Turkish President Erdogan canceled proposed lockdown measures for fifteen municipalities, which were supposed to take effect over the past weekend. New Covid-19 infections continue to increase, but 12 hours after the Ministry of the Interior announces curfews will be reimposed, President Erdogan backtracked, citing economic and social consequences. A rush to lift restrictions implemented to fight the spread if the Covid-19 pandemic globally, spiked new infections, as evident in data over the past two weeks. The USD/TRY was able to enter a minor short-covering rally following a breakout above its support zone, but the absence of bullish momentum is poised to extend the correction.

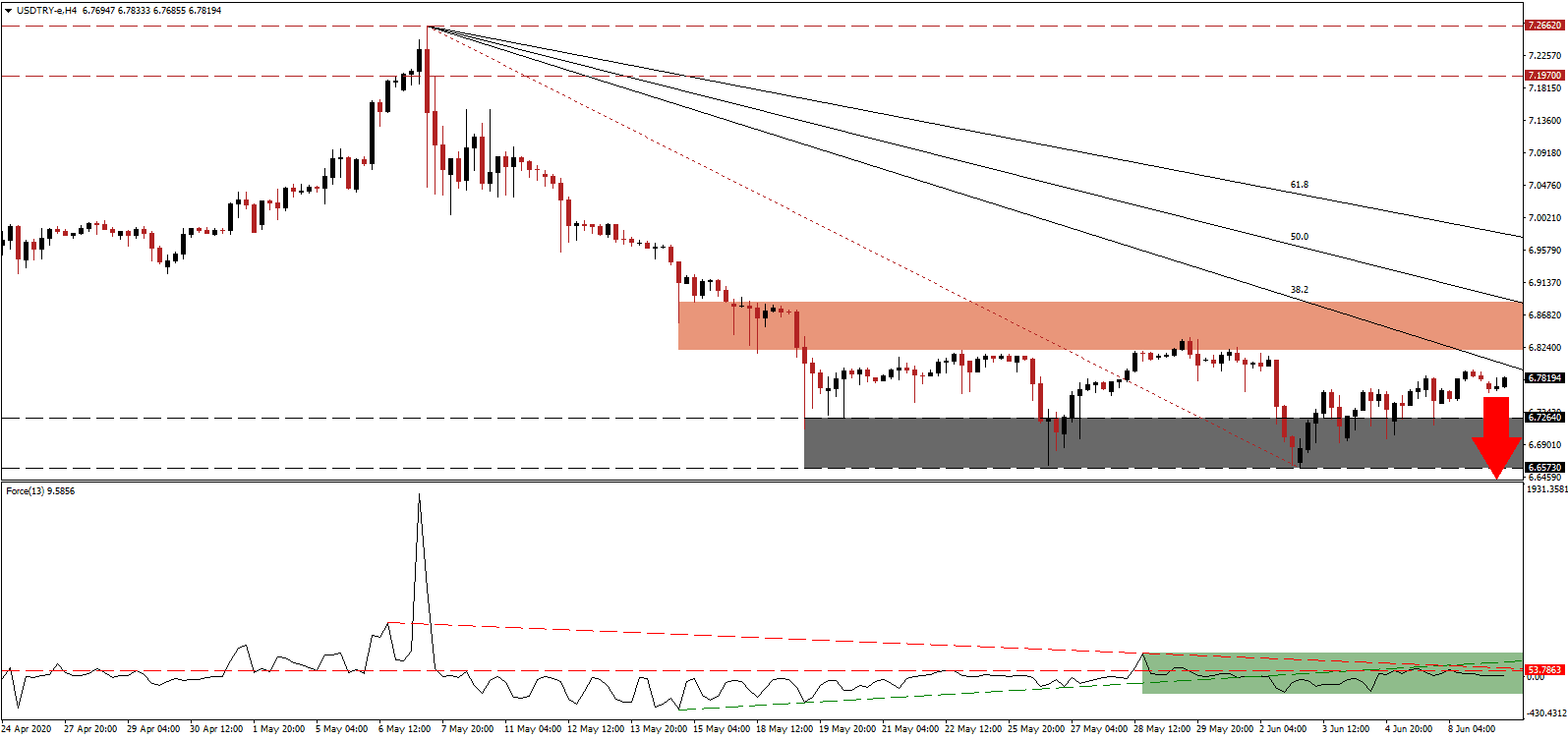

The Force Index, a next-generation technical indicator, suggests a new push to the downside after failing to eclipse its horizontal resistance level. Bearish pressures manifested following the move below its ascending support level, while the descending resistance level is adding to breakdown pressures, as marked by the green rectangle. Bears wait for this technical indicator to slide below the 0 center-line to regain complete control of the USD/TRY.

Per comments made to reported by Treasury and Finance Minister Albayrak, the government’s focus lies in shielding employment and sectors most exposed to the fallout of the pandemic. Fiscal discipline was reduced to a secondary role, but Turkey’s debt-to-GDP ratio of 33% allows room for flexibility. By contrast, the US debt-to-GDP ratio exceeds 100% and is 107% and on track to exceed the all-time high of 119% over the next 12 to 24 months. The descending 38.2 Fibonacci Retracement Fan Resistance Level is favored to enforce the dominant bearish chart pattern in the USD/TRY, after crossing below its short-term resistance zone located between 6.8198 and 6.8864, as identified by the red rectangle.

Providing economic optimism is the new hydroelectric power plant at the Yusufeli Dam, built on the Çoruh River in Turkey's northeastern Artvin province. It is the highest dam in Turkey and the third-highest in the world, expected to generate 540 megawatts of electricity and contribute 1.5 billion Turkish Lira to the economy annually. President Erdogan confirmed that plans are in place beyond recovering losses faced by the Covid-19 pandemic. The USD/TRY anticipated to challenge its support zone located between 6.6573 and 6.7264, as marked by the grey rectangle, before extending its breakdown sequence. The next support zone awaits price action between 6.3747 and 6.4454.

USD/TRY Technical Trading Set-Up - Breakdown Extension Scenario

Short Entry @ 6.7825

Take Profit @ 6.3750

Stop Loss @ 6.8900

Downside Potential: 4,075 pips

Upside Risk: 1,075 pips

Risk/Reward Ratio: 3.79

Should the Force Index spike above its ascending support level, serving as resistance, the USD/TRY could attempt to push farther the upside. The 61.8 Fibonacci Retracement Fan Resistance Level is likely to enforce the established bearish chart pattern. Increasing downside pressure is the fallout from US riots and demonstrations, anticipated to scar economic activity. Forex traders are recommended to sell any advance from current levels.

USD/TRY Technical Trading Set-Up - Limited Breakout Scenario

Long Entry @ 6.9250

Take Profit @ 6.9750

Stop Loss @ 6.9000

Upside Potential: 500 pips

Downside Risk: 250 pips

Risk/Reward Ratio: 2.00