While optimism across financial markets remains unrealistically elevated about the gradual reopening of economies, the reality is distinctly different. One prime example is Singapore’s famed Orchard Road, considered a reliable indicator for the island nation’s economy. Streets are deserted, shopping malls closed, and the outlook bleak. April retail sales plunged 40.5% to S$2.1 billion, the lowest figure since February 2011. Despite a gradual resumption of activities and an expected surge in sales for May as compared to April, the broad economy will face a recessionary environment for an extended period. The USD/SGD is ripe for a temporary price spike out of its support zone, but given worse fundamental conditions out of the US, an extension of the long-term corrective phase is anticipated.

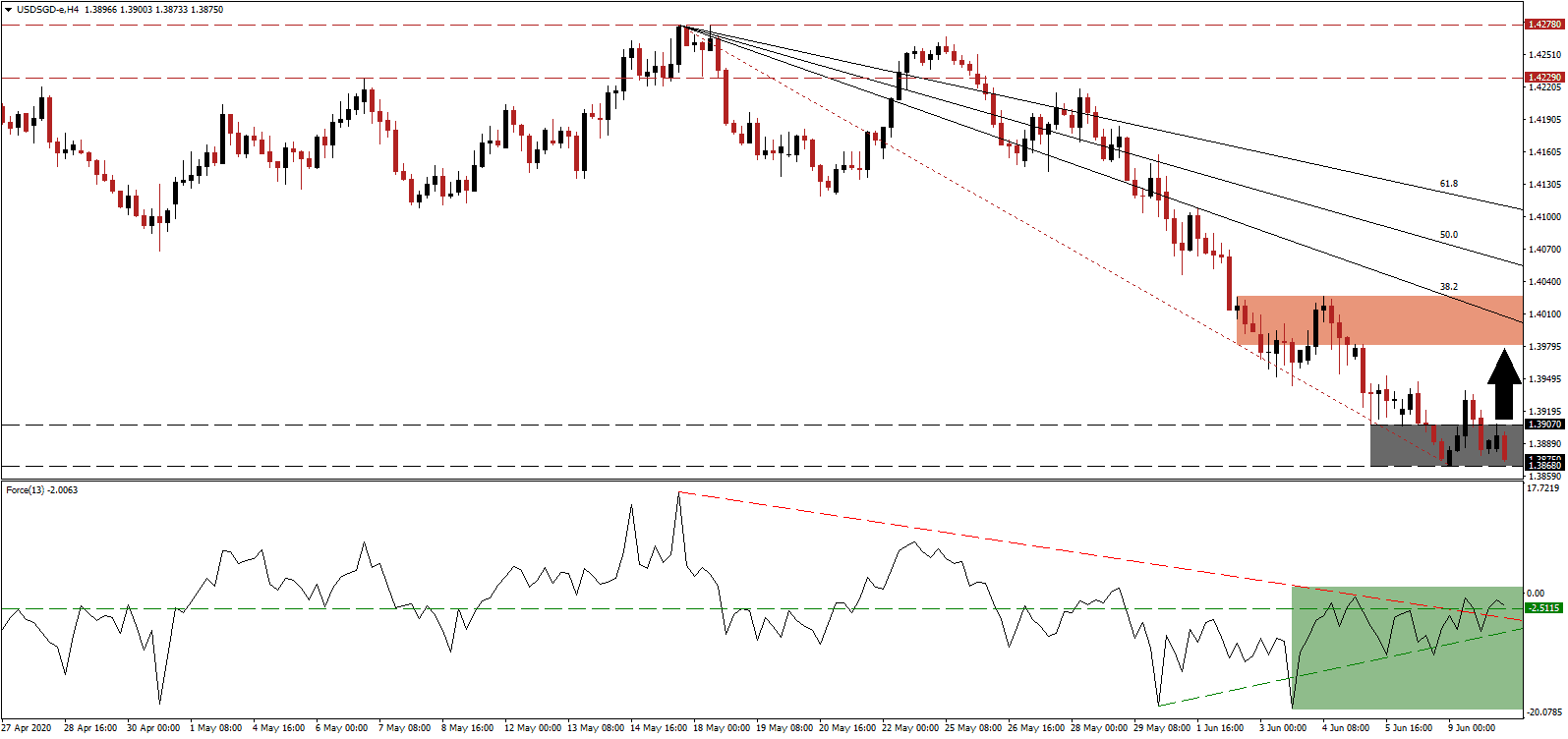

The Force Index, a next-generation technical indicator, confirms the accumulation of bullish momentum after being pressured higher by its ascending support level. It suggests a short-term counter-trend advance may be imminent. Following the breakout above its descending resistance level, as marked by the green rectangle, the Force Index converted its horizontal resistance level into support. Bears remain in control of the USD/SGD with this technical indicator below the 0 center-line, but a limited spike higher cannot be excluded.

Adding to the bearish scenario is the bulk of retail sales are from supermarkets, as consumers reduced purchased to essentials. E-commerce platforms offer a rare bright spot, indicative of a change in shopping behavior anticipated to last. It remains one of the underestimated impacts of the global Covid-19 pandemic. Singapore will rely on exports of precision manufacturing and biotechnology to aid its economic recovery.

Forex traders are recommended to sell any breakout attempt in the USD/SGD, which is confined to its short-term resistance zone located between 1.3981 and 1.4026, as marked by the red rectangle, and pending a downward revision. The descending 38.2 Fibonacci Retracement Fan Resistance Level is maintaining the established bearish chart pattern.

Today’s US Federal Reserve meeting is awaited for an update on the central bank's economic outlook. No change in interest rates is expected, currently ranging between 0.00% and 0.25%, but negative interest rates remain an option. Given the swiftly deteriorating conditions, any suggestions of more stimulus or interest rate cuts are likely to pressure the USD/SGD into a breakdown below its support zone located between 1.3868 and 1.3907, as identified by the grey rectangle. It will bypass a healthy counter-trend advance from where an accelerated collapse into its next support zone between 1.3690 and 1.3752 is favored.

USD/SGD Technical Trading Set-Up - Brief Price Spike Scenario

Long Entry @ 1.3875

Take Profit @ 1.3980

Stop Loss @ 1.3835

Upside Potential: 105 pips

Downside Risk: 40 pips

Risk/Reward Ratio: 2.63

A contraction in the Force Index below its descending resistance level, serving as temporary support, is poised to intensify selling pressure in the USD/SGD. The US risks a spike in new Covid-19 infections, which could materialize in two to three weeks, due to the ongoing riots and protests. Health officials voiced concerns over the disregard for social distancing and protective measures, adding to a worsening outlook for the US economy. Any price spike will offer Forex traders an excellent short selling opportunity.

USD/SGD Technical Trading Set-Up - Breakdown Extension Scenario

Short Entry @ 1.3825

Take Profit @ 1.3690

Stop Loss @ 1.3865

Downside Potential: 135 pips

Upside Risk: 40 pips

Risk/Reward Ratio: 3.38