Singapore initiated the first phase of easing lockdown restrictions due to the Covid-19 pandemic. It is unlikely to prevent the island nation from recording its worst-ever GDP contraction in 2020. The government predicts the economy will shrink between 4% and 7%, placing it ahead of the previous 3.1% annualized decrease recorded in 1964. As part of the response to the virus, Singapore tapped its currency reserves twice in one year, also a first. Despite economic disruptions, pockets of resilience remain, namely in precision manufacturing and biotechnology, providing long-term bullish drivers for Singapore Dollar. A brief reversal in the USD/SGD is likely to precede a new breakdown sequence in price action.

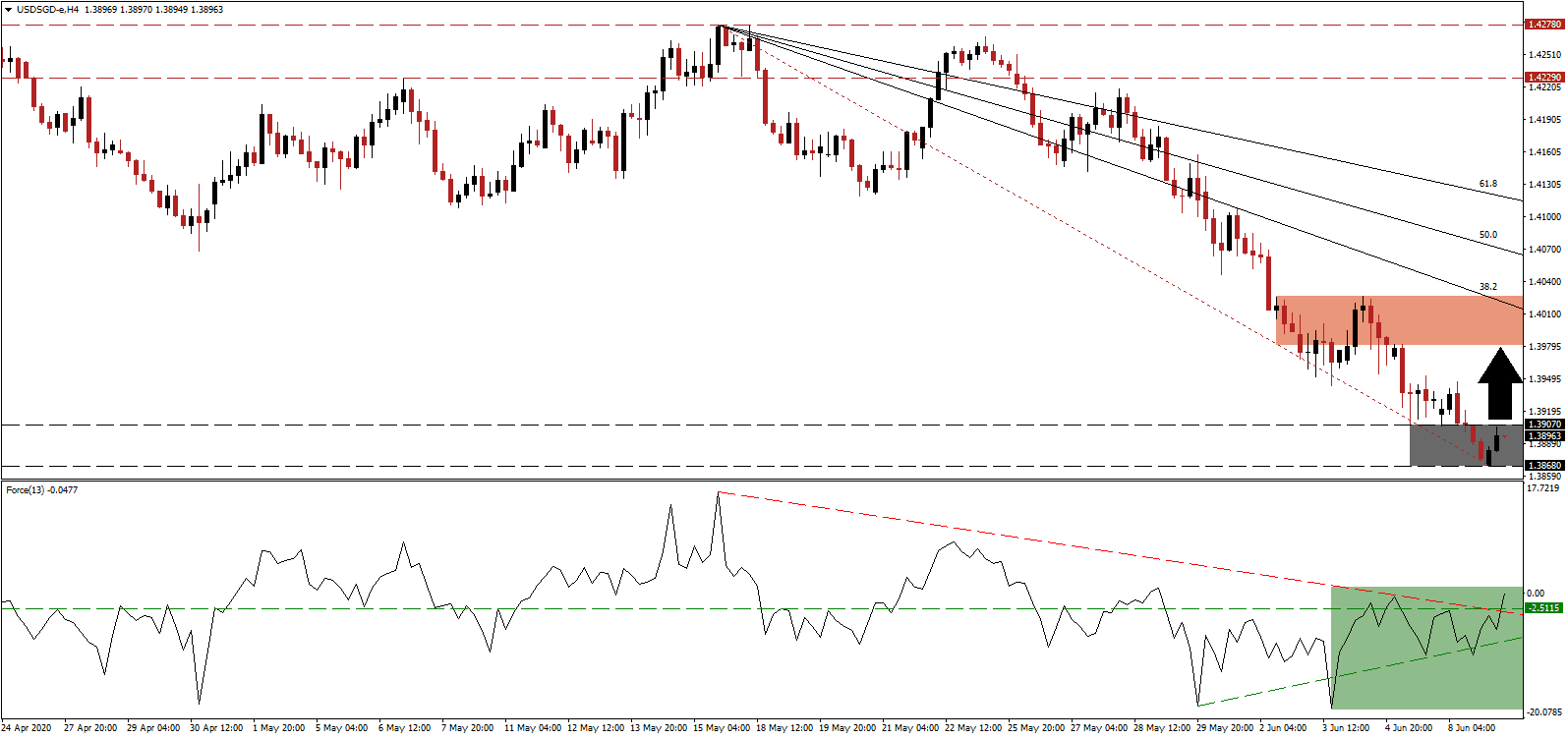

The Force Index, a next-generation technical indicator, points towards the build-up in bullish momentum after recording a series of higher lows. It allowed for the emergence of an ascending support level, which pushed the Force Index above its horizontal resistance level, converting it into support. A breakout above its descending resistance level, as marked by the green rectangle, adds to short-term bullish pressures. While an extension of the present advance is likely, a collapse in this technical indicator is favored to ensure bears remain in control of the USD/SGD.

After China passed a new security law governing its semi-autonomous region Hong Kong, considered Asia’s financial center, Singapore witnessed an inflow of capital. April saw an increase of nearly 400% in foreign capital deposits as compared to 2019, per data from the Monetary Authority of Singapore. It remains premature to accurately assess if this trend continues following the initial panic response. The USD/SGD is well-positioned for a temporary advance out of its support zone located between 1.3868 and 1.3907, as marked by the grey rectangle, but the long-term downtrend is unlikely to be violated.

Limiting the upside potential are ongoing riots and demonstrations across the US and disregard for warnings from health officials considering social distancing as well as protective measures. Adding the preferred US approach of increasing debt to stimulate demand artificially and an ill-advised foreign policy further enhances the long-term bearish chart pattern. Reflecting this development is the continuously downward revision of the short-term resistance zone, currently located between 1.3981 and 1.4026, as identified by the red rectangle. The descending 38.2 Fibonacci Retracement Fan Resistance Level is poised to end any advance in the USD/SGD and enforce the corrective phase.

USD/SGD Technical Trading Set-Up - Temporary Breakout Scenario

Long Entry @ 1.3895

Take Profit @ 1.3980

Stop Loss @ 1.3865

Upside Potential: 85 pips

Downside Risk: 30 pips

Risk/Reward Ratio: 2.83

In case the Force Index collapses below its ascending support level, the USD/SGD is expected to resume its long-term downtrend. Given ongoing bearish progress out of the US, Forex Traders are advised to consider any breakout attempt as an excellent short-selling opportunity. Singapore is positioned to enter the post-Covid-19 economy as a more significant player, while the US continues to magnify existing problems. Price action will challenge its next support zone between 1.3690 and 1.3752.

USD/SGD Technical Trading Set-Up - Breakdown Extension Scenario

Short Entry @ 1.3825

Take Profit @ 1.3690

Stop Loss @ 1.3865

Downside Potential: 135 pips

Upside Risk: 40 pips

Risk/Reward Ratio: 3.38