Singapore is on track to reopen its entire economy by the end of June, but limitations in the number of people permitted will remain in place. New cases in China are worrisome, and new Covid-19 infections are surging globally. Despite this development, Singapore continues to lift restrictions. After the initial government response was hailed a success by the international community, a premature resumption of activities led to the city-state becoming one of the most infected countries in Asia. It was led by a rapid spread in the migrant worker community, living in cramped conditions. While the USD/SGD embarked in a short-covering rally, momentum collapsed after reaching its short-term resistance zone.

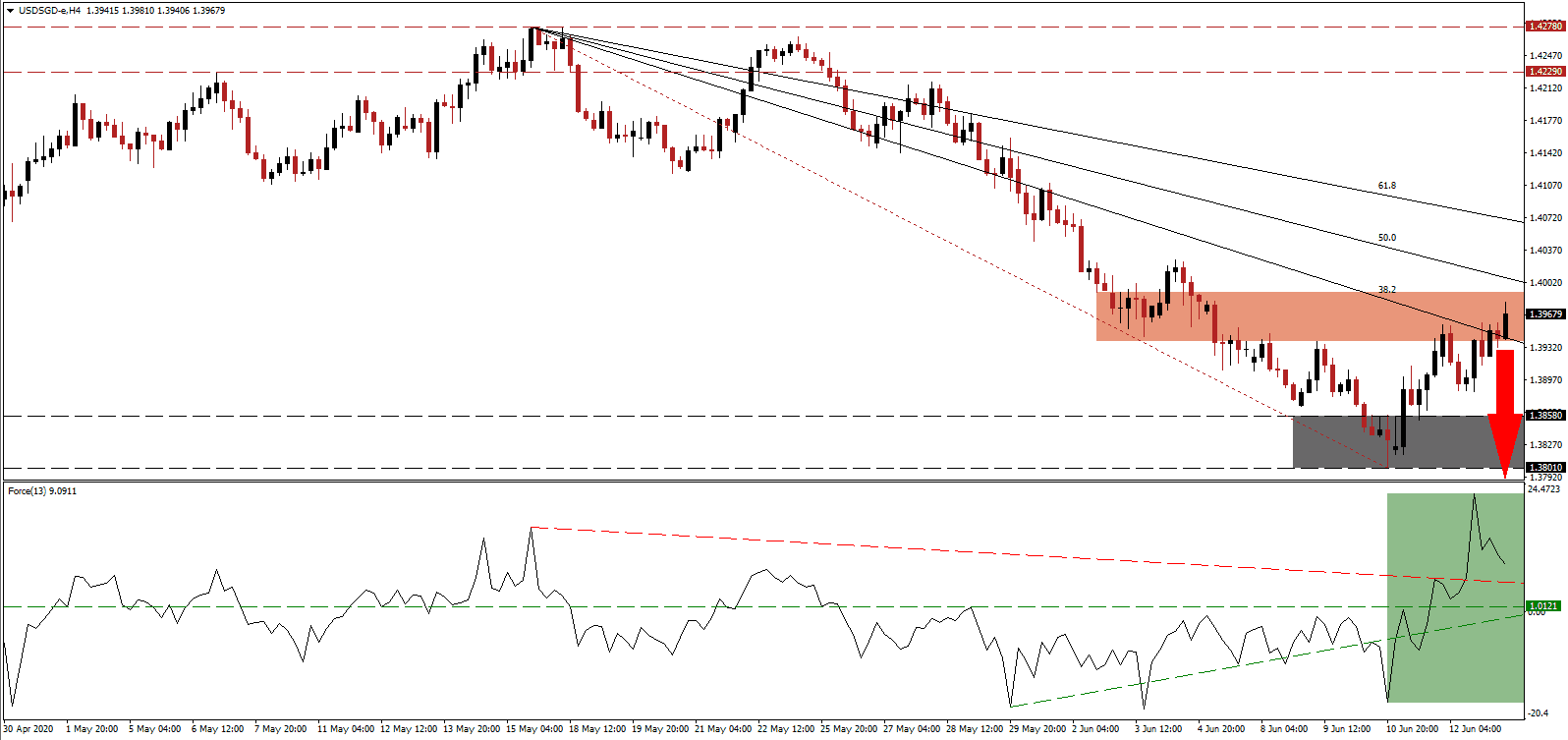

The Force Index, a next-generation technical indicator, accelerated to a new multi-week high before retreating. It is now anticipated to correct below its descending resistance level, serving as temporary support, as marked by the green rectangle. The rise in bearish pressures is likely to convert the horizontal support level into resistance, before collapsing below its ascending support level into negative territory. Bears will then regain complete control of the USD/SGD, resulting in more downside potential.

Per the latest survey of 23 economists conducted by the Monetary Authority of Singapore, the economy will plunge 11.8% in the second quarter and correct 5.8% in 2020. The Covid-19 pandemic will lead to a less globalized world, as supply chain adjustments will see the repatriation of sectors. Singapore is set to benefit from pending rotations, and while growth rates are expected to decrease globally, Singapore is ideally positioned to become a more dominant economy. The USD/SGD faces rejection by its short-term resistance zone located between 1.3938 and 1.3991, as marked by the red rectangle.

Global trade will contract due to the Covid-19 virus, and Singapore implemented four stimulus packages worth S$92.9 billion or almost 20% of GDP to combat the negative shock to its economy. Singapore will distribute the first portable contact tracing devices this month but has no plans to make them mandatory. It prefers an open dialogue with its citizens, explaining why they are required to aide in fighting the pandemic while resuming activities. The descending 50.0 Fibonacci Retracement Fan Resistance Level is favored to enforce the dominant bearish trend. A retracement of the counter-trend advance in the USD/SGD into its support zone located between 1.3801 and 1.3858, as identified by the grey rectangle, is poised to lead to a breakdown extension into its support zone between 1.3690 and 1.3752.

USD/SGD Technical Trading Set-Up - Breakdown Scenario

Short Entry @ 1.3965

Take Profit @ 1.3690

Stop Loss @ 1.4040

Downside Potential: 275 pips

Upside Risk: 75 pips

Risk/Reward Ratio: 3.67

In case the Force Index uses its descending resistance level as a platform to advance, the USD/SGD may attempt a breakout. Forex traders are advised to view any advance from current levels as an excellent selling opportunity. The economic outlook in the US is increasingly bearish, with a pending expiration of the $600 monthly subsidy to initial jobless claims payments the latest reason for concern, while Covid-19 infections are surging. The next resistance zone is located between 1.4229 and 1.4278.

USD/SGD Technical Trading Set-Up - Limited Breakout Scenario

Long Entry @ 1.4100

Take Profit @ 1.4225

Stop Loss @ 1.4040

Upside Potential: 125 pips

Downside Risk: 60 pips

Risk/Reward Ratio: 2.08