Singapore, which retained the top spot as the world’s most competitive economy, as measured by the IMD World Competitiveness Ranking, implemented one of the most comprehensive lockdown measures globally in response to Covid-19. A surge in infections, originating in crowded dormitories for migrant workers, turned Singapore into one of the worst-affected Asian countries. After ensuring a proper test, trace, and isolate (TTI) infrastructure is operational, together with an understanding and compliant population, an aggressive easing of restrictions in ongoing. The USD/SGD completed a healthy counter-trend advance, but the short-term resistance zone is expected to force an extended corrective phase.

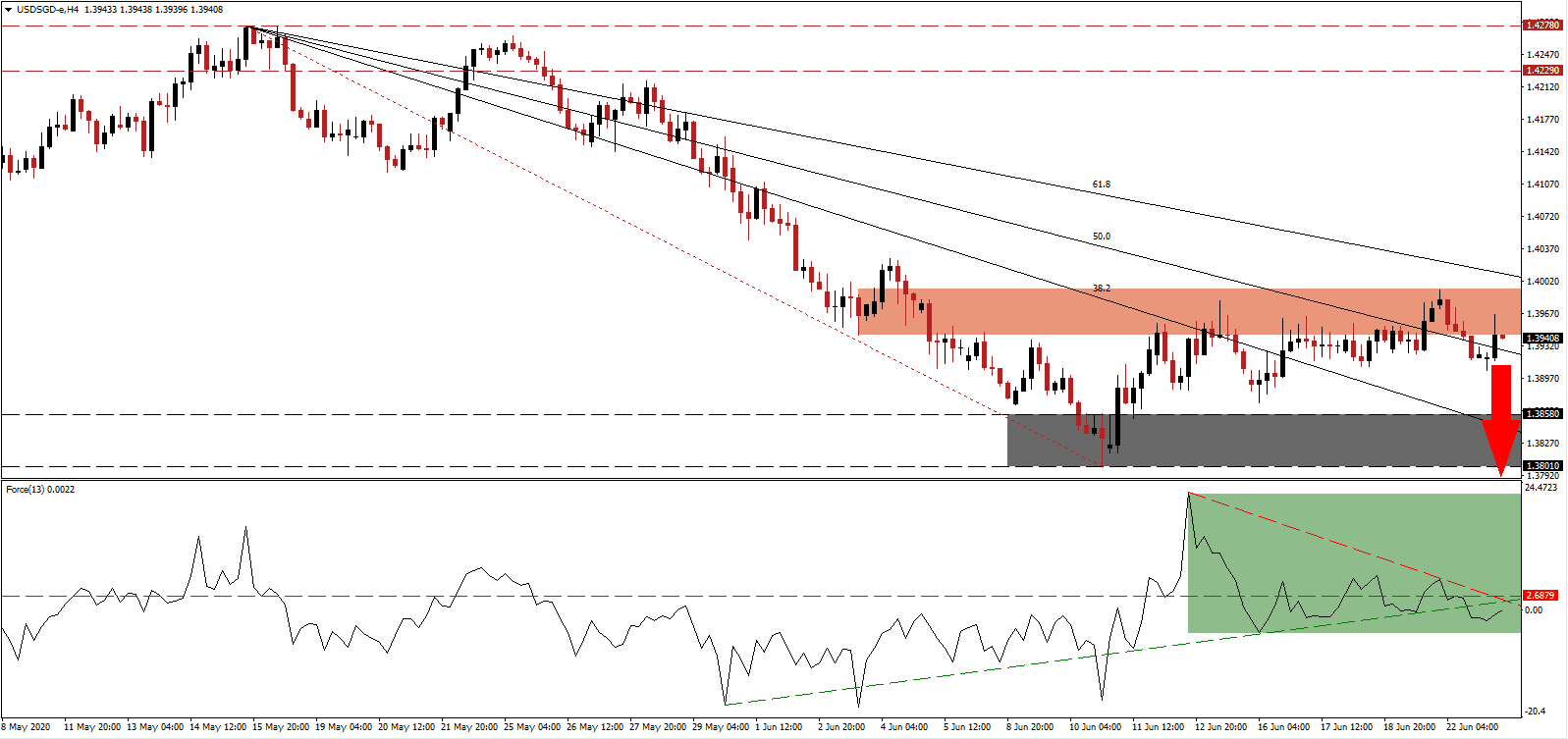

The Force Index, a next-generation technical indicator, initially spiked to a new multi-week peak before swiftly collapsing into a series of lower highs. It confirmed the dominance of bearish pressures, maintained by the descending resistance level. After the Force Index converted its horizontal support level into support, as marked by the green rectangle, a breakdown below its ascending support level followed. This technical indicator is now on the verge to move below the 0 center-line, granting bears complete control of the USD/SGD.

Despite easing of restrictions, retailers in Singapore retain a pessimistic outlook, with many facing financial difficulties. The threat of a new surge in Covid-19 infections remains dominant and understood. The US pushed ahead with easing of restrictions without a proper TTI infrastructure, and a significant percentage of the population ignoring the recommendations and warnings of healthcare officials. It adds to breakdown pressures in the USD/SGD, currently challenging the bottom range of its short-term resistance zone located between 1.3944 and 1.3993, as marked by the red rectangle.

Adding a dominant bullish catalyst to the Singaporean economy and the Singapore Dollar is a deep understanding of a changing global supply-chain resulting from the Covid-19 pandemic. Deputy Prime Minister Heng Swee Keat identified the importance to master changing trends and to accelerate the transformation of its economy to emerge as a more powerful one in the aftermath of the pandemic. The descending 61.8 Fibonacci Retracement Fan Resistance Level is favored to maintain the dominant bearish chart pattern, allowing the USD/SGD to accelerate into its support zone located between 1.3801 and 1.3858, as identified by the grey rectangle. The pending corrective phase is anticipated to extend into its next support zone between 1.3690 and 1.3752.

USD/SGD Technical Trading Set-Up - Breakdown Extension Scenario

Short Entry @ 1.3935

Take Profit @ 1.3690

Stop Loss @ 1.4000

Downside Potential: 245 pips

Upside Risk: 65 pips

Risk/Reward Ratio: 3.77

Should the Force Index push above its descending resistance level, the USD/SGD is likely to attempt a breakout. The upside potential is limited to its intra-day low of 1.4143, from where this currency pair advanced into a lower high before entering a correction. With the US discussing more debt, while failing to comprehend the need to adjust existing policies, any breakout attempt will grant Forex traders a secondary short-selling opportunity.

USD/SGD Technical Trading Set-Up - Limited Breakout Scenario

Long Entry @ 1.4050

Take Profit @ 1.4140

Stop Loss @ 1.4000

Upside Potential: 90 pips

Downside Risk: 50 pips

Risk/Reward Ratio: 1.80