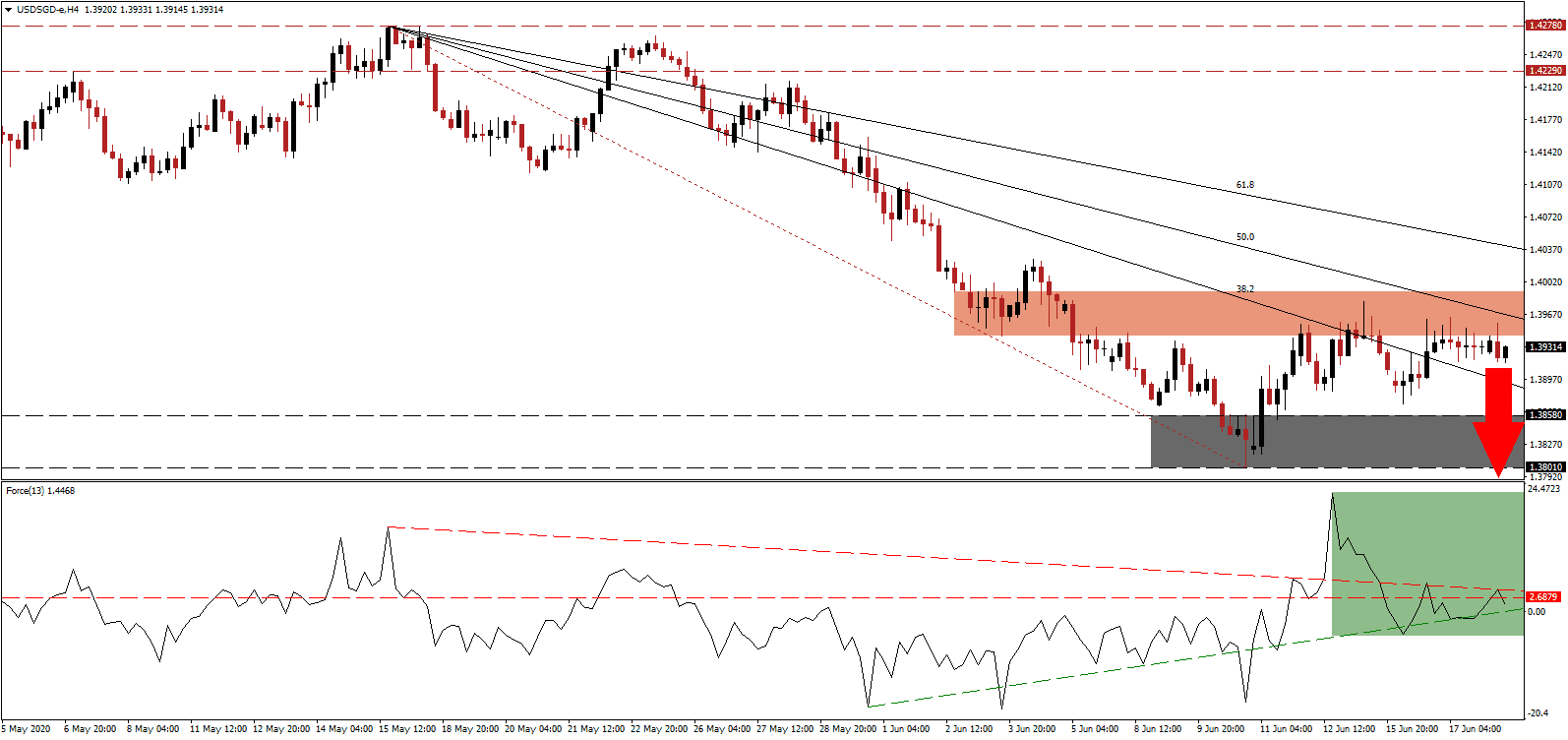

With the global economy in a recession, which started in 2019 with a manufacturing-led contraction, magnified by the Covid-19 pandemic in 2020, Singapore remained the most competitive economy for a second consecutive year. The IMD World Competitiveness Ranking publishes its list annually and ranks 63 economies based on their ability to generate prosperity. Denmark, Switzerland, the Netherlands, and Hong Kong round up the Top 5 for 2020. It confirms the policies of the city-state will ensure it can grow out of this recession as a more dominant economy. The USD/SGD was rejected by its short-term resistance zone and is well-positioned to accelerate to the downside.

The Force Index, a next-generation technical indicator, briefly pierced above its horizontal resistance level before being pressured into a reversal by its descending resistance level, as marked by the green rectangle. The Force Index is now on track to correct below its ascending support level, adding to downside pressure in the USD/SGD. A pending collapse in this technical indicator below the 0 center-line will grant bears full control of price action.

Smaller economies are in a superior position to combat the Covid-19 pandemic, partially based in the ease to reach social consensus. Singapore benefits from its economic performance anchored in global trade, investment, and labor market conditions. With global trade challenging over the next few quarters, an edge in precision manufacturing and biotechnology will counter the negative global trend. The descending 50.0 Fibonacci Retracement Fan Resistance Level, passing through the short-term resistance zone located between 1.3943 and 1.3991, as identified by the red rectangle, is expected to force the USD/SGD into an extended corrective phase.

A short-term fundamental catalyst awaits with today’s US initial jobless claims data. Forex traders should pay attention to continuing jobless claims, where a level above 20 million will confirm that May’s NFP report was an anomaly, due to a spike in temporary additions to comply with new rules to resume economic activity. New cases are surging across the US, and numerous hospitals are near-maximum capacity. The USD/SGD is favored to challenge its support zone located between 1.3801 and 1.3858, as marked by the grey rectangle. A breakdown is anticipated to extend price action down into its next support zone between 1.3690 and 1.3752.

USD/SGD Technical Trading Set-Up - Breakdown Extension Scenario

Short Entry @ 1.3930

Take Profit @ 1.3690

Stop Loss @ 1.4000

Downside Potential: 240 pips

Upside Risk: 70 pips

Risk/Reward Ratio: 3.43

A breakout in the Force Index above its descending resistance level may inspire the USD/SGD to follow suit. Given the intensifying structural economic issues out of the US, with the prospects of a slow and painful recovery, while losing global competitiveness further, the upside potential remains limited. Forex traders should take advantage of any advance with new net short positions. Price action will experience massive resistance at its intra-day low of 1.4143, a previous base resulting in a lower high before the current sell-off materialized.

USD/SGD Technical Trading Set-Up - Limited Breakout Scenario

Long Entry @ 1.4050

Take Profit @ 1.4140

Stop Loss @ 1.4000

Upside Potential: 90 pips

Downside Risk: 50 pips

Risk/Reward Ratio: 1.80