete control of the USD/ZAR once this technical indicator moves into negative territory.

South Africa’s social divide and economic issues were exposed by the Covid-19 pandemic. The country entered the crisis with an average five-year unemployment rate of 29% and a GDP growth of 1.5%. The blame is placed on current President Ramaphosa and his predecessor President Zuma. In Africa’s most industrialized country, 54% have no access to clean water, and 14% live in crowded illegal settlements. After the USD/ZAR reached its short-term resistance zone located between 17.0717 and 17.2890, as identified by the red rectangle, breakdown pressures were driven by rising US Dollar weakness are on the rise.

With the $600 subsidy to US initial jobless claims set to expire in six weeks, and the economy faced with a surge in new Covid-19 infection after the rush to resume activities, more long-term stress is anticipated. A new stimulus, pushed by US Democrats, will pressure the US Dollar farther to the downside, the absence of one will force more hardship. The issues out of the US trump those in South Africa. Where the former is unwilling to implement changes, the latter is willing to reform. The USD/ZAR is expected to correct its advance, as the bearish trend remains intact. A challenge of its support zone located between 16.3072 and 16.5860, as marked by the grey rectangle, could result in more downside.

USD/ZAR Technical Trading Set-Up - Profit-Taking Scenario

Short Entry @ 17.2250

Take Profit @ 16.3050

Stop Loss @ 17.4250

Downside Potential: 9,200 pips

Upside Risk: 2,000 pips

Risk/Reward Ratio: 4.60

A reversal in the Force Index inspired by its ascending support level may result in a brief price spike in the USD/ZAR. Given the rapidly deteriorating outlook for the US economy, Forex traders are advised to take advantage of any move higher with new net short positions. Volatility is favored to rise, but the bearish trend remains dominant. The upside potential is confined to reduced to its descending 61.8 Fibonacci Retracement Fan Resistance Level.

USD/ZAR Technical Trading Set-Up - Limited Breakout Scenario

Long Entry @ 17.5250

Take Profit @ 17.7750

Stop Loss @ 17.4250

Upside Potential: 2,500 pips

Downside Risk: 1,000 pips

Risk/Reward Ratio: 2.50