South Africa crossed the 100,000 level in Covid-19 infections yesterday, as global daily cases continue to surge globally, while governments push for more aggressive reopenings of their economies. South African Reserve Bank (SARB) Governor Lesetja Kganyago reaffirmed the central bank’s forecast for a GDP contraction of 7.0% for 2020. It will be the worst drop since a 6.2% decrease recorded during the 1931 Great Recession. With the US leading the rise in new infections, the USD/ZAR is faced with a bearish momentum build-up inside of its short-term resistance zone, favored to result in a breakdown.

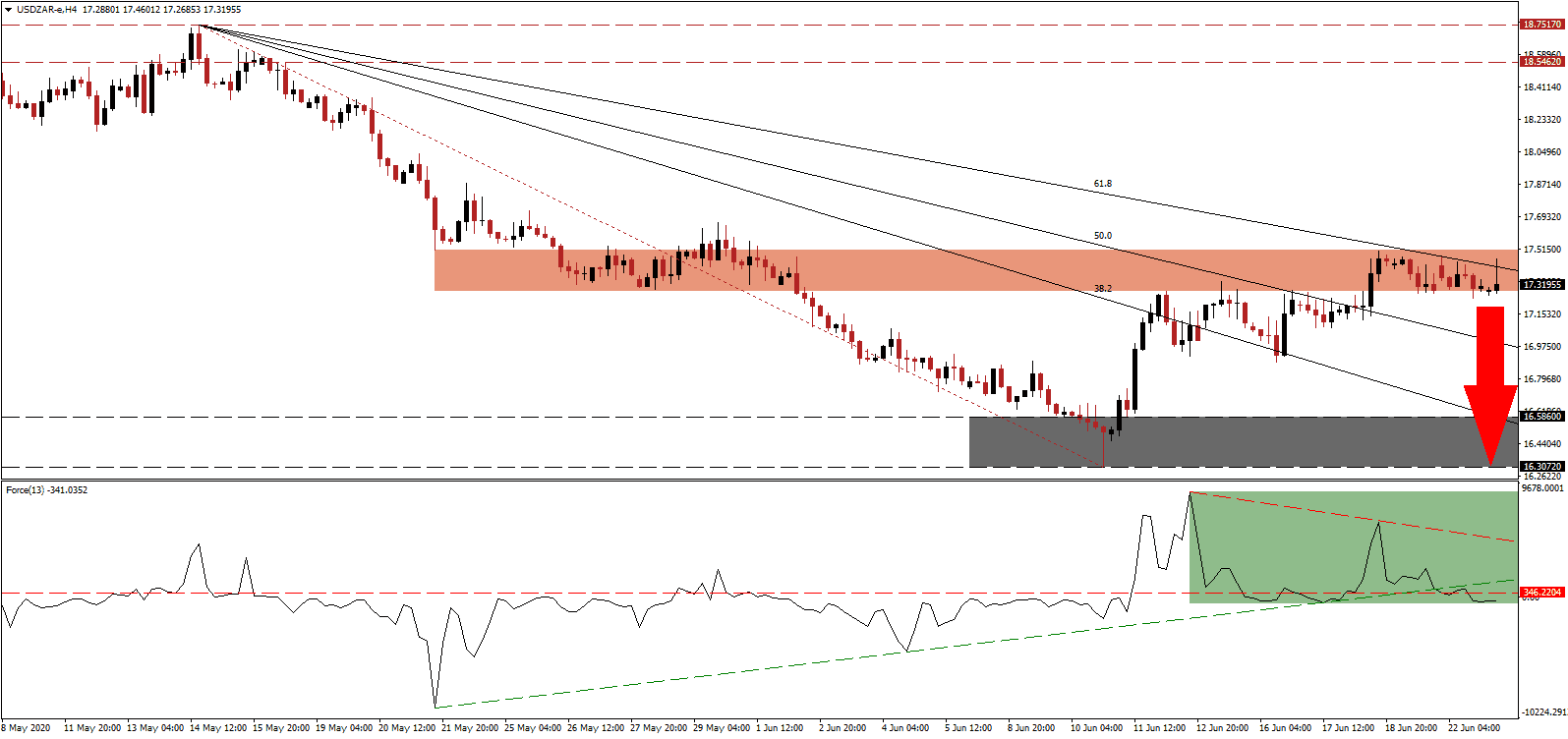

The Force Index, a next-generation technical indicator, shows the presence of a negative divergence, indicating a pending price action reversal. Adding to bearish momentum was the collapse in the Force Index below the ascending support level, which led to a conversion of the horizontal support level into resistance, as marked by the green rectangle. The descending resistance level is maintaining downside pressure, and bears are in complete control of the USD/ZAR after this technical indicator moved below the 0 center-line.

Following the same path as other central banks, the SARB increased its quantitative easing program but at a significantly smaller scale. The R25 billion expansion will increase the bond portfolio by 0.6% of GDP as compared to pre-Covid-19 levels. Small and medium enterprises (SMEs) have access to an R100 billion credit facility, which can be expanded to R200 billion if necessary. Governor Kganyago stressed the importance that quantitative easing is not equal to free money. The USD/ZAR is expected to collapse below its short-term resistance zone located between 17.2813 and 17.5081, as marked by the red rectangle.

High unemployment plagued the South African economy before the global Covid-19 pandemic, with today’s first-quarter data forecast to show an increase to 29.7%. President Ramaphosa, in his weekly newsletter, warned that difficult days lie ahead. Despite the challenges, deepening negative progress out of the US is adding to downside pressure on the US Dollar, increasing the likelihood of a breakdown in the USD/ZAR. The descending 61.8 Fibonacci Retracement Fan Resistance Level is anticipated to enforce the bearish chart pattern. Price action may correct into its support zone located between 16.3072 and 16.5860, as identified by the grey rectangle.

USD/ZAR Technical Trading Set-Up - Breakdown Scenario

Short Entry @ 17.3100

Take Profit @ 16.3100

Stop Loss @ 17.6100

Downside Potential: 10,000 pips

Upside Risk: 3,000 pips

Risk/Reward Ratio: 3.33

In case the Force Index reclaims its ascending support level, serving as short-term resistance, the USD/ZAR could attempt a breakout. Forex traders are recommended to view any advance from current levels as a secondary short-selling opportunity, on the back of intensifying bearish pressures on the US Dollar. A second stimulus package is being discussed, which will lead to more debt, while economic activity is expected to remain depressed. The next resistance zone awaits between 18.5462 and 18.7517.

USD/ZAR Technical Trading Set-Up - Temporary Breakout Scenario

Long Entry @ 17.9100

Take Profit @ 18.5600

Stop Loss @ 17.6100

Upside Potential: 6,500 pips

Downside Risk: 3,000 pips

Risk/Reward Ratio: 2.17