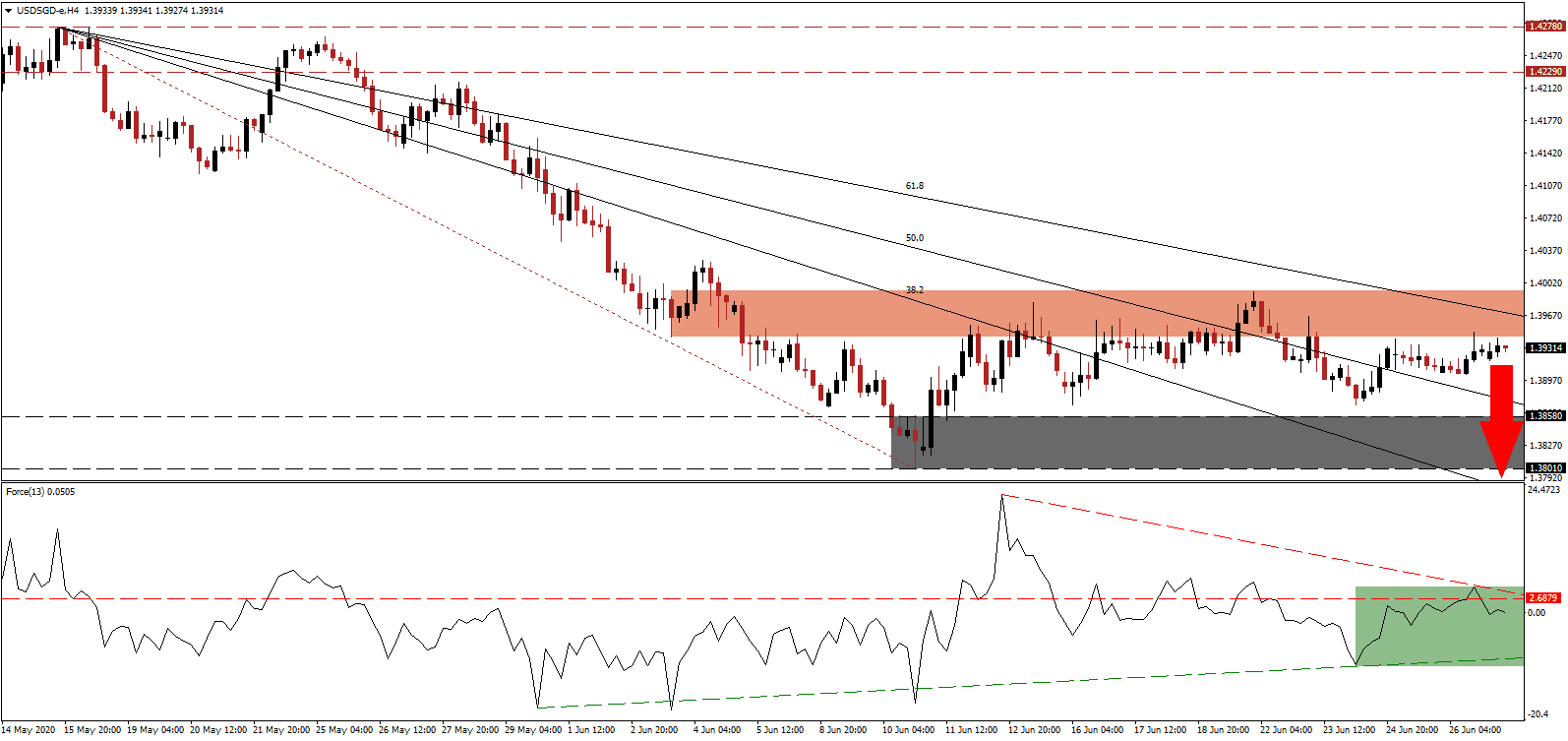

Singapore industrial production posted a surprise 7.4% drop in May year-over-year despite an ongoing increase in pharmaceutical output. It ended the two-month expansion. Month-over-month, the contraction clocked in at 16.5% while April’s 3.6% increase was revised to reflect a 0.5% loss. It follows the 4.5% decrease in May non-oil exports and highlights the severity of the economic fallout from the Covid-19 pandemic. The USD/SGD drifted into the bottom range of its short-term resistance zone, enforced by its descending 61.8 Fibonacci Retracement Fan Resistance Level, from where more downside is favored.

The Force Index, a next-generation technical indicator, recorded a higher low, resulting in an adjustment of its ascending support level. It was followed by a lower high before the descending resistance level assisted the conversion of its horizontal support level into resistance, as marked by the green rectangle. This technical indicator is now on course to correct into negative territory, ceding control of the USD/SGD to bears.

Deflationary pressures in Singapore following a two-month lockdown period add a concern for the Monetary Authority of Singapore. Food costs are the sole category expanding, while core inflation remained negative for the fourth consecutive month in May. Economists believe the trend can continue over the next six months. After the USD/SGD completed a breakdown below its short-term resistance zone located between 1.3944 and 1.3993, as identified by the red rectangle, it entered a minor advance, likely to face renewed rejection.

One significant long-term positive development is the commitment to sign the Regional Comprehensive Economic Partnership (RCEP), confirmed by Singapore last week. India walked out of the agreement last November, but the remaining fifteen economies account for approximately 30% of the global population and GDP. It will provide a significant boost to the regional economy, granting a much needed post-Covid-19 recovery platform. The 61.8 Fibonacci Retracement Fan Resistance Level is expected to force the USD/SGD into its support zone located between 1.3801 and 1.3858, as marked by the grey rectangle. Due to the outlook, an extension into its next support zone between 1.3690 and 1.3752 is probable.

USD/SGD Technical Trading Set-Up - Breakdown Extension Scenario

Short Entry @ 1.3930

Take Profit @ 1.3690

Stop Loss @ 1.4000

Downside Potential: 240 pips

Upside Risk: 70 pips

Risk/Reward Ratio: 3.43

In case the Force Index accelerates above its descending resistance level, the USD/SGD may pressure for a breakout. As US Covid-19 cases surge to daily records, the US is debating to issue more debt-funded stimuli, expanding bearish pressures on the US Dollar. The upside potential is confined to its intra-day low of 1.4143, which led to a lower high in price action before entering an extended correction. Selling any rallies from present levels remains the recommended approach.

USD/SGD Technical Trading Set-Up - Confined Breakout Scenario

Long Entry @ 1.4050

Take Profit @ 1.4140

Stop Loss @ 1.4000

Upside Potential: 90 pips

Downside Risk: 50 pips

- Risk/Reward Ratio: 1.80