While numerous African nations receive debt relief due to the devastating negative stress resulting from the global Covid-19 pandemic, South Africa is deemed to rich to qualify. It adds another blow to the continent’s most industrialized nation, risking it falling behind emerging competitors. It already lost the GDP top spot to Nigeria last year. South Africa’s debt load is expected to swell, as outlined by Finance Minister Tito Mboweni’s budget update this week. Despite GDP forecasts predicting the worst contraction since 1931, the outlook for the USD/ZAR remains bearish, driven by US Dollar weakness. The breakdown in price action below its short-term resistance zone is likely to result in a more massive sell-off.

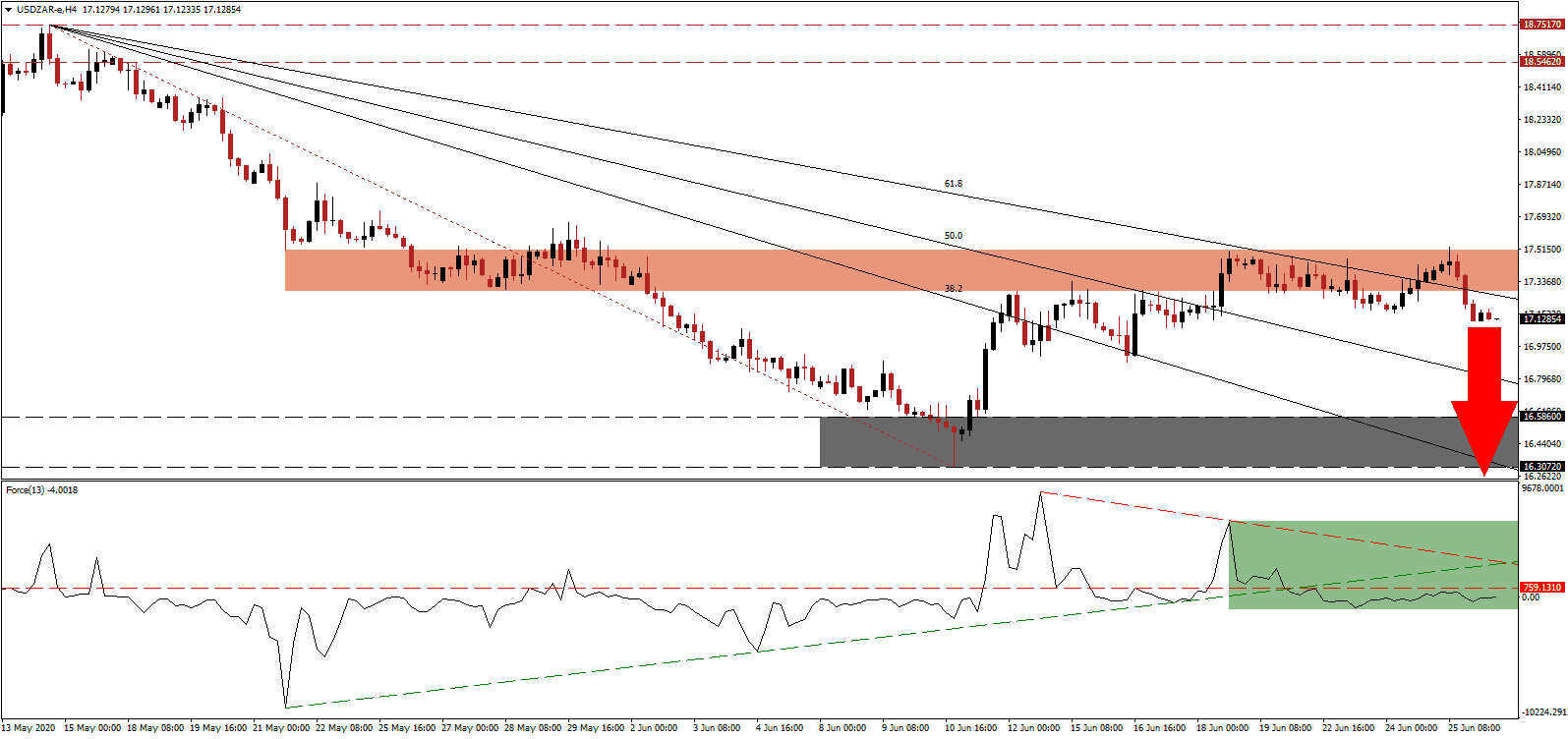

The Force Index, a next-generation technical indicator, points towards the accumulation in bearish momentum. After sliding below its ascending support level, it converted its horizontal support level into resistance, as marked by the green rectangle. This technical indicator has now corrected below the 0 center-line, while the descending resistance level is increasing downside pressure. Bears regained complete control of the USD/ZAR, favored to result in more selling pressure.

One of the most prominent drains on public finances is the preference for state-owned companies. Eskom and South African Airways are two of the most recent examples of why structural reforms are required. The Covid-19 pandemic is forcing the government to address those issues, which extend to tax and labor reforms. After the USD/ZAR completed a breakdown below its short-term resistance zone located between 17.2813 and 17.5081, as marked by the red rectangle, more selling pressure is anticipated from the descending 61.8 Fibonacci Retracement Fan Resistance Level.

South Africa is a member of the G-20, which agreed to suspend payments on government loans, primarily in Africa. It places South Africa in a challenging position moving forward, as the country requires urgent financial assistance. The loss of its investment-grade credit ratings is adding additional stress to public finances. Cautious optimism emerged after the pledge to increase revenues by R40 billion and decrease spending by R230 billion over the next four years. The USD/ZAR is on course to correct into its support zone located between 16.3072 and 16.5860, as identified by the grey rectangle. The 38.2 Fibonacci Retracement Fan Support Level may guide price action farther to the downside.

USD/ZAR Technical Trading Set-Up - Breakdown Extension Scenario

Short Entry @ 17.1300

Take Profit @ 16.3000

Stop Loss @ 17.3400

Downside Potential: 8,300 pips

Upside Risk: 2,100 pips

Risk/Reward Ratio: 3.95

In case the Fore Index pushes above its descending resistance level, the USD/ZAR may attempt a price action reversal. Forex traders are advised to consider any breakout from current levels as a secondary short selling opportunity amid more US Dollar stress highlighted in the Federal Reserve’s stress test highlighting cracks in the financial system. The upside potential is confined to its intra-day high of 17.8759, a lower high that ensured the continuation of the dominant corrective phase.

USD/ZAR Technical Trading Set-Up - Confined Breakout Scenario

Long Entry @ 17.5400

Take Profit @ 17.8700

Stop Loss @ 17.3400

Upside Potential: 3,300 pips

Downside Risk: 2,000 pips

Risk/Reward Ratio: 1.65