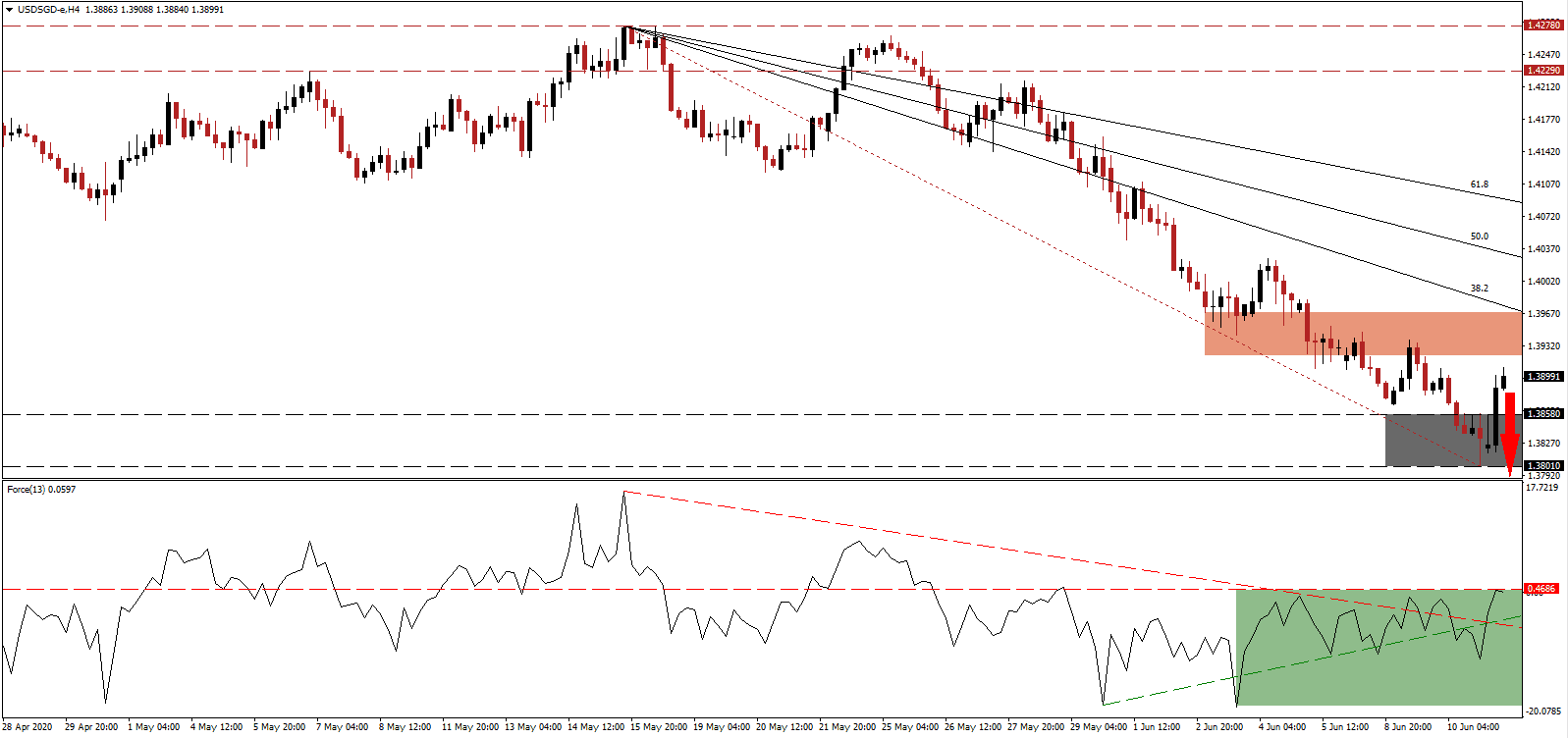

Yesterday’s press conference by US Federal Reserve Chairman Powell dented misplaced optimism running rampant across the global financial system. He confirmed no interest rate increases throughout 2022, suggesting a more pessimistic and uncertain economic outlook. The central bank presently predicts a 6.5% GDP contraction for 2020, followed by above-trend expansion rates of 5.0% and 3.5% for 2021 and 2022, respectively. Given the provided monetary policy outlook, the forecast is merely achievable with manipulation by central banks, confirming structural weakness in the global economy. After the USD/SGD spiked above its support zone, fading bullish momentum hints at a sell-off resumption.

The Force Index, a next-generation technical indicator, has created a marginally lower low before eclipsing its ascending support level and its descending resistance level, as marked by the green rectangle. With bullish momentum unable to carry it above the horizontal resistance level, located near the 0 center-line, a trend reversal is probable. A collapse in this technical indicator is expected to grant control of the USD/SGD to bears, leading to an accelerated correction.

No change in the US Federal Reserve’s bond-buying program is likely in the foreseeable future. It currently includes $80 billion per month in Treasury purchases and $40 billion mortgage-backed securities. The US central bank also became active in the ETF space, adding corporate bond ETFs to its expanding balance sheet. It utilizes leverage of 1:10, deploying $750 billion into the sector after receiving $75 billion from the Treasury. Fund management firm BlackRock was chosen to run the operations, despite the company creating ETFs the central bank may acquire. The downward revised short-term resistance zone located between 1.3921 and 1.3968, as marked by the red rectangle, is anticipated to reject the USD/SGD and force a resumption of the established breakdown sequence.

Singapore is well-positioned to grow out of the Covid-19 pandemic as a more dominant economy. While precision manufacturing, healthcare, and biotechnology will boost exports, and capital inflows out of Hong Kong could result in more market share of the financial sector, especially across Asia. It provides a distinct bullish catalyst for the Singapore economy and currency. The descending 38.2 Fibonacci Retracement Fan Resistance Level is adding downside pressure, likely to result in a breakdown in the USD/SGD below its support zone located between 1.3801 and 1.3858, as identified by the grey rectangle. Price action will face its next support zone between 1.3690 and 1.3752.

USD/SGD Technical Trading Set-Up - Breakdown Scenario

Short Entry @ 1.3895

Take Profit @ 1.3690

Stop Loss @ 1.3960

Downside Potential: 205 pips

Upside Risk: 65 pips

Risk/Reward Ratio: 3.15

Should the ascending support level pressure the Fore Index farther to the upside, the USD/SGD is likely to attempt a breakout. The upside potential remains limited to its 61.8 Fibonacci Retracement Fan Resistance Level. Forex traders are advised to consider this an excellent secondary selling opportunity on the back of an increasingly bearish outlook for price action, enhanced by US Dollar weakness.

USD/SGD Technical Trading Set-Up - Limited Breakout Scenario

Long Entry @ 1.4000

Take Profit @ 1.4075

Stop Loss @ 1.3960

Upside Potential: 75 pips

Downside Risk: 40 pips

Risk/Reward Ratio: 1.88