US President Trump announced he instructed his government to revoke all special considerations for Hong Kong after China passed a new security law governing its semi-autonomous regions. While he refrained from imposing sanctions or announcing more tariffs, it served to deteriorate the relationship between the world’s top two economies further. President Trump is careful not to add more pressure on the domestic economy, struggling with an intensifying Covid-19 pandemic and a multi-year trade war with China, heading into an election. Bearish progress is adding to renewed breakdown pressures in the USD/ZAR.

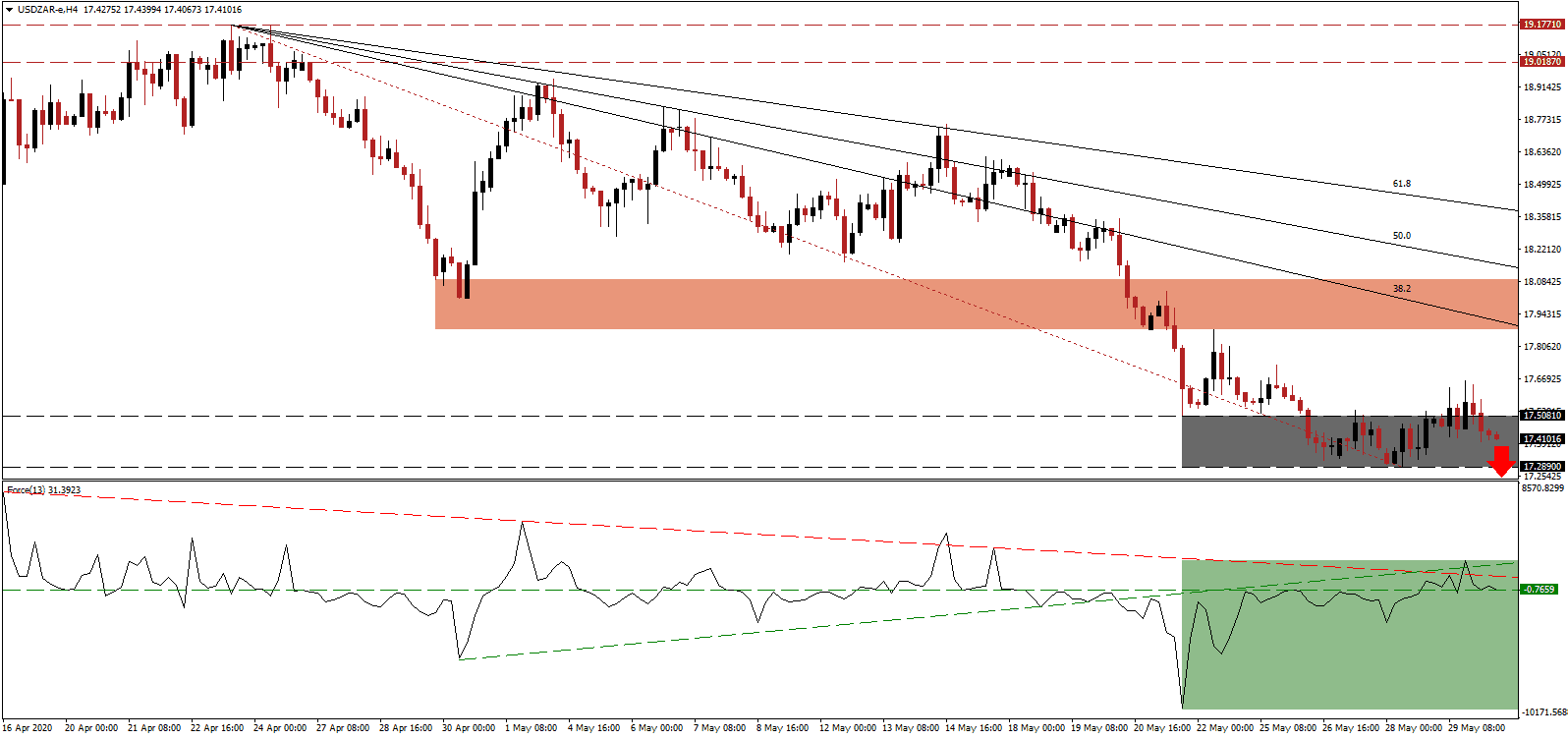

The Force Index, a next-generation technical indicator, briefly pierced above its ascending support level before correcting below its descending resistance level, as marked by the green rectangle. It confirms the lack of bullish momentum, and the Force Index is on the verge of moving below its horizontal support level, converting it into resistance. After this technical indicator crosses below the 0 center-line, bears will be in charge of the USD/ZAR.

Economic data shows the global impact is more severe than previously anticipated. The US is discussing another $3 trillion stimulus package, including a second direct payment to consumers. It will increase the unsustainable debt burden of the US, the most massive in history, where annualized interest payments exceed $1 trillion. A breakout attempt in the USD/ZAR above its support zone located between 17.2890 and 17.5081, as marked by the grey rectangle, was swiftly rejected. The next support zone awaits price action between 16.5316 and 16.7365.

South Africa, continuing to ease lockdown restrictions as new Covid-19 cases surge to new records globally, is facing long-term economic challenges. Lack of capital, in combination with insufficient domestic demand, may result in lasting damages. The government led by President Ramaphosa is willing to address structural reforms to change the present course, adding a distinct bullish catalyst. It will result in the continuing downward adjustments of the short-term resistance zone in the USD/ZAR, currently located between 17.8759 and 18.0895, as identified by the red rectangle. The descending 38.2 Fibonacci Retracement Fan Resistance Level is enforcing the established bearish chart pattern in this currency pair.

USD/ZAR Technical Trading Set-Up - Breakdown Scenario

Short Entry @ 17.4100

Take Profit @ 16.5325

Stop Loss @ 17.6600

Downside Potential: 8,775 pips

Upside Risk: 2,500 pips

Risk/Reward Ratio: 3.51

Should the Force Index accelerate above its ascending support level, serving as resistance, the USD/ZAR is likely to attempt a second breakout attempt. Given the ongoing bearish developments in the US Dollar, the upside potential is confined to its short-term resistance zone. Forex traders are recommended to consider any advance as an excellent opportunity to add to existing short positions.

USD/ZAR Technical Trading Set-Up - Confined Breakout Scenario

Long Entry @ 17.8000

Take Profit @ 18.0800

Stop Loss @ 17.6600

Upside Potential: 2,800 pips

Downside Risk: 1,400 pips

Risk/Reward Ratio: 2.00